I am writing today to help inform people who are new to the stock market and want to begin learning the link between Sun Art Retail Group Limited (HKG:6808)’s return fundamentals and stock market performance.

Sun Art Retail Group Limited (HKG:6808) delivered an ROE of 12.82% over the past 12 months, which is an impressive feat relative to its industry average of 8.52% during the same period. But what is more interesting is whether 6808 can sustain this above-average ratio. This can be measured by looking at the company’s financial leverage. With more debt, 6808 can invest even more and earn more money, thus pushing up its returns. However, ROE only measures returns against equity, not debt. This can be distorted, so let’s take a look at it further. View out our latest analysis for Sun Art Retail Group

What you must know about ROE

Return on Equity (ROE) is a measure of Sun Art Retail Group’s profit relative to its shareholders’ equity. An ROE of 12.82% implies HK$0.13 returned on every HK$1 invested, so the higher the return, the better. Investors seeking to maximise their return in the Hypermarkets and Super Centers industry may want to choose the highest returning stock. But this can be misleading as each company has different costs of equity and also varying debt levels, which could artificially push up ROE whilst accumulating high interest expense.

Return on Equity = Net Profit ÷ Shareholders Equity

Returns are usually compared to costs to measure the efficiency of capital. Sun Art Retail Group’s cost of equity is 8.85%. Since Sun Art Retail Group’s return covers its cost in excess of 3.97%, its use of equity capital is efficient and likely to be sustainable. Simply put, Sun Art Retail Group pays less for its capital than what it generates in return. ROE can be broken down into three different ratios: net profit margin, asset turnover, and financial leverage. This is called the Dupont Formula:

Dupont Formula

ROE = profit margin × asset turnover × financial leverage

ROE = (annual net profit ÷ sales) × (sales ÷ assets) × (assets ÷ shareholders’ equity)

ROE = annual net profit ÷ shareholders’ equity

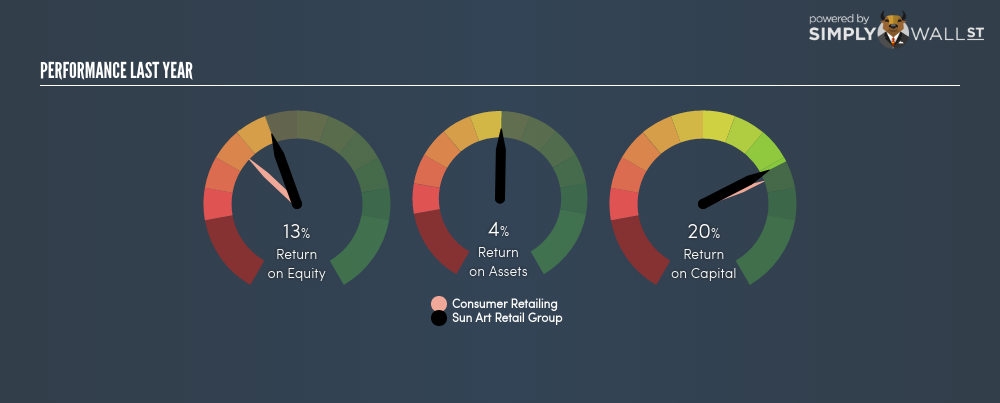

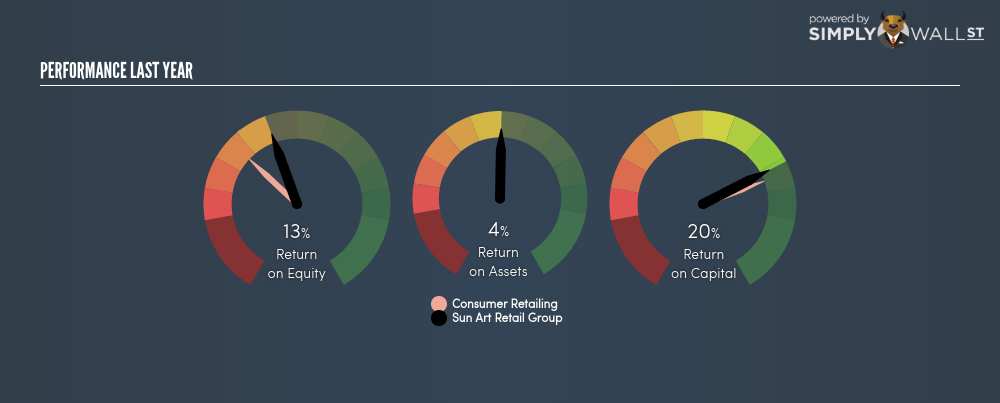

SEHK:6808 Last Perf June 25th 18

SEHK:6808 Last Perf June 25th 18

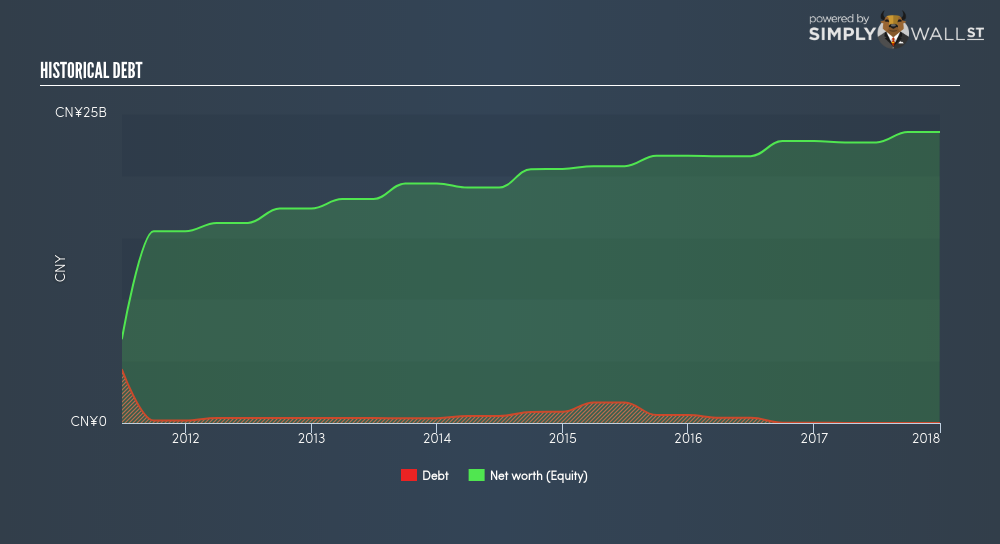

Essentially, profit margin shows how much money the company makes after paying for all its expenses. Asset turnover shows how much revenue Sun Art Retail Group can generate with its current asset base. The most interesting ratio, and reflective of sustainability of its ROE, is financial leverage. We can determine if Sun Art Retail Group’s ROE is inflated by borrowing high levels of debt. Generally, a balanced capital structure means its returns will be sustainable over the long run. We can examine this by looking at Sun Art Retail Group’s debt-to-equity ratio. Currently Sun Art Retail Group has virtually no debt, which means its returns are predominantly driven by equity capital. Therefore, the level of financial leverage has no impact on ROE, and the ratio is a representative measure of the efficiency of all its capital employed firm-wide.

SEHK:6808 Historical Debt June 25th 18

SEHK:6808 Historical Debt June 25th 18

Next Steps:

While ROE is a relatively simple calculation, it can be broken down into different ratios, each telling a different story about the strengths and weaknesses of a company. Sun Art Retail Group’s ROE is impressive relative to the industry average and also covers its cost of equity. ROE is not likely to be inflated by excessive debt funding, giving shareholders more conviction in the sustainability of high returns. Although ROE can be a useful metric, it is only a small part of diligent research.

For Sun Art Retail Group, I’ve put together three pertinent aspects you should look at:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Valuation: What is Sun Art Retail Group worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether Sun Art Retail Group is currently mispriced by the market.

- Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Sun Art Retail Group? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

Daniel Loeb has achieved 16.2% annualized returns over the last 20 years. What is he holding today?

Founder of the event-driven, value-oriented hedge fund Third Point, Daniel Loeb is one of the most successful activist investors on the market today. Explore his portfolio’s top holdings, see how he diversifies his investments, past performance and growth estimates. Click here to view a FREE detailed infographic analysis of Daniel Loeb’s investment portfolio.