Cyber Monday is set to become the biggest online shopping day of the year in America, surpassing Black Friday both in terms of sales and importance for all generations, as Covid-19-related anxiety causes consumers to pull back from in-store shopping, according to Deloitte’s 2020 holiday study.

While total holiday spend in the US is forecast to drop 7 per cent, online spending is on the rise overall. Black Friday (27 November) is projected to generate $10 billion in online sales this year, a 39 per cent year-on-year increase. Cyber Monday will be the biggest online shopping day of the year, reaching $12.7 billion, a 35 per cent jump year-on-year, according to Adobe’s 2020 holiday season report, which analysed one trillion visits to US retail sites and 100 million SKUs from 80 of the 100 largest US retailers.

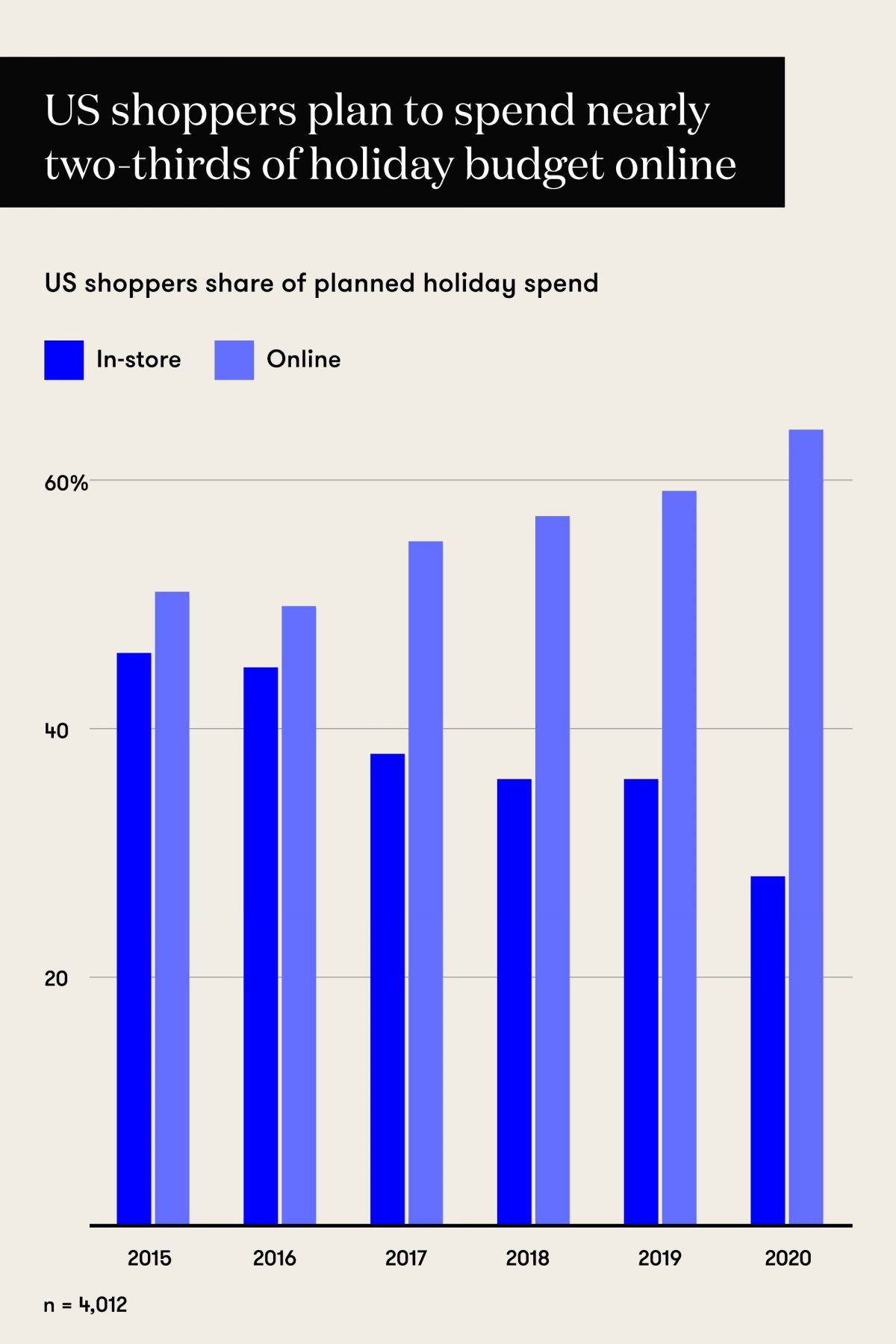

It’s a trend that has been growing for the past five years. The majority of shoppers (65 per cent) already prefer to shop online to avoid crowds, says Rodney Sides, vice chairman and US leader of retail and distribution at Deloitte. Younger consumers primarily shop on their phones, which also contributes to the Cyber Monday bump, he adds.

As online shopping becomes the preferred way for many to make their purchases, retailers plan to meet their customers where they are. Traditionally, Bloomingdale’s and Saks Fifth Avenue draw large crowds at their New York flagships to view their holiday windows. That’s not the case this year because of the pandemic, and retailers are hosting virtual holiday events instead. Saks will unveil its windows virtually with 20 lighting ceremonies beginning on 23 November. Bloomingdale’s will host a virtual holiday benefit on the same day, with an online performance from singer Andra Day and dancers from the American Ballet Theatre.

The challenge for retailers this year, however, will be combating delays and keeping up with demand, warns Gabriella Santaniello, founder and chief executive of retail research firm A Line Partners. “Nobody wants to go into stores, particularly those who live in areas of the United States where there have been spikes in cases of Covid-19. Chances are that you’re going to see some pretty significant delays. Customers can’t do any last-minute shopping this year,” she says.

Amid concerns around shipping delays, retailers are encouraging customers to shop early, turning Cyber Monday into a month-long event. Some 33 per cent of consumers plan to have their holiday shopping complete by Black Friday, Adobe found. Amazon’s Prime Day, which normally takes place in July but was postponed to October this year, has also contributed to the holiday shopping season starting even earlier.

The holiday shopping season traditionally begins after Halloween, but lingerie brand Journelle kicked off the period in early October with a Columbus Day sale on 12 October. Shipping and supply disruption was a key factor, says Guido Campello, co-CEO of Journelle. “A lot of retailers right now do not have stock, or will be very tight on stock. Because of the supply chain disruptions and the surplus due to Covid, that is going to be an issue for a lot of brands,” he explains. “We ship with UPS and we’re telling everyone to ship overnight if they really need it, because everything’s coming one or two days late.”

Cyber Monday deals are often announced by brands on Thanksgiving weekend to encourage shoppers to make purchases spontaneously. This has historically encouraged people to sign up to their favourite retailers’ emails to receive Cyber Monday offers in their inbox. That’s not the case this year, and customers are advised to place their orders sooner than later, says Campello.

Brands are also recommended to segment subscribers to avoid emails ending up in spam folders or under the promotions tab on Google’s new Gmail view. “Instead of sending a blanket email to 1,000 subscribers, consider pools of 100 spread out over a few minutes,” says Ciaran Bollard, chief executive of Kooomo, a global e-commerce platform that works with LVMH, Dolce & Gabbana and Morrisons.

To help avoid the shipping crunch, retailers like Nordstrom and Target are offering click-and-collect or contactless kerbside pickup. It means that shoppers can collect orders at nearby locations, provided that the retailer has the products in stock.

But the popularity of BOPIS (buy online, pick-up in store) among consumers represents another challenge for retailers, says Bollard. One of his clients — a retailer with 500 stores across the UK — has a fraction of the volume they would have liked in store, and has started shipping products from its warehouse for in-store collection. Delays are also expected with this method: “Same day or next-day delivery has become expected, but realistically it’s looking like three days for retailers during the holiday season.”

The good news is that most consumers (85 per cent) prefer free shipping over fast delivery (15 per cent). The latter are only willing to pay minimal amounts for this convenience, according to Deloitte’s findings. To cut back on returns, some brands in the US have started charging customers for return shipping, says Sides. For consumers to avoid disappointment, he adds, free shipping cut-off dates need to be communicated by retailers early. “There’s a policy play here where great service extends beyond just a great price.”