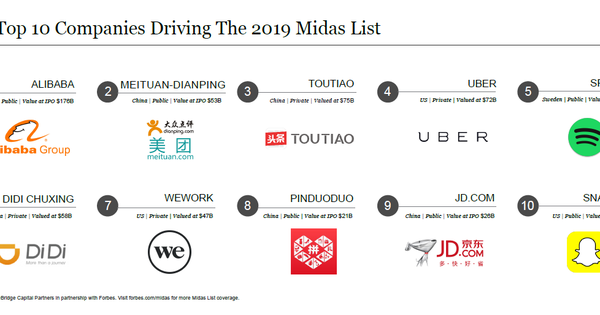

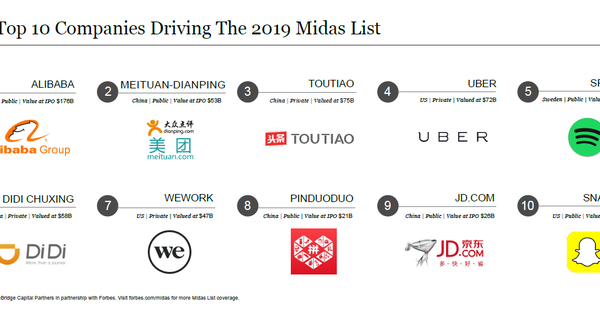

Each year, TrueBridge examines the top 10 companies to generate value for the investors on the annual Forbes Midas List. While this year’s list will look similar – there are only three newcomers to the list – it still reflects macro trends that are unique to 2018.

This year’s list of top 10 performance drivers show that China was even more of a dominant player in venture capital than it was in 2017. Six of this year’s top ten companies originated in China, including Meituan-Dianping and ByteDance’s Toutiao, which moved up significantly following the former’s $4.2 billion IPO and the latter’s multi-billion-dollar fundraising.

The top 10 list also shows that, while the IPO window creaked open last year, it didn’t go further than that. Only two newcomers to the list – Spotify and Pinduoduo – arrived thanks to their debuts on the public markets. The third newcomer – WeWork – joined after raising $5.0 billion from SoftBank. But with Uber and Lyft now on file with the SEC, and Alibaba approaching TrueBridge’s five-year lookback threshold for inclusion on the Midas List, 2019 portends some significant changes to 2020’s list of top drivers.

Here are the top 10 companies to help investors make it onto Midas in 2019:

Top 10 Drivers

TrueBridge Capital

- Alibaba Group Holding Ltd.

Perhaps unsurprisingly, Alibaba has maintained its place as the top driver of value for Midas List investors following its $25 billion IPO in 2014.

Alibaba has recently been focused on growing its e-commerce and “New Retail” business, which aims to digitize brick-and-mortar retail operations. For example, on its latest annual “Singles’ Day,” the company partnered with brands to create pop-up stores fixed with augmented reality mirrors and tools to connect shoppers to their accounts on Alibaba-owned e-commerce shops T-mall and Taobao. While the company has a global profile, a lot of its success remains dependent on consumer spending in China. It will remain to be seen how the company will fare in China’s current economic slowdown and the ongoing tensions between U.S. and China trade.

Where It Counted The Most On The 2019 Midas List*:

- Neil Shen, Sequoia Capital (#1)

- Scott Shleifer, Tiger Global (#13)

- Anton Levy, General Atlantic (#31)

- China Internet Plus (dba Meituan-Dianping)

After just one year on the Top 10 list, Meituan-Dianping jumped quickly in the ranks from #8 to #2 following its IPO in September 2018, which valued the company at $52.8 billion. Its last valuation as a private company was less than half that amount ($18 billion).

Founded in 2015 through the merger of two multi-billion-dollar companies, Meituan-Dianping provides group discounts (similar to Groupon) and functions as a marketplace for services from local vendors, including hotels, restaurants, and entertainment venues. It’s best known for pioneering China’s O2O (“offline to online”) market, in which physical commerce industries are connected with consumers through the internet and mobile devices. The company has grown from one of China’s earliest “group-buying” websites into its largest by gross merchandise volume, with 20 million daily mobile users in over 1,000 cities.

Where It Counted The Most On The 2019 Midas List*:

- Neil Shen, Sequoia Capital (#1)

- JP Gan, Qiming Venture Partners (#5)

- Kathy (Xin) Xu, Capital Today (#6)

- James Mi, Lightspeed Venture Partners (#12)

- Anton Levy, General Atlantic (#31)

- Yi (Charlie) Cao, Source Code Capital (#47)

- Young Guo, IDG Capital Partners (#84)

- Toutiao

Like Meituan-Dianping, Toutiao and its parent company, Beijing Bytedance Technology, has rocketed through the top 10 after its initial appearance. In October, ByteDance closed a $3.0 billion funding round at a valuation of $75 billion. Despite the eye-popping valuation, it’s still a private company.

Toutiao is a news-aggregation app that leverages AI technology and unique algorithms to quickly learn what its users like to read and create personalized news feeds based on their preferences. Currently installed on over 240 million monthly unique devices, Toutiao has grown into one of the top news aggregators in China and a budding threat against China’s tech giants Tencent, Baidu, and Alibaba. According to TechCrunch, the company plans to continue investing in its content business, including creating tools to incentivize independent content creators and, in response to recent criticism, better monitor its app for illegal and inappropriate content.

Where It Counted The Most On The 2019 Midas List*:

- Hans Tung, GGV Capital (#7)

- Scott Sandell, New Enterprise Associates (#24)

- Anton Levy, General Atlantic (#31)

- Yi Cao, Source Code Capital (#47)

- Uber

While slightly down from its #2 ranking last year, Uber remains one of the primary value drivers for Midas List investors.

Uber emerged from 2018 following a series of setbacks and scandals, including allegations of sexual harassment, use of illicit software to evade regulators, and IP theft, as well as management changes, including the appointment of current CEO Dara Khosrowshahi. Now, the company has reportedly filed its confidential S-1, and it’s expected to complete its initial public offering this spring.

While Uber is the clear leader in its market and more diversified than its competitors, expect all eyes to remain on Uber’s rivalry with Lyft, which has been its top competitor since inception and is expected to complete its own public offering shortly before Uber.

Where It Counted The Most On The 2019 Midas List*:

- Bill Gurley, Benchmark Capital (#3)

- Eric Paley, Founder Collective (#10)

- Rob Hayes, First Round Capital (#15)

- Bill Trenchard, First Round Capital (#26)

- Anton Levy, General Atlantic (#31)

- John Doerr, Kleiner Perkins (#56)

- Spotify

One of the few new entrants to this year’s top 10, Spotify rose quickly following its public listing in April 2018 at a valuation of nearly $30 billion.

Spotify’s decision to undertake a direct listing, the first ever for a modern consumer tech company, was seen as a landmark moment. The success of its listing has prompted speculation that other tech “unicorns” like Slack and Airbnb will be emboldened to follow suit. As one of the world’s largest streaming music providers, with over 150 million total listeners, Spotify made the case that its brand is high-profile enough to forego the traditional investor marketing process before an IPO. It remains to be seen whether direct listings will become a preferred avenue to the public markets for other consumer-focused tech companies with similarly strong brands.

Where It Counted The Most On The 2019 Midas List*:

- Mary Meeker, Kleiner Perkins/Bond Capital (#8)

- Lee Fixel, Tiger Global (#16)

- Sameer Gandhi, Accel (#27)

- Brian Singerman, Founders Fund (#28)

- Rahul Mehta, DST Global (#34)

- John Lindfors, DST Global (#41)

- Klaus Hommels, Lakestar (#46)

- Par Jorgen Parson, Northzone Ventures AS (#58)

- Jeff Crowe, Norwest Venture Partners (#72)

- Sonali De Rycker, Accel (#83)

- DiDi Chuxing

Although some still refer to it as “China’s Uber,” DiDi Chuxing has become a globally recognized company. At a reported valuation of $56 billion as of its last fundraising round in June 2018, and clocking 40 billion routing requests daily, DiDi is one of the world’s most valuable and high-profile startups.

DiDi reportedly is expanding into several countries in Latin America, following its expansion into Australia, Taiwan, Mexico, and Brazil last year. Like its global rival Uber, DiDi is also aiming to be a leader in self-driving cars, and it has diversified its business through an array of on-demand mobility offerings, including Taxi hailing, social ride-sharing, and car rentals.

Where It Counted The Most On The 2019 Midas List*:

- Scott Shleifer, Tiger Global (#13)

- Jenny Lee, GGV Capital (#19)

- Allen Zhu, GSR Ventures (#25)

- John Lindfors, DST Global (#41)

- Jixun Foo, GGV Capital (#60)

- WeWork

WeWork debuted on this year’s top 10 following SoftBank’s sizable investment in the company in January 2019. While SoftBank had reportedly planned to acquire a majority of the company and decided to scale back its investment, its $6.0 billion investment in the company at a $47 billion post-money valuation was still enough to make WeWork a top driver behind the Midas List. Although Michael Eisenberg was the only VC from this year’s Midas List invested in WeWork, this deal was the primary cause for his inclusion – eclipsing all his other investments.

Shortly after SoftBank’s investment, WeWork – known today as a provider of shared workspace communities and office services – rebranded to The We Company, a decision that demonstrates the company’s growth ambitions. As co-founder and CEO Adam Neumann told FastCompany, WeWork aims to expand beyond commercial real estate and transform spaces in people’s digital and physical worlds through two additional business units: WeLive, a residential unit, and WeGrow, which currently includes an elementary school and a coding academy.

Where It Counted The Most On The 2019 Midas List*:

- Michael Eisenberg, Aleph Europe (#98)

- Pinduoduo

Pinduoduo, our last debut company on the top 10, has been described as a rising challenger against Alibaba in the e-commerce space. Backed by Alibaba rival Tencent, Pinduoduo offers a fun and interactive mobile platform that merges shopping with social networks, primarily through Tencent’s popular WeChat message app. The platform allows users to participate in group buying, which it calls a “team purchase” model, and offers low-price products ranging from groceries to home appliances.

The company went public in July 2018, raising $1.6 billion and earning a $21 billion valuation. Since then, Pinduoduo has reportedly been working to bring imported, higher-quality products to China’s smaller cities and rural areas at an affordable price, and it’s shown strong traction amongst its user base. As of September last year, the company claimed to have 232 million monthly active users that are growing at over 200% year-over-year.

Where It Counted The Most On The 2019 Midas List*:

- Neil Shen, Sequoia Capital (#1)

- James Mi, Lightspeed Venture Partners (#12)

- Xiaojun Li, IDG Capital Partners (#17)

- Zhen Zhang, Gaorong Capital (fka Banyan Capital) (#20)

- JD.com

Although dropping from #5 to #9 on this year’s list, JD.com, China’s largest e-commerce firm behind Alibaba, has remained a significant value driver on the back of its $26 billion IPO in 2014.

Recently, JD.com has been focused on expanding its business beyond traditional e-commerce and into areas like smart cities. The company recently created a new brand, iCity, dedicated to bringing its work in big data, artificial intelligence, and the Internet of Things to Chinese cities. JD.com is reportedly planning to build a JD-branded smart town, which will include capabilities in smart retail, Internet of Things, logistics lighting, and transporting. In addition to its investments in smart cities, JD.com is looking to grow overseas by launching a store, called Joybuy, on the Google Express online shopping site. This follows Google’s $550 million investment in the company last year.

Where It Counted The Most On The 2019 Midas List*:

- Neil Shen, Sequoia Capital (#1)

- Kathy (Xin) Xu, Capital Today (#6)

- Mary Meeker, Kleiner Perkins/Bond Capital (#8)

- Scott Shleifer, Tiger Global (#13)

- Rahul Mehta, DST Global (#34)

- John Lindfors, DST Global (#41)

- Snap Inc.

Two years into its life as a public company, Snap’s share price has been on a roller coaster following a controversial redesign of its flagship product Snapchat and a series of executive departures. But the company’s $3.4 billion listing on the NYSE in 2017 has continued to create significant value for investors on this year’s Midas List.

Since its appearance on last year’s top 10, Snap has taken steps to enhance its app performance and increase monetization of its users. The company’s most recent quarterly earnings report showed promising signs of a turnaround for Snap, as it beat analyst expectations on daily active user growth and earnings.

Where It Counted The Most On The 2019 Midas List*:

- Mary Meeker, Kleiner Perkins/KPCB (#8)

- Jeremy Liew, Lightspeed Venture Partners (#22)

- Hemant Taneja, General Catalyst Partners (#32)

- Rahul Mehta, DST Global (#34)

- Mitch Lasky, Benchmark Capital (#68)

- Dennis Phelps, Institutional Venture Partners (#76)

*Listed alphabetically by VC last name. Does not include all investors in the company.