TikTok’s retail ambitions took a major leap forward Tuesday when the social video platform and partner Shopify unveiled a significant expansion to pilot TikTok Shopping across the U.S., U.K. and Canada.

The social and e-commerce companies joined forces in October 2020 in a deal that gave merchants the ability to launch and run TikTok marketing within Shopify. But that relationship turned out to be a stepping stone to the more direct shopping functionality that was just announced.

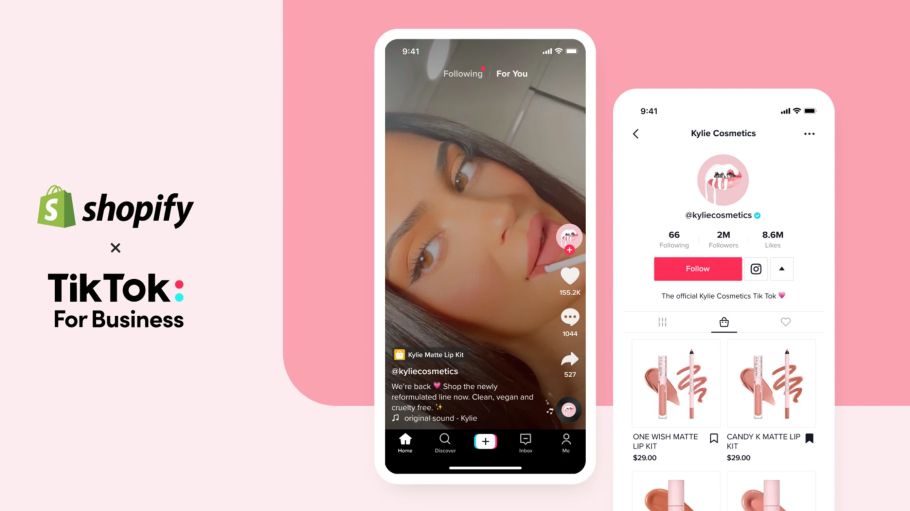

The test, already launched in the U.S. and U.K. and coming to Canada in the coming weeks, allows select Shopify merchants with a TikTok for Business account to open a “Shopping” tab on their TikTok profile that’s tied to their product catalogs, effectively creating a store destination. These merchants will also be able to tag items in organic TikTok posts and videos that link to their storefronts, so consumers can buy them. Transactions will be handled by Shopify.

The retail tech company is no stranger to social commerce, as it already works with Pinterest product pins, Facebook Shops and Instagram Shops. But with TikTok — an emerging social heavy weight, especially among Gen Z consumers — there seems to be a different level of excitement.

“By enabling new in-app shopping experiences and product discovery on TikTok for the first time, Shopify is powering the creator economy on one of the fastest-growing social and entertainment platforms in the world,” said Harley Finkelstein, president of Shopify. “We are excited to help this next generation of entrepreneurs connect with their audiences in more ways — and with TikTok as a visionary partner.”

Shopify stores interested in joining the pilot can make the request on Shopify’s TikTok channel, the company said.

The proposition has immediately generated interest, at least among high-profile TikTokers like Kylie Jenner, who revealed that Kylie Cosmetics will be among the first to directly sell through the video-sharing network.

“I built my business on social media; it’s where my fans go first to look for what’s new from Kylie Cosmetics,” Jenner was quoted as saying in the Shopify announcement. “I have so much fun creating TikTok videos, and I love sharing posts of my fans using the products. That’s why I’m excited for Kylie Cosmetics to be one of the first to let customers shop directly on our TikTok!”

According to the company, there’s growing demand for TikTok among its merchants, with installs across Shopify’s social commerce channels jumping 76 percent between February 2020 and 2021.

Meanwhile on TikTok, its interest in shopping has steadily progressed over an array of retail-related moves, including a shoppable hashtag challenge in 2019 and commerce partnerships with brands and retailers like Levi Strauss & Co. and Walmart Inc. The latter worked with TikTok on livestream shopping for the holidays and returned for a live shopping campaign last spring.

Then in May, TikTok confirmed it was testing in-app shopping in Europe. It looked like the most concrete evidence of the tech company’s social commerce ambitions, at least prior to Tuesday’s announcement.

It’s worth noting that the Shopify-fueled pilot in TikTok redirects to stores’ e-commerce sites, where users will actually make their purchases. However, TikTok’s in-app shopping test may signal its desire to contain the entire experience within its own walls.

For TikTok, whose test will cover hundreds of stores — a tiny slice of a massive platform that boasts more than 2 billion downloads and more than 1 billion monthly active users — that distinction could matter. It suggests that the Shopify arrangement, while a big step forward, is still just a step in the journey, not the destination.

The continued development, set against rivals like Facebook and Instagram racing to boost video services, shopping features and ad products, marks the momentum of today’s social commerce.

While the frenzy of 2020 reached maximum froth thanks to a pandemic that has kept many consumers out of physical stores, U.S. social commerce sales in 2021 is still set to grow by 35.8 percent, according to eMarketer, putting $36.62 billion at stake.