Brian Chesky, chief executive of Airbnb, likes to tell the story of his early struggles to fund his home-sharing start-up. Many venture capitalists refused to meet with him, he said in an email. Some walked out in the middle of meetings.

That changed after venture firms such as Sequoia Capital, Andreessen Horowitz and Founders Fund decided to gamble on Airbnb’s potential to shake up the vacation rentals business.

Three investors at those firms — Alfred Lin of Sequoia, Jeff Jordan at Andreessen Horowitz and Brian Singerman of Founders Fund — are now among the top players in the venture capital industry, according to an annual ranking compiled for The New York Times by CB Insights, which tracks the start-up industry. Airbnb, privately valued at $31 billion, landed more venture investors at the top of the list than any other company.

In his email, Mr. Chesky said Mr. Lin, Mr. Jordan and Mr. Singerman “have a founder’s mind-set” and “share our long-term vision.”

Airbnb is expected to go public sometime in the next year, following a bumper crop of initial public offerings that began on Friday with the ride-hailing company Lyft. Uber, Pinterest, Slack and others are also expected to list their shares in the next few months.

These offerings will likely mint many venture capital winners, generating huge returns for those who wrote the early checks to these companies. Here’s a look at some of the venture investors who may reap the I.P.O. rewards.

Alfred Lin

Sequoia Capital

When Uber goes public, Mr. Lin may feel a sting. That’s because he made a small personal investment in the ride-hailing company when it was very young, but turned down numerous chances to invest on behalf of Sequoia as Uber grew into a behemoth.

“We just didn’t dream with the entrepreneurs,” said Mr. Lin, 46, who joined Sequoia in 2010. “Sometimes we just make the wrong call.”

He may have other opportunities to celebrate. Mr. Lin and Sequoia invested early in Airbnb; DoorDash, a food delivery start-up valued at $7.1 billion; and Houzz, a home design and remodeling start-up worth $4 billion.

Sequoia wrote Airbnb a $585,000 check in 2009 and invested in each of the company’s later funding rounds. Mr. Lin said he was impressed by how the Airbnb founders could “articulate a dream of the world that is very different from what exists today.”

Yet sometimes those lofty dreams clashed with reality. As Airbnb grew, Mr. Chesky said, he wanted to hire executives from Apple and Disney, companies he admired for their creativity, design and simple product lines.

Mr. Lin, a former executive at Amazon-owned Zappos, said he had gently suggested that Airbnb emulate businesses that looked more like itself: ones with complex operations in many different places and a wide array of inventory, like Airbnb’s millions of home listings.

To help make the point, Mr. Lin introduced Mr. Chesky to Jeff Wilke, the head of Amazon’s retail business, in 2012. That meeting persuaded Mr. Chesky to shift his focus. Airbnb ended up poaching top Amazon executives to become its chief financial officer and head of its homes business.

“Part of our job is to help with the sparring of ideas,” Mr. Lin said.

With the I.P.O. stampede now on, he said, he is cautioning companies not to rush to go public because their peers are doing so. “These things are milestones, to some degree, that you celebrate,” he said. “But soon after you go public, you have to go back to running your business.”

What’s next? Mr. Lin said he and his team were looking at everything from robotics and artificial intelligence to payments and short-form video.

Jeff Jordan

Andreessen Horowitz

Marc Andreessen and Ben Horowitz, the founders of Andreessen Horowitz, have long been fixtures in the top rankings of venture capital investors, thanks to investments in companies like Lyft. Mr. Jordan, their partner, has recently outdone them.

Mr. Jordan, 60, got behind companies such as Pinterest, the digital pin board, which recently filed its prospectus for going public. He also bet on Instacart, the grocery delivery company worth $7.6 billion, and Lime, a scooter start-up valued at $2.4 billion.

In 2011, Mr. Jordan also led Andreessen Horowitz’s $60 million investment in Airbnb. He has said the company’s “marketplace” model of matching travelers with home providers reminded him of the early days of eBay, where he was an executive for five years.

When Airbnb experienced a hiccup in 2011 — a host’s home was trashed by a guest — Mr. Jordan helped the company with a new insurance program, Airbnb Guarantee, which was modeled after one at eBay.

Mr. Jordan, who also led OpenTable before joining Andreessen Horowitz in 2011, said part of his investment success was due to the firm’s wide range of services for start-ups, including recruiting, public relations and business development. It was once unusual for venture firms to to provide those services, though they have become more common.

Apoorva Mehta, founder and chief executive of Instacart, said Mr. Jordan often provided corporate development advice and introductions to potential retail partners.

“Jeff has always felt like an extension of our team,” Mr. Mehta said.

Mr. Jordan, who declined to comment on the current wave of I.P.O.s, said he was looking for the next “platform,” which could be voice or augmented reality and virtual reality.

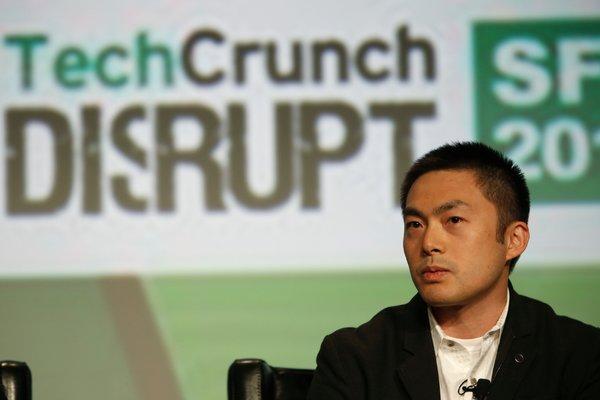

Brian Singerman

Founders Fund

Founders Fund does not offer a suite of services to its start-ups. That’s in keeping with the contrarian philosophy of its founder, Peter Thiel.

“We’re not operating the company,” Mr. Singerman, a partner at the firm, said of the reason for not providing additional services. He added that he also eschewed the typical venture capital practice of investing in companies based on a specific strategy or thesis.

“That is not me,” he said. “I’m actually open to anything. “

All of this helps explain why Mr. Singerman, a 42-year-old former Google engineer, has backed companies as diverse as a health insurance start-up, a payments company, a cancer drug maker and a seller of cheap novelty gifts. And, of course, Airbnb.

When Founders Fund helped fund Airbnb in 2013, its international growth had begun taking off.

“We had never seen an international network effect like they had,” Mr. Singerman said. He said Mr. Chesky also had a strong sense of what his customers wanted and “kind of wills things into existence.”

Mr. Singerman, who joined Founders Fund in 2008, said his biggest challenge was finding the right companies and persuading the founders to let him invest. To source deals, he relies on a broad network of contacts, which led him to Stemcentrx, a cancer drug company that was sold to AbbVie in 2016 for $5.8 billion, and RigUp, an online job platform for energy industry workers.

There’s one area in which Mr. Singerman is like other venture capitalists: his professed nonchalance toward I.P.O.s. Founders Fund tends to hold stock in its investments “for a very, very long time,” so a company’s public offering “doesn’t impact us,” he said.

In 2016, Mr. Singerman invested in a company called Long Term Stock Exchange. Founded by Eric Ries, the author of the start-up bible “The Lean Startup,” the company wants to open a new stock exchange for young companies that are seeking investors who will stick around for the long haul.

Mr. Ries said he had gone to Mr. Singerman for funding because he knew his idea was “out on a limb” and would require patience from investors.

The Top 20 Venture Capitalists

CB Insights analyzed investors’ deals, including companies that sold or went public and the value of current portfolio companies, to rank the top venture capitalists. The analysis spanned 2010 through March 2019 and is weighted toward more recent performance. The Times presents the top 20 here:

1. Neil Shen — Sequoia Capital China

2. Lee Fixel — Tiger Global Management

3. Bill Gurley — Benchmark

4. Alfred Lin — Sequoia Capital

5. Jeffrey Jordan — Andreessen Horowitz

6. Peter Fenton — Benchmark

7. Brian Singerman — Founders Fund

8. Mary Meeker — Bond

9. Matt Cohler — Benchmark

10. Ravi Mhatre — Lightspeed Venture Partners

11. Joshua Kopelman — First Round Capital

12. Bryan Schreier — Sequoia Capital

13. Allen Zhu — GSR Ventures

14. Mike Volpi — Index Ventures

15. Sameer Gandhi — Accel

16. JP Gan — Qiming Venture Partners

17. Ann Miura-Ko — Floodgate

18. Hans Tung — GGV

19. Aydin Senkut — Felicis Ventures

20. Ben Horowitz — Andreessen Horowitz