The junk-bond market has been on fire. And, now, as corporate debt piles up to “precarious heights” in the face of a rising-rate environment and a hawkish Federal Reserve, Wolf Richter of the Wolf Street blog finds that Wall Street pros are licking their lips over the potential popping of the bubble.

The so-called smart money, he says, is getting ready to load up on distressed debt, which is defined as junk-rated bonds yielding at least 10 percentage points above equivalent U.S. Treasurys TMUBMUSD10Y, +1.33% .

“It’s preparing now because these preparations include raising billions of dollars for their funds, and that takes some time,” Richter wrote in a post.

He explained that distressed-debt investors can rack up big profits during times of economic stress by buying bonds of companies they believe will emerge from the gloomy cycle without defaulting.

“In this scenario, a distressed bond might sell for 40 cents on the dollar, and two years later, the company is still intact and the credit squeeze is resolved, and now the bond is worth face value,” he said. “For those two years, the bond paid a huge yield to investors that bought at 40 cents on the dollar – and the profit might be 200% in capital gains and interest.”

That’s the kind of scenario investors like Jason Mudrick, founder of Mudrick Capital, are hoping for in the coming weeks and months.

“This economy is roaring right now,” Mudrick told the Financial Times. “It’s rocking and rolling. But that’s just not sustainable. My job is not to predict exactly when [the turn in the cycle] happens but to have the platform ready when it does.”

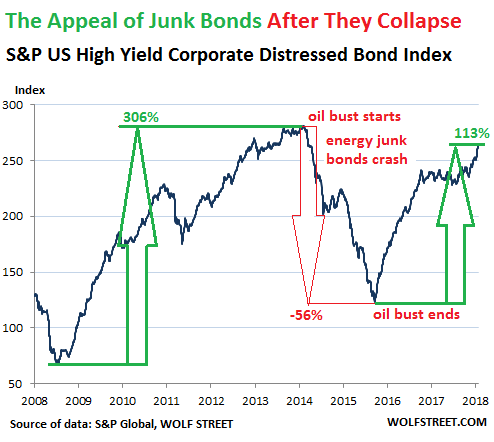

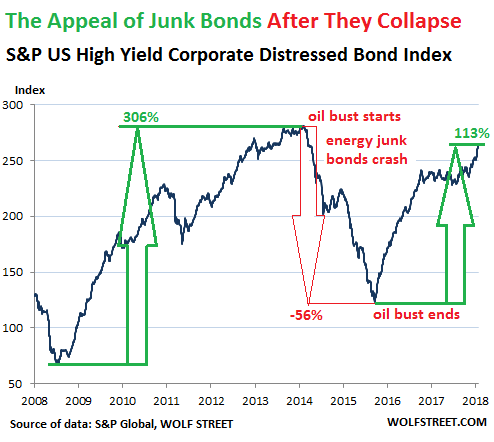

Richter gave an example of the kinds of gains those who time the shift correctly can pocket. The U.S. High Yield Corporate Distressed Bond Index, for instance, peaked in early July 2014 right before the oil bust and proceeded to drop 56% over the next 18 months. This chart tells you all you need to know about where it went when new money flowed back in and banks started lending again.

The index’s gain over the next two years or so doubled that of the S&P SPX, +0.17% which notched a 46% rally of its own. “The smart money that got the timing right made huge gains,” Richter wrote. “But the hypothetical buy-and-holder, whose portfolio mirrors the bonds in the index, would have seen their investments plunge and then recover mostly, but they would still be down 6%.”

So, the smart money is at it again, building up a cash pile — $74 billion, by one measure — and preparing for the next downturn in junk bonds HYG, +0.10% . According to the FT, seven distressed debt funds have raised money more than $15 billion total this year alone. One of them is run by Sheru Chowdhry, the former co-portfolio manager of the Paulson Credit Opportunities fund.

“I think we’ll be doing a lot of distressed stuff when there’s distressed stuff to do,” Chowdhry told the Financial Times. “It feels like we’re about 12 months away, but we could get into extended innings.”

Read: Next wreck in junk bonds will be bigger, longer, uglier.

Richter says while the smart money sets up for the next credit event and the opportunities it will bring, the little guy has to tread cautiously as it takes “a special expertise” to pull it off successfully.

“When the bottom falls out, distressed debt becomes an illiquid market. When forced selling sets in as bond mutual funds and others that have to meet redemptions by nervous retail investors, while buyers simply evaporate, incredible deals can be made,” he explained.

“But the risk of total wipeout is large. Many distressed bonds get crushed in bankruptcy. This is a fate to be avoided.”