Target reported a strong fourth quarter for ecommerce with digital sales up 31%, hitting $5 billion for the year, a five-fold increase since 2012. Overall comp sales were up 5.3% in Q4 on traffic growth of 4.5%, but revenue was flat at $23 billion.

Same-store sales grew 2.9%, and physical locations contributed nearly 75% of Target’s fourth quarter digital sales. The company reported EPS of $1.52 in the quarter and $5.50 for the year, down from $1.99 and $5.29, respectively in 2017.

“Across the business, we’re growing market share in every major category and our guests love what they see,” said Target CEO and Chairman Brian Cornell in an earnings call.

Cornell said Target laid out an ambitious investment agenda in 2017 to reimagine its stores and reinvent its supply chain and fulfillment capabilities while adding to its team and its brands.

For the year, overall comps were up 5%, Target’s strongest performance since 2005 and ahead of most others in retail.

“With our guest as our guide, we kept our stores and our people at the center of our strategy, but committed to deploy them in a radically different way,” said Cornell.

Cornell said in the last two years, more than 400 stores have been made over, outfitted with new technology, fixtures and design to give them a new look, feel and function.

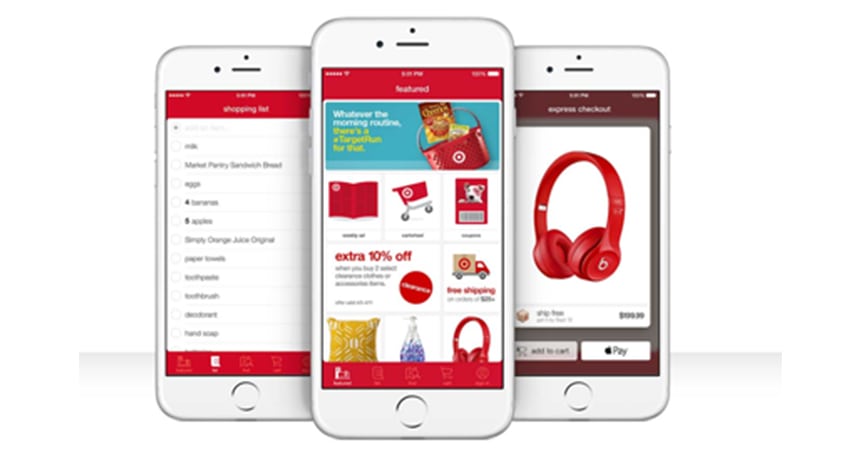

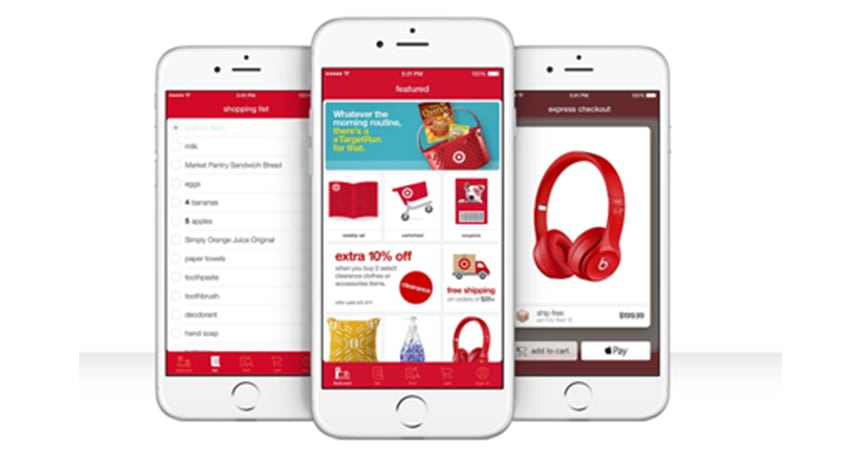

Target’s digital growth isn’t coming at the expense of its stores, Cornell said. “We invested to build industry leading digital and technology teams,” he added. “They’ve created a seamless and inspired user experience that’s worthy of our Target brand.”

Cornell said Target is investing in new technologies including conversational commerce, augmented reality, artificial intelligence and virtual reality to provide greater utility and a richer experience for its guests. It’s also focusing on greater levels of personalization and engagement across every touchpoint and channel.

“Personalization and engagement are also the cornerstones of our evolving loyalty strategy,” said Cornell. “Building out our loyalty strategy we saw the opportunity to tap into a full range of shopper types, folks who visit us each week and knows who might only show up once a year.”

He added Red Card and Cartwheel members are more engaged, shop more often and spend more than the average guest.

In February, Target expanded Target Circle, a new loyalty program in its mobile app. Originally tested in Dallas, it’s now being rolled out to five new markets. Members perks include a 1% rebate, the ability to direct philanthropic giving and special offers.