Retail is used to change.

Valentine’s Day hearts come down,

St. Patrick’s Day shamrocks go up, Mother’s Day flowers are trimmed and arranged. Ah, those days!

Today’s change is much different – more rapid, much more complicated, highly technological and completely unpredictable. And just as retailers think they’ve finally settled into a sweet spot, the whole thing moves.

So a look at the state of the industry in mid-2018 is purely a snapshot. Save it in your photo gallery if you wish, but be ready to replace it in six months or so. (That’s one good thing about snapshots in the digital age – film was so expensive.)

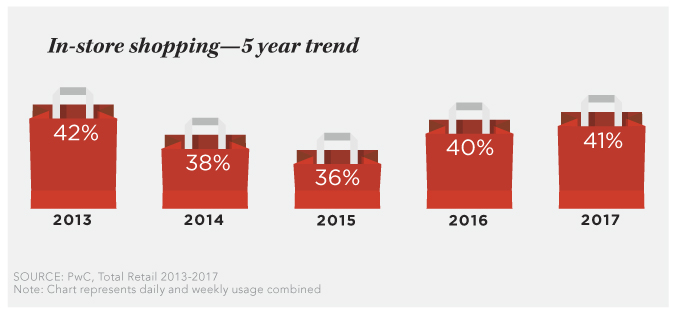

Of course, today’s consumers will continue to buy. The challenge is figuring out how to communicate with them, how to market to them and especially how to get them to keep coming into your stores.

How are retailers facing some of these challenges? Let’s take a look.

At Nordstrom Local in West Hollywood, Calif., actual purchases are eschewed in favor of services like tailoring and alterations, returns and even manicures.

WHAT’S IN STORE?

Nordstrom (Seattle) received a great deal of attention for the opening of its first ever full-line store in Manhattan. But perhaps a keener view into the future of the retailer, and many others, is the Nordstrom Local concept that debuted late last year on Melrose Place in West Hollywood, Calif.

This 3000-square-foot “store” has no merchandise for sale. Customers can try things on and order them online at the store, but no physical transactions take place. Instead, a variety of Nordstrom services are offered: Shoppers can pick up Nordstrom online purchases there, or return purchases; they can even return online purchases from other retailers, and Nordstrom will pay the shipping cost, if any.

They also can get free basic alterations, again whether or not the items were purchased at Nordstrom. They can book a consultation with a stylist. They can get all kinds of manicure services from a “nail technician.” And they can get a glass of beer, or wine or fresh-squeezed orange juice.

The 21st century consumer wants an experience – and that, as Nordstrom Local demonstrates, includes something as simple and low-tech as offering food and drink.

Detroit-based Tappers, a high-end luxury jewelry retailer, has installed a free bar in its store in the Somerset Mall (Troy, Mich.). Anyone walking through the mall is welcome to come in for wine, beer or root beer.

Luxury jeweler Tappers offers shoppers Michigan-made beers on tap along with wine and soft drinks as part of its in-store experience.

Ken Nisch, Chairman of JGA Inc., the Southfield, Mich., design firm responsible for the project, says the “social bar” is part of a bigger overall trend in retail, which is “social shopping.” Stores have become gathering places or meeting destinations, as in “meet me at Tappers, and we’ll have a beer.”

Another part of the “experience” package is the realization that retailers’ physical space can be used for events – demonstrations, cocktail parties, fashion shows, classes – that draw people into the store.

The U.K. department store operator Selfridges & Co. recently turned part of its Oxford Street flagship store in London into Lamyland, featuring designer and artist Michèle Lamy’s exploration and interpretation of luxury.

The first chapter, launched last December, was an actual, fully functioning boxing gym in Selfridges’ Corner Shop, which is dedicated to temporary themed residencies. The 3500-square-foot space offered punching bags and a boxing ring, along with strength and conditioning stations. There were boxing classes, demonstrations, weight training and core exercises from professional coaches for the initiative, which ran for one month.

U.K. retailer Selfridges embraced experiential retail with a temporary boxing gym, complete with a ring and punching bags, at its Oxford Street flagship.

THE CLOTHING WARS

Amazon.com Inc. (Seattle) is more than just the elephant in the room. It’s claimed the room and is looking at taking over the entire house. Having already raided the pantry, its next foray is expected to be into the clothes closet.

Online apparel shopping has become “the highest online-penetration consumer products good sector,” says Sunny Dillhon, partner at Signia Venture Partners (Menlo Park, Calif.). “The majority of women have shopped for clothing online. And e-commerce accounts for nearly twice as big a proportion of total clothing sales as it does for most product sectors.”

However, even as Amazon enters into very public relationships with notable apparel brands like Calvin Klein and Chico’s, no one knows how many of its own brands Amazon has created. Carol Spieckerman of Spieckerman Retail (Bentonville, Ark.) says, “They’re building a private brand portfolio at an unprecedented scale. As a result, anyone who does business with Amazon is increasingly competing with Amazon’s own brands. It will have a dilutive effect.”

GETTING SMARTER ALL THE TIME

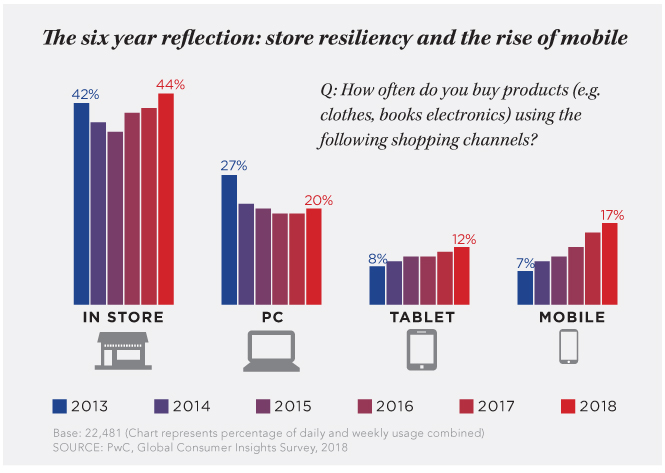

A study by Ericsson Consumer and IndustryLab (Stockholm) reported that 43 percent of those surveyed make weekly purchases with their smartphones. Most of these mobile shoppers said they expect to be able to access a personal shopping advisor powered by artificial intelligence within three years.

Instagram says at least 80 percent of its users already follow a brand on the network. And that’s a powerful potential following. The latest Instagram numbers show more than 800 million monthly active users; some believe it could reach a billion in 2018.

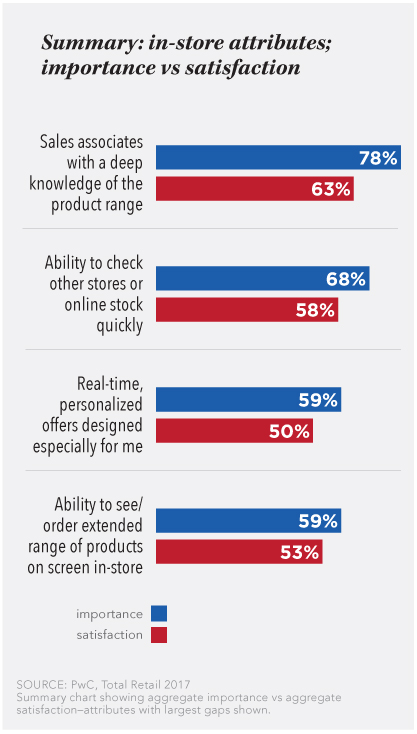

Sephora’s new Studio concept integrates social media with its in-store offerings so customers can make appointments, track the results of previous visits and retrieve ratings and reviews on any product throughout the store. Its Sephora Digital Makeover Guide captures a customer’s product, application and look preferences from the makeover. A record of the shopper’s makeover experience is then delivered to him or her, via email, for easy future reference.

But even email is being viewed as outmoded, like a cell phone that only makes calls. In fact, the opportunity for social media conversations between consumers and brands is only growing. Brands are beginning to understand that social media can be effective in creating relationships, not just advertising and selling products.

“It’s absolutely essential to keep your followers happy by providing a network where they can reach you,” according to Alex York, Senior SEO Specialist with platform developer Sprout Social (Chicago).

One technology newly developed to keep these conversations flowing and productive is a customizable chatbot – a computer program that simulates an actual conversation through artificial intelligence technology, found mostly in messaging apps such as Facebook Messenger, WhatsApp, WeChat and Viber.

Today’s messaging apps are reported to have more than five billion monthly active users and are said to be overtaking social networks. On Facebook Messenger alone, there are more than 100,000 chatbots in use to gather information, give product guidance and take actual orders.

Facebook has announced new features for businesses using its Messenger platform, including an integrated AR capability that Sephora, Nike and Asus, among others, will be adopting, according to a Facebook blog post. The function, using brand-specific AR filters and effects, allows customers to visualize products and applications before they buy them.

THE NEW REALITY

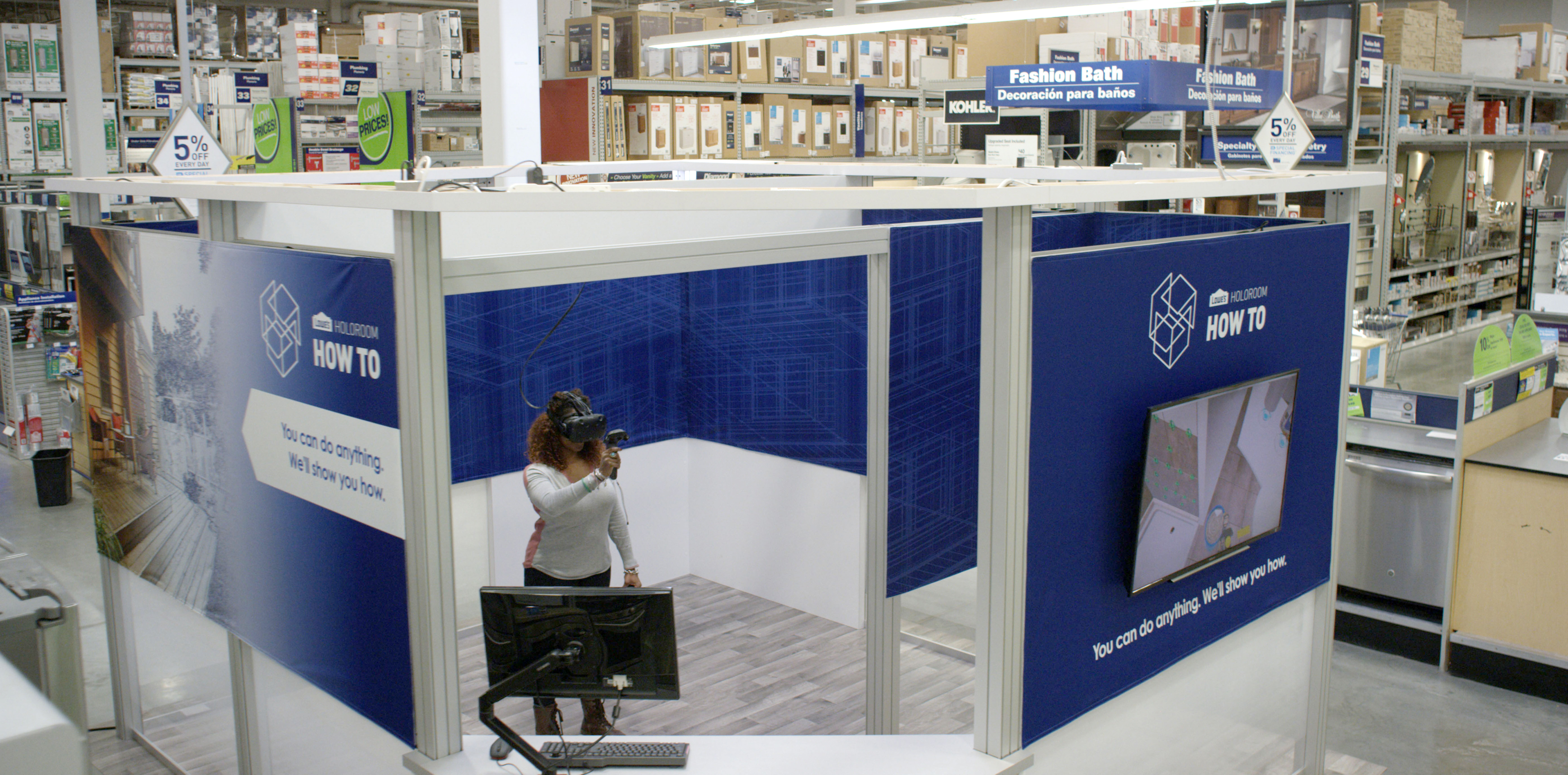

The Holoroom How To initiative by Lowe’s Cos. Inc. (Mooresville, N.C.) has turned a mundane shopping trip for hammers and nails into an immersive home-improvement experience.

The concept, launched a year ago in a Lowe’s location in Framingham, Mass., allows customers within the store, using a virtual reality headset and a controller in each hand, to become immersed in their own DIY projects (painting a room, tiling a shower, building a bookshelf), getting the necessary step-by-step instructions to complete the task. They’re not listening to a talking head, they’re part of the tutorial, even feeling the vibration of a drill through the controller.

IKEA (Leiden, The Netherlands) has developed IKEA Place, an app that allows users to preview how IKEA furniture and appointments would look in their homes. All they need to do is scan the floor using their iPhone and then select the product they want to place.

BJ’s Wholesale Club (Westborough, Mass.) has introduced a new “wish list” inspired by online dating apps. Shoppers in the store are presented with a series of products in the app’s discover feature, and then swipe right to accept the suggestion, and put it on their wish lists, or swipe left to reject the offering. The more they engage with the feature, the more the app uses machine learning to refine its personalized suggestions for each individual consumer.

Nor is AR just for hard goods. Saks Fifth Avenue (New York) is rolling out a new augmented reality concept called the Salon Project, which allows clients to “try on” different hairstyles and cosmetics with the help of augmented reality programs installed in mirrors and on iPads.

Lowe’s Holoroom is an immersive VR design and visualization tool that empowers customers to learn about DIY projects at their own pace.

YOUTH WILL BE SERVED

There are an estimated 83 million millennials in the U.S. They are often identified as the generation that grew up using and becoming familiar with, even dependent on, digital communications and social media.

But the group that is coming along behind millennials has never known anything but. If millennials began their high-tech journey with Nintendo and dial-up Internet, Gen Z has never not had a smartphone at thumb’s reach.

What these generations do have in common is values, like sustainability and environmental consciousness, and impatience with any corporation that skirts accountability. While they still want and need merchandise, they value “experience” more than “stuff.”

Stuff’s in the palm of their hands, every hour of every day. What are retailers offering to get them into the store?

“They don’t want to feel they’re being manipulated or coerced toward a certain behavior,” says Spieckerman. “They expect transparency from you. They actually like shopping in stores, but if you are attempting to manipulate the shopping experience, they’ll push against it. If they feel they’re being subjected to any ‘tricks’ – whether in pricing, or availability, or quality of merchandise, or attempts at upselling, they’re outta there. Their BS detectors are unerringly accurate.”

The “experiential” movement that’s overtaken the retail conversation recently has been driven by these two generations.

“Millenials like to shop somewhere that’s built around social interaction, rather than just transaction,” says JGA’s Nisch. “They want casualization of luxury and experience.”

However, he says, don’t simply consider the needs of millennials and Gen Z. The approach works for baby boomers, too, who still are out there waving their credit cards – and who actually still feel more comfortable shopping in the store than online.

“While today’s retail design is aimed at millennials,” he says, “we all want to associate ourselves with that younger dynamic. If a store makes a boomer feel younger, that’s not a bad thing.”