This article is intended for those of you who are at the beginning of your investing journey and looking to gauge the potential return on investment in Ryazan Energy Retail Company Public Joint-Stock Company (MCX:RZSB).

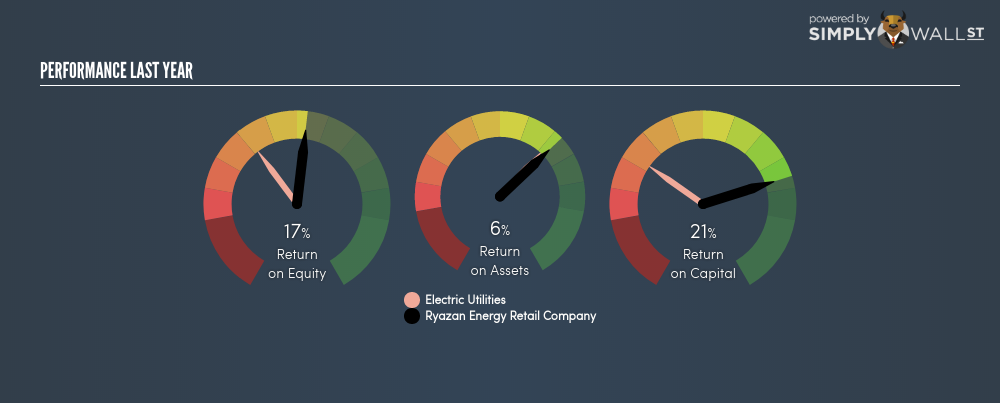

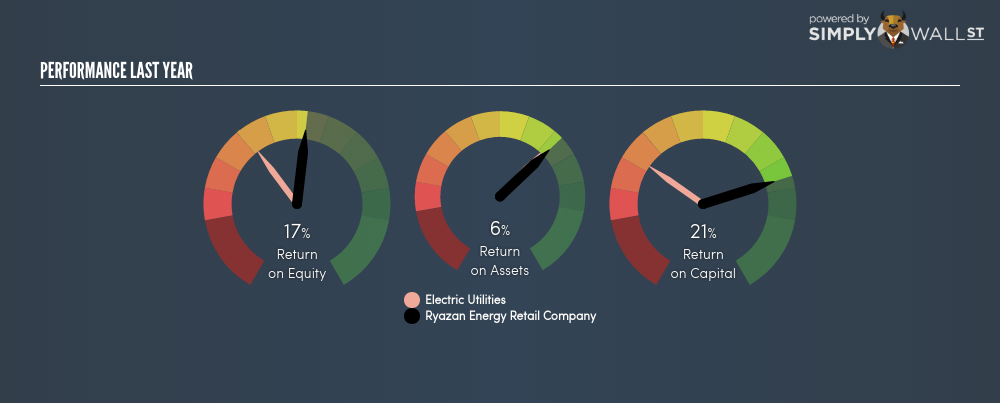

Ryazan Energy Retail Company Public Joint-Stock Company (MCX:RZSB) delivered an ROE of 17.07% over the past 12 months, which is an impressive feat relative to its industry average of 8.51% during the same period. However, whether this above-industry ROE is actually impressive depends on if it can be maintained. A measure of sustainable returns is RZSB’s financial leverage. If RZSB borrows debt to invest in its business, its profits will be higher. But ROE does not capture any debt, so we only see high profits and low equity, which is great on the surface. But today let’s take a deeper dive below this surface. Check out our latest analysis for Ryazan Energy Retail Company

Breaking down ROE — the mother of all ratios

Return on Equity (ROE) is a measure of Ryazan Energy Retail Company’s profit relative to its shareholders’ equity. For example, if the company invests RUB1 in the form of equity, it will generate RUB0.17 in earnings from this. Investors that are diversifying their portfolio based on industry may want to maximise their return in the Electric Utilities sector by choosing the highest returning stock. But this can be misleading as each company has different costs of equity and also varying debt levels, which could artificially push up ROE whilst accumulating high interest expense.

Return on Equity = Net Profit ÷ Shareholders Equity

ROE is measured against cost of equity in order to determine the efficiency of Ryazan Energy Retail Company’s equity capital deployed. Its cost of equity is 13.41%. Given a positive discrepancy of 3.66% between return and cost, this indicates that Ryazan Energy Retail Company pays less for its capital than what it generates in return, which is a sign of capital efficiency. ROE can be dissected into three distinct ratios: net profit margin, asset turnover, and financial leverage. This is called the Dupont Formula:

Dupont Formula

ROE = profit margin × asset turnover × financial leverage

ROE = (annual net profit ÷ sales) × (sales ÷ assets) × (assets ÷ shareholders’ equity)

ROE = annual net profit ÷ shareholders’ equity

MISX:RZSB Last Perf June 28th 18

MISX:RZSB Last Perf June 28th 18

The first component is profit margin, which measures how much of sales is retained after the company pays for all its expenses. Asset turnover reveals how much revenue can be generated from Ryazan Energy Retail Company’s asset base. The most interesting ratio, and reflective of sustainability of its ROE, is financial leverage. We can assess whether Ryazan Energy Retail Company is fuelling ROE by excessively raising debt. Ideally, Ryazan Energy Retail Company should have a balanced capital structure, which we can check by looking at the historic debt-to-equity ratio of the company. Currently, Ryazan Energy Retail Company has no debt which means its returns are driven purely by equity capital. Therefore, the level of financial leverage has no impact on ROE, and the ratio is a representative measure of the efficiency of all its capital employed firm-wide.

MISX:RZSB Historical Debt June 28th 18

MISX:RZSB Historical Debt June 28th 18

Next Steps:

ROE is one of many ratios which meaningfully dissects financial statements, which illustrates the quality of a company. Ryazan Energy Retail Company’s above-industry ROE is encouraging, and is also in excess of its cost of equity. Its high ROE is not likely to be driven by high debt. Therefore, investors may have more confidence in the sustainability of this level of returns going forward. ROE is a helpful signal, but it is definitely not sufficient on its own to make an investment decision.

For Ryazan Energy Retail Company, I’ve put together three fundamental aspects you should further research:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Future Earnings: How does Ryazan Energy Retail Company’s growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

- Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Ryazan Energy Retail Company? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

Investors! Do you know the famous “Icahn’s lift”?

Noted activist shareholder, Carl Ichan has become famous (and rich) by taking positions in badly run public corporations and forcing them to make radical changes to uncover shareholders value. “Icahn lift” is a bump in a company’s stock price that often occurs after he has taken a position in it. What were his last buys? Click here to view a FREE detailed infographic analysis of Carl Icahn’s investment portfolio.