Alibaba is about to get a jolt from its largest rival in Southeast Asia. Sea, the Nasdaq-listed business, is raising as much as $1.5 billion from a new share offering that’s sure to be funneled into its Shopee e-commerce business.

Singapore-based Sea said in a filing that it plans to offer 60 million American Depositary Shares (ADS) at a price of $22.50 each. That could raise $1.35 billion, but that number could increase by a further $202 million if underwriters take up the full allotment of 9 million additional shares that are open to them. If that were to happen, the grand total raised would pass $1.5 billion. (Shopee raised $500 million in a sale last year.)

Sea said it would use the capital for “business expansion and other general corporate purposes.” That’s a pretty general statement, and its businesses span gaming (Garena) and payments (AirPay), but you would imagine that Shopee, its primary focus these days, would be the main benefactor.

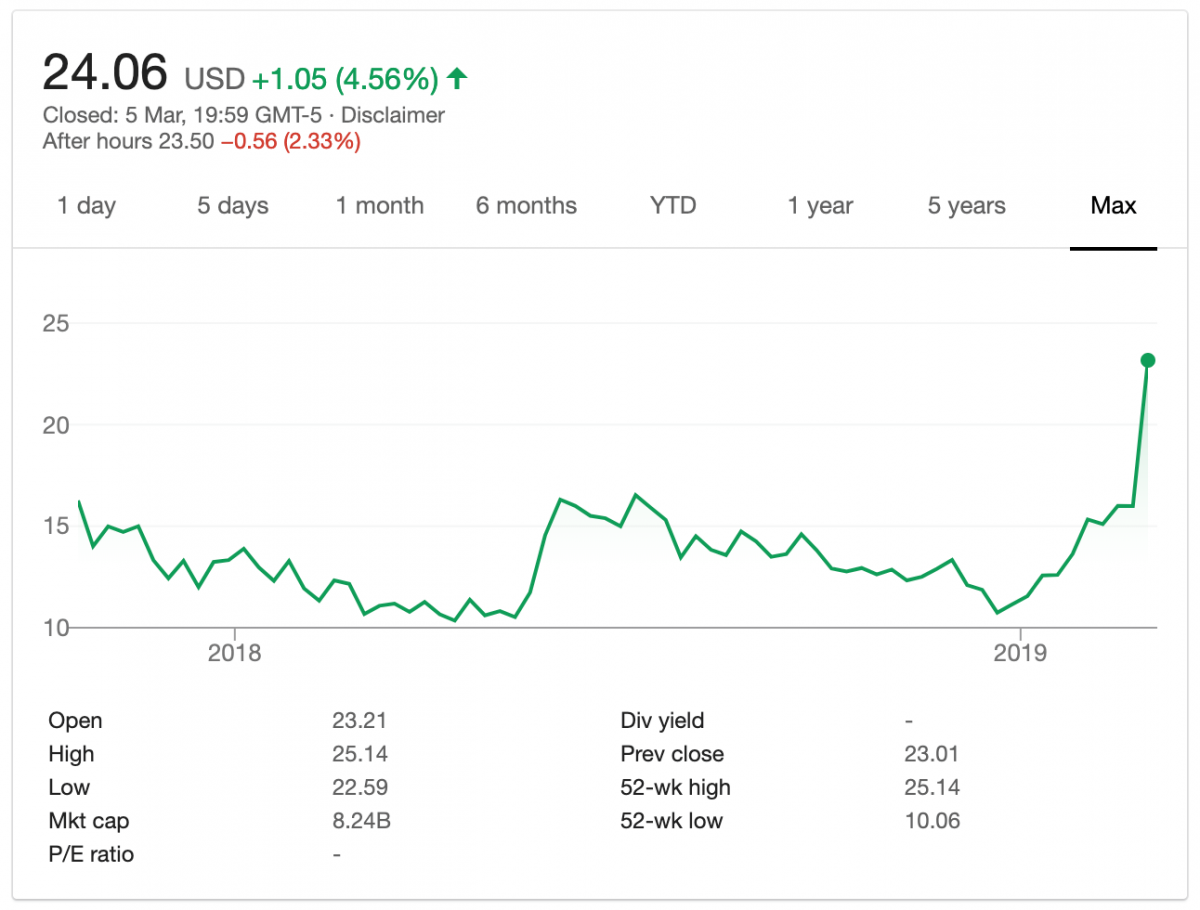

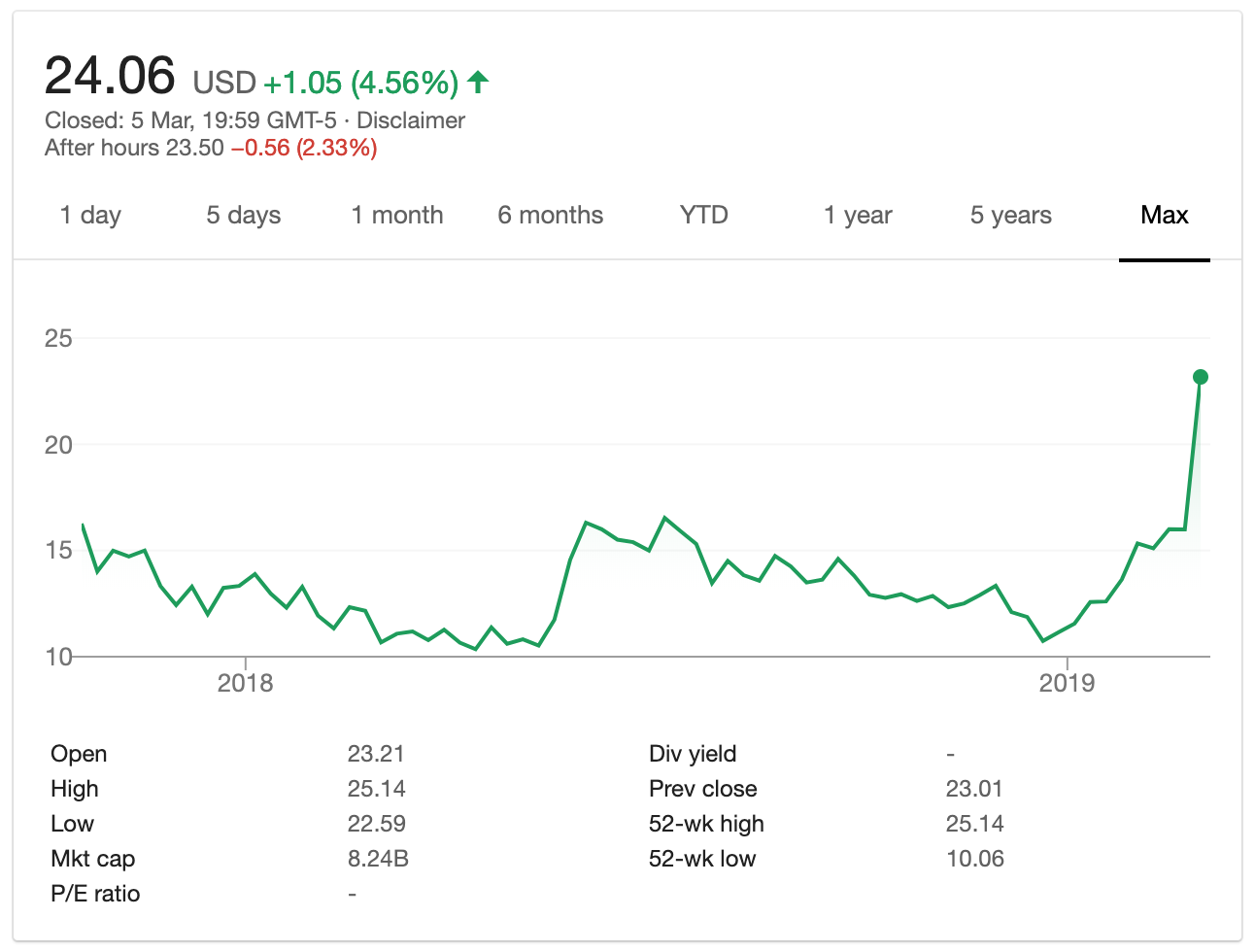

The $22.50 price represents a discount on Sea’s current share price — $24.06 at the time of writing — and the timing sees Sea take advantage of a recent share price rally. The company last month announced its end of year financials for 2018, which included positive progress for Shopee and Garena.

Whilst it remains unprofitable, Shopee saw annual GMV — total e-commerce transactions, an indicator of business health — cross $10 billion for the first time, growing 117 percent in the fourth quarter alone.

Those green shoots were met with enthusiasm by investors, as trading drove the stock price to a record high since its October 2017 IPO. That, in turn, made founder Forrest Li a billionaire on paper and gave Sea a market cap of more than $8 billion.

Shopee shares have rallied after its 2018 financial report showed signs of promising growth for its Shopee e-commerce business

The capital is very much needed, however, as Shopee is some way from profitability and that is dragging down Sea’s overall business.

While adjusted revenue for Shopee increased by more than 1,500 percent last year, it represented just over one-quarter of Sea’s overall $1 billion income in 2018 and contributed heavily to the parent company’s net loss of $961 million. Shopee alone posted an $893 million net loss in 2018.

Shopee is up against some tough competitors in Southeast Asia, most of which have strong links to Alibaba. Those include Alibaba’s own AliExpress service, Lazada — the e-commerce service it acquired — and Tokopedia, the $7 billion-valued Indonesian company that counts Alibaba and SoftBank’s Vision Fund among its backers.

Sea claims to be the largest e-commerce firm in “Greater Southeast Asia” — a classification that includes Taiwan alongside Southeast Asia — although direct comparisons are not possible because Alibaba doesn’t provide detailed information on its e-commerce businesses outside of China.

Alibaba said its international e-commerce businesses — which include many other services beyond Lazada — made $849 million in revenue during its most recent quarter, an annual increase of 23 percent. Lazada is in the midst of a transition — it appointed a new CEO in December — that has included a move away from direct sales. Alibaba said that impacted growth, with GMV rates slowing, but it pledged to continue its focus, having invested a fresh $2 billion into the business last year.

“We continue to invest resources to integrate Lazada’s business and technology operations into Alibaba with the aim of building a strong foundation for us to extend our offerings in Southeast Asia,” it said.