-

Retailers in many countries are back in business as lockdowns ease, but they are operating under tight hygiene and distancing controls.

-

Luxury group Richemont’s gloomy warning of up to three years of economic slowdown reflected another week of bleak news.

-

The Covid-19 crisis is prompting an ongoing debate about the fashion system, with leading retailers and designers seeking to reshape fashion season timings.

Retailers are reopening worldwide, but no one in the fashion and luxury industries is expecting a return to business as normal. As JC Penney joined the lengthening list of American retailers seeking bankruptcy protection, a downbeat mood prevailed. Switzerland-based luxury group Richemont announced an 18 per cent drop in sales for its fourth quarter and warned of a long haul ahead.

Here, Vogue Business highlights the latest news from the luxury industry and related sectors.

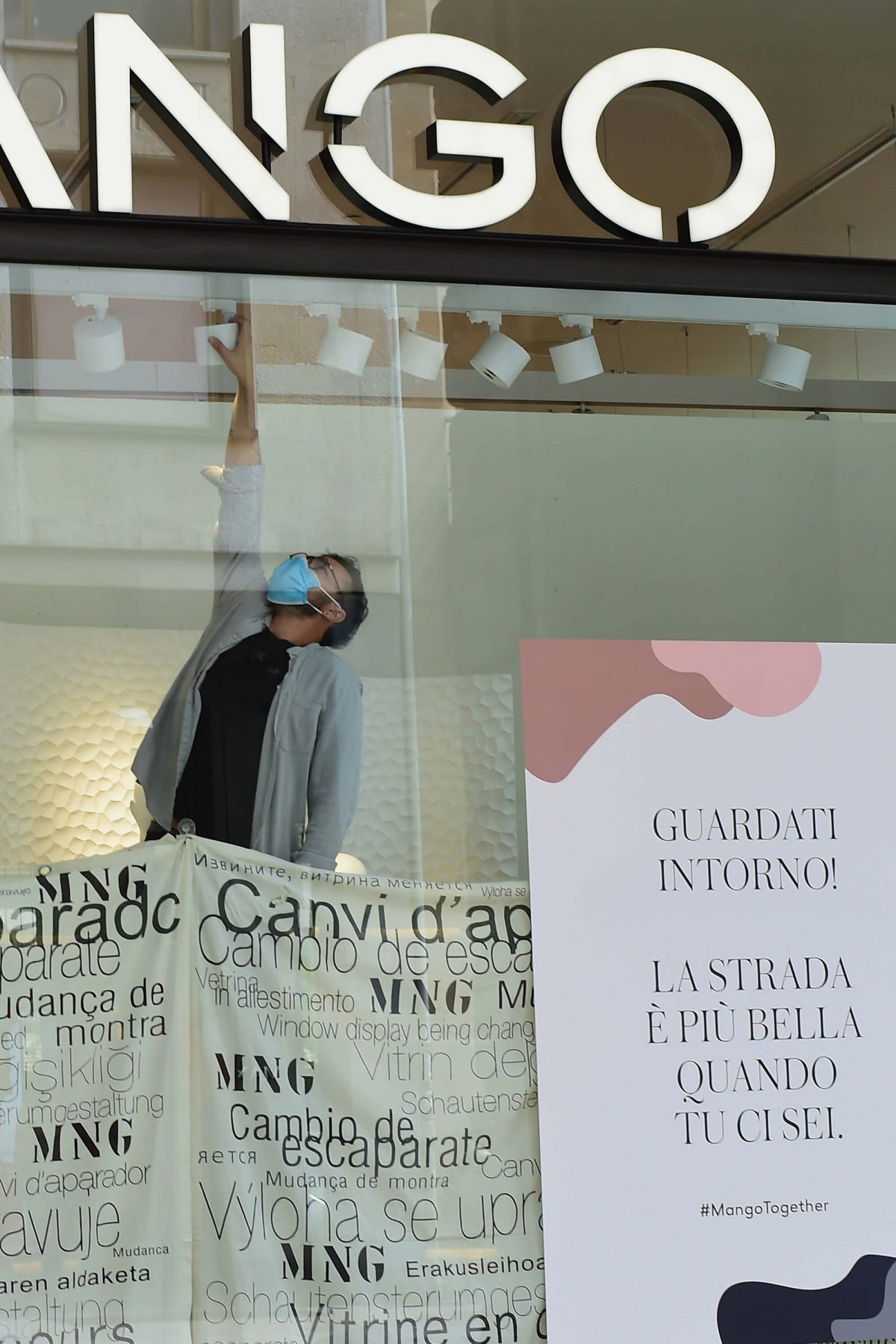

Fashion retailers in the West cautiously reopen. Fashion retailers across North America and Europe are joining a global reopening, following strict hygiene and distancing controls. One week into reopening across France, Claudia D’Arpizio, Bain & Company partner, said feedback was rather positive. “We saw a pattern similar to China: lower traffic but higher conversion rate.” Department stores and shopping centres of over 40,000 sqm in the Île-de-France region around Paris remain closed until at least 10 July.

Stores across Italy are also reopening. However, business association Confcommercio predicts consumer spending on fashion will slump by 20 per cent this year, and a quarter of Italy’s 115,000 fashion retailers will collapse. Fashion retailers remain closed in the UK.

Meanwhile, on 15 May American department store group JC Penney became the latest debt-laden retailer to file for bankruptcy during the pandemic. The company has $500 million in cash on hand and has reported commitments for $900 million in financing from existing lenders to fund bankruptcy. As many as 200 of its 850 stores could close. “The American retail industry has experienced a profoundly different new reality,” said CEO Jill Soltau in a statement.

Long-haul warning from luxury, online retailers see opportunities. Reporting an 18 per cent fall in sales in its fourth-quarter, luxury group Richemont was downbeat about the prospects of a bounceback. “No one can say when we will see economic activity normalise. We may be looking at 12, 24 or 36 months of grave economic consequences. Perhaps that is too pessimistic but who knows?” said chairman Johann Rupert in a statement.

On 22 May, Burberry is forecast to report operating profit for the year down 23 per cent to £337 million and may cut its dividend. In Japan, heritage brand company Renown, part-owned by China’s Shandong Ruyi, filed for bankruptcy on 15 May.

Companies that are unencumbered by heavy debt have been less disrupted by the pandemic thanks to their strong online presence sense opportunities. UK online retailer Boohoo, which has reported robust trading, raised £198 million through a share placing on 14 May to fund acquisitions. The company said it would “take advantage of numerous opportunities that are likely to emerge in the global fashion industry over the coming months”.

Advice to prevent Covid-19 transmission displayed on the door of a Louis Vuitton store in Milan.

© Francesco Prandoni/Getty Images

E-commerce soared in the month of April worldwide, with the general retail sector experiencing 209 per cent growth compared to the same month last year, according to an analysis by ACI Worldwide of hundreds of millions of e-commerce transactions. In the US, online apparel sales rose by 34 per cent year-on-year on the back of heavy discounting, according to the latest datafrom Adobe’s Digital Economy Index.

In a surprise move that brings designer brands into the orbit of Amazon, Amazon Fashion is collaborating with Vogue and the Council of Fashion Designers of America (CFDA) to help fashion businesses. A digital store has been created, titled Common Threads: Vogue x Amazon Fashion, and Amazon has made a $500,000 contribution to A Common Thread, a fundraising and storytelling initiative launched in April.

Rethinking the system, from luxury to fast fashion. As reported by Vogue Business, leading designers and retailers, ranging from Dries Van Noten to Selfridges and Hong Kong’s Lane Crawford, have issued a collective call for sweeping changes to the high-end fashion system, posting a petition online. A core proposal would play down pre-collections and rework the Autumn/Winter season to last from August to January and Spring/Summer from February to July. The traditional fashion show format has also come under intense scrutiny.

Meanwhile, the fast fashion supply chain is anticipating a “Darwinian shakeout”, according to Achim Berg, a fashion industry specialist at McKinsey. Manufacturers in Bangladesh have lost $3.18 billion in export orders cancelled or suspended, according to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA). It could get worse for suppliers in Asia as retailers in the West are likely to shift more sourcing closer to their markets, shortening lead times.

The urgent need to shift stock is a key talking point across all levels of the fashion industry. Many retailers are ‘hibernating’ stock, which means warehousing basics that can be resold in spring 2021, to avoid discounting. UK retailer Next has identified£330 million – or 15 per cent – of its stock from this spring that can be sold in 2021.

Far from discounting, many premium brands are tweaking prices upwards. Chanel denied price increases on some handbags and small leather goods ranging from 5 to 17 per cent were directly related to the pandemic, saying they were part of a continuing process of price reevaluation.