In a report using Nielsen point-of-sale data with WellnessTrack claims and sustainable product attributes sourced by Nielsen Product Insider, the sales data insights firm took a deep dive into the performance of sustainability claims in chocolate and coffee.

Defining sustainable claims

When looking at callouts of sustainability claims for chocolate, Nielsen stuck to environmental claims (carbon neutral, ethically sourced, made with renewable energy, etc.), fair trade designation, and the absence of artificial ingredients.

While chocolate with environmental claims makes up only 0.2% of the total category share, it grew by 22% from March 2017 to March 2018 – more than 4x the rate of total category dollar sales growth.

In terms of units, Nielsen data showed that chocolate product with environmental claims sold at a rate 5x faster than the overall category (15% unit sales growth compared with 3%).

Sales of products with fair trade claims (which make up only 0.1% of total chocolate share) are growing faster than the overall category as well, with dollar sales growth outpacing category growth by 2x (10% vs. 5%) and unit sales growth by 5x (15% vs. 3%).

‘Clean’ chocolate on the rise

Consumers are also willing to pay more for chocolate products that are free-from ‘undesirable’ or artificial ingredients, a subset of products that makes up 15.2% of the overall chocolate category, according to Nielsen.

Chocolate that is free of artificial ingredients, or made with ‘clean’ ingredients, is growing on par in unit sales with the total chocolate category, both growing at 3%. This data insight could lead to the assumption that products with clean ingredient claims are not growing faster than the total category, Nielsen pointed out.

“However, products with this claim have grown faster from a dollar sales perspective than the total market (16% vs 5%). Based on that, we can infer that price is actually higher per unit, and that consumers are willing to pay more for the sustainable choice.”

Along with the increase of the average retail unit price, chocolate free from artificial ingredients is increasingly being sold in a greater number of stores, while the distribution of all other chocolate is flat, Nielsen added.

“Although the share of chocolate free from artificial ingredients may seem small from a manufacturer standpoint, the growth rate is remarkable given the relatively smaller share of the total market that the segment makes up.”

How about sustainable coffee?

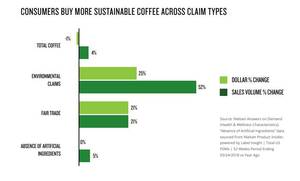

The same three types of claims (environmental claims such as recyclable packaging to eco-friendly labeling, absence of artificial ingredients, and fair trade) were assessed in the coffee category.

Nielsen found that while the total coffee category declined 1% in dollar growth from March 2017 to March 2018, coffee products with environmental and fair trade claims experienced double-digit dollar sales growth for the same period.

Coffee products with environmental claims on its packaging saw total dollar growth increase by 25% from March 2017 to March 2018, compared to the sales volume growth of 4% in the total coffee category.

Quantities sold of coffee with environmental claims were also up, growing 52% in sales volume in the last year, according to Nielsen.

“It’s important to remember that price and distribution affect consumers’ willingness and ability to purchase coffee products with sustainability claims,” noted Nielsen.

“Given their fast rate of sales growth in stores, coffee brands that have an environmental sustainability claim can often request greater shelf placement from retailers because they (and retailers) know that consumers are increasingly seeking them out in-store.”

The takeaway on sustainability claims

While consumers are spending more on products with sustainability claims within the chocolate and coffee categories, distribution and in-store availability of conventional products is 200x greater than the presence of sustainable products.

“What we do know is that sustainability presents an opportunity to be creative about innovative growth,” said Nielsen. “Embedding consumer demand for sustainability into your company strategy and product pipeline requires data specific to your brand footprint and consumer profile.”