Store credit has the power to do many things. It’s more than just another payment option for retail customers — it can help boost retention and inspire brand loyalty. You can increase spending and grow your store’s revenue by using store credit deliberately and in more innovative ways. That’s why the most successful retailers offer store credit in a variety of forms — they’ve seen the benefits and doubled down.

Store credit has the power to do many things. It’s more than just another payment option for retail customers — it can help boost retention and inspire brand loyalty. You can increase spending and grow your store’s revenue by using store credit deliberately and in more innovative ways. That’s why the most successful retailers offer store credit in a variety of forms — they’ve seen the benefits and doubled down.

Let’s look at how can you use store credit to help build your business.

What is Store Credit?

First, let’s step back and look at what exactly we mean when we say “store credit.”

Store credit is a value that you offer customers toward any purchase they make with your business. This credit typically isn’t transferable to other stores or brands, and it’s different from a sale or a discount in that store credit applies to one particular customer and usually doesn’t expire the way temporary sales or promotions do.

Common Types of Store Credit

There are four main ways store credit retailers use all over the world:

- Returns and exchanges: When customers return or exchange merchandise, store credit is often offered in addition to or in lieu of a full refund.

- Store credit cards, financing, and layaway: Any time a retailer extends credit and allows customers to pay at a later date, or incrementally, they’re issuing store credit.

- Gift cards: When a customer buys a gift card, they essentially are purchasing store credit to give to someone else. Gift cards also often are used to hold store credit from returns or loyalty rewards.

- Loyalty rewards: One of the most common rewards customers earn through loyalty programs is store credit toward a future purchase.

The Benefits of Issuing Store Credit

There’s a reason the world’s most successful retailers all use store credit — a few reasons actually. The bottom line is that store credit offers you flexibility and an added tool to help inspire customer spending and loyalty.

Let’s look at the top three benefits of offering store credit:

Better, Long-term Customer Retention and Loyalty

Store credit is one way retailers can boost customer retention and loyalty.

Store credit is one way retailers can boost customer retention and loyalty.

As IBM reports, “The more you’re tied to a brand, the more likely you are to be a brand advocate.”

In other words, store credit offers customers an additional incentive (on top of great products and A-plus customer experience) to come back to your shop instead of looking elsewhere. As one facet of a robust customer loyalty program, store credit gives you yet another tool to showcase to customers what their repeated business means to you.

Encourage Customers to Spend More

Using store credit to encourage customers to spend more money might seem counterintuitive — but it works.

GE Capital once ran a study on retailer-branded credit cards (a type of store credit) and found they led to more frequent visits to that retailer, with a 29% increase in in-store visits. Customers who shop using gift cards often spend above and beyond their store credit, too, leading to higher sales.

FURTHER READING: Learn more ways to use gift cards to boost your retail business.

Customers also feel better about spending more when stores offer a reasonable return policy. So, if you use store credit to allow for more flexible returns, you’re helping customers feel comfortable spending with you.

Lose Less Revenue to Returns

Returns and exchanges can put retailers in a bind. You want to be flexible and provide customers with a good, satisfying experience, but returns mean lost revenue, period.

Offering store credit is one way you can avoid losing revenue to returns and help turn those transactions into exchanges instead.

Store credit enables you to expand your return policy to a longer timeframe or accept returns without a receipt — making your policy more customer friendly. This also ensures more money stays within the business, helping ease the burden of returns on your bottom line.

Innovative Ways to Use Store Credit to Grow Customer Retention

Now that you know the benefits store credit can provide, you need to explore how to go about implementing it. Finding innovative ways to offer store credit can set your business a notch above competitors and go that much further in helping to boost customer retention and overall spending.

There are all kinds of ways your store can leverage credit, but here are the three most important ones: to build social responsibility into your business, to incentivize customer referrals, and to augment your return policy.

Use Store Credit to be Charitable

According to Forbes, more than 66% of all consumers — and 73% of millennials — are willing to spend more with socially responsible retailers. A brand’s social responsibility mandate can come in all shapes and sizes, but they all have one thing in common: a financial commitment. That can be hard for smaller retailers to pull off.

By using store credit as your charitable contribution, your store can make more of a difference without directly impacting revenue. For example, you can donate gift cards or other store credit to charities or causes you and your customers care about. Or you can offer store credit to members, employees, or beneficiaries of nonprofits.

Donating store credit or gift cards is more realistic for many smaller retailers than donating cash — but it’s still important to take the increased costs into account.

Incentivize Referrals with Store Credit

Plenty of retailers offer loyalty programs, but the smartest take it a step further: they offer a referral program for customers, too.

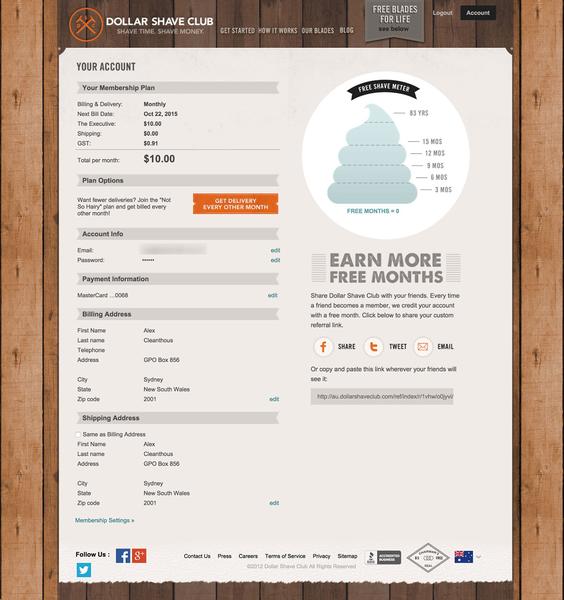

Consider the recent success of direct-to-consumer (D2C) brands like Dollar Shave Club and Warby Parker. Those businesses have seen a ton of growth by disrupting traditional industries. They also all offer well-publicized referral programs to help spread word of mouth.

Your store can do the same by incentivizing that word of mouth and offering store credit in exchange for any referrals that turn into new customers.

Expand Your Return Policy and Add Flexibility

In the U.S., consumers return an average of 8% of all retail sales. That adds up to about $260 billion annually. When we talk about the effect of a good return policy on sales, we’re usually focused on ecommerce brands — but the same applies to brick-and-mortar retailers.

A study at the University of Texas, Dallas found that a lenient return policy led to higher sales across the more than 11,000 retailers examined.

As mentioned above, store credit (usually in the form of a gift card) is one of the ways you can add leniency and flexibility to your return policy and capitalize on those increased sales. Offering store credit for returns means you can allow customers a longer return timeframe and be more flexible about receipts and tags required — all while ensuring you don’t lose out on revenue.

Use Store Credit to Reduce Returns and Boost Customer Retention

Store credit is a lot more than just another way for customers to pay. It’s a tool you can use to help grow customer retention and increase sales. Finding innovative new ways to do that can bring big benefits to your store.

How will you use store credit to boost your store’s bottom line?