Focusrite (TUNE), recently honoured with its fourth consecutive ‘Queen’s Award for Enterprise: Innovation’, bucked the consumer trend in the lead up to Christmas, with strengthening sales through November giving rise to revenue “ahead of the comparative period” in the previous year. The continued drive for in-house efficiencies is also paying off, as the global music and audio products group continued to build its gross margin through the year, coming in at 42.2 per cent, a 30 basis point improvement on the previous year despite foreign exchange and tariff barrier challenges.

It may be that the recent experience of Focusrite points to the relative resilience of specialists in a tricky consumer market. Challenges have intensified over the past 12 months, highlighted by several high-profile failures, including Toys ‘R’ Us and Maplin, while the survival of established high-street names such as Debenhams (DEB) is far from assured.

And if we needed a further reminder of the ongoing pressures facing retailers, HMV – which accounts for nearly a third of all physical music sales in the UK – has just collapsed into administration for the second time in six years. As well as weakening consumer confidence and rising business rates, the existential threat posed by the increased utilisation of music streaming platforms such as Spotify (US:SPOT) has finally caught up with the venerable retailer.

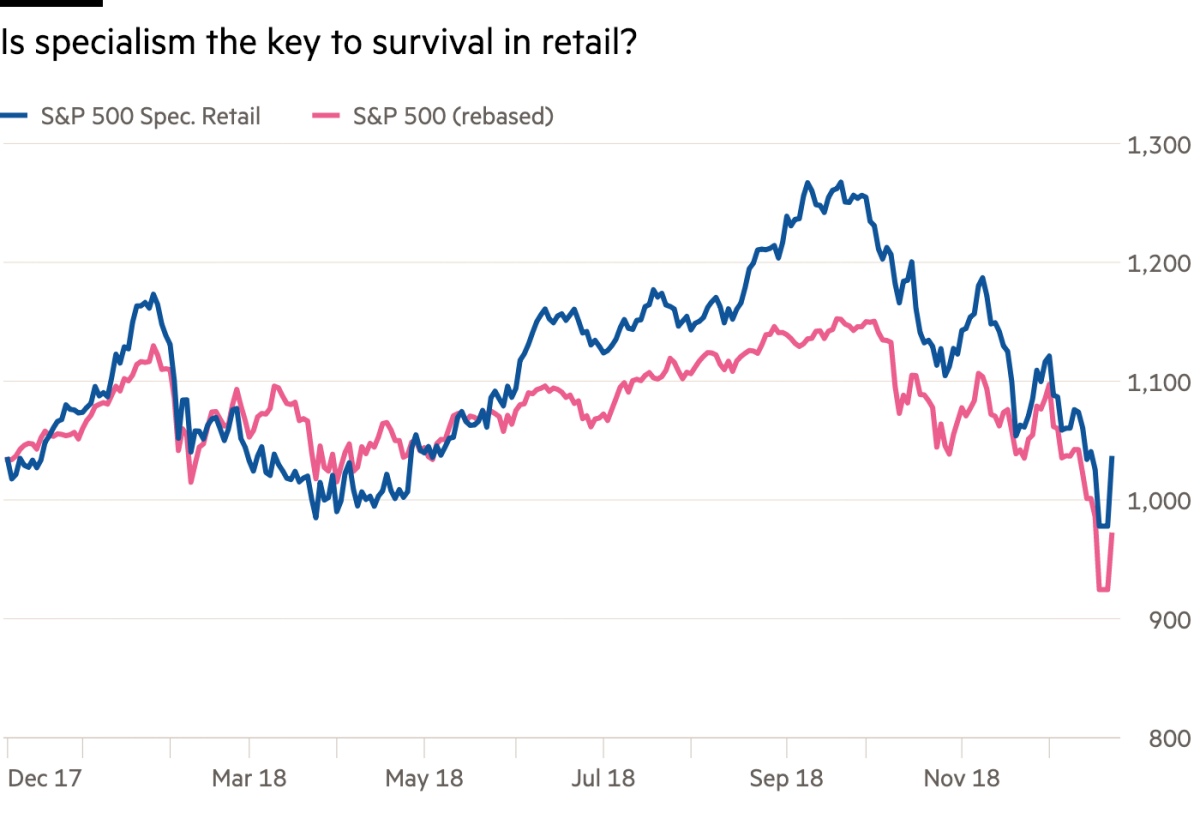

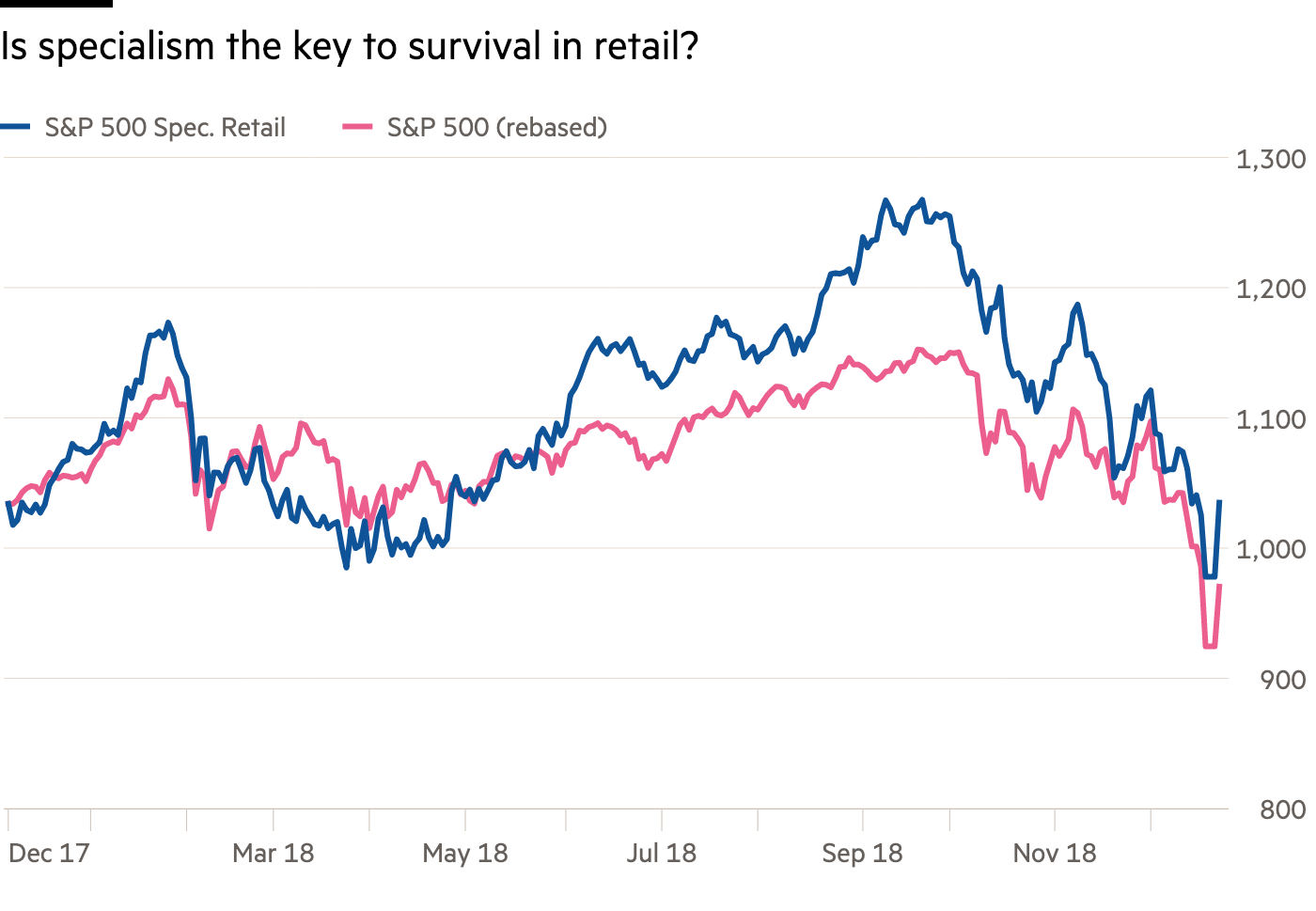

And yet, as the accompanying chart shows, the S&P 500 Specialty Retail Index has outperformed the wider benchmark by 6.2 per cent over the period, with peak divergence of 11.6 per cent in the early part of September. Although, whether this divergence holds true over the long run is anyone’s guess – the retail sector is essentially a moving target now, as it’s not altogether clear whether consumer trends are driving digitalisation, or vice versa.

Nevertheless, while no retailer is immune to the cyclicality of consumer spending and any consequent fall-away in aggregate demand, companies that manage to differentiate their product offering, or provide specialist aftersales service, appear less susceptible to market disruptors such as Amazon (US:AMZN).

In terms of price discovery and the range of goods at their disposal, today’s consumers have never had it so good – with gratification just a click away. The rise of Amazon – and, arguably, Walmart (US:WMT) in the pre-digital age – shows that the most successful retailers have been those that covered as many bases as possible, but there’s an obvious trade-off in terms of customer support. The argument runs that, when you specialise, you can immediately separate yourself from your competitors on this basis. Games Workshop (GAW), which makes and sells fantasy models, has seen its shares rise in a year where most retailers’ share prices have moved well into the red – Gear4Music (G4M), which sells Focusrite’s products, has had a better year than most.

Indeed, unlike the likes of HMV, we think that Focusrite is on the right side of consumer trends, as it has tapped into the growing market for digital audio workstations, which moved beyond the professional sphere in the 1990s, as analogue recording systems were either augmented or replaced altogether by software-based technologies.

The market for home studio DIY equipment has continued to expand, whereas the overall market for products designed for professional studios has contracted, and many pro-audio manufacturers have started to focus their attentions on the home and project studio market. This is reflected in Focusrite’s proprietary hardware and software products, which are utilised by audio professionals and amateur musicians alike – profit is to be made from those making music rather than buying it, it seems.

IC View

At 473p, shares in Focusrite are around a third in advance of where they should be based on their enterprise/cash profit multiple to peers, and well above Edison’s discounted cash-flow target rate of 457p. They’re also 196 per cent ahead of our May 2016 buy call; a tempting point at which to cash out given the glum outlook on consumer spending, but you could always offload enough shares to cover your original investment, thereby providing a ‘free’ carry on the remainder. We reiterate our view that shareholders should take a long-term perspective given Focusrite’s growth prospects are matched by its rigid capital discipline and understanding of its end markets.