The U.S. Supreme Court on Thursday cleared the path for Nebraska’s collection of state sales taxes already owed on Internet purchases, opening the door to an increase in state revenue estimated at $30 million to $40 million a year.

The 5-4 decision overruled a previous court ruling that prohibited collection of state sales taxes from retailers without a presence in the state.

Small, local retailers are cheering the change, while at least one local e-commerce company is predicting a minimal impact.

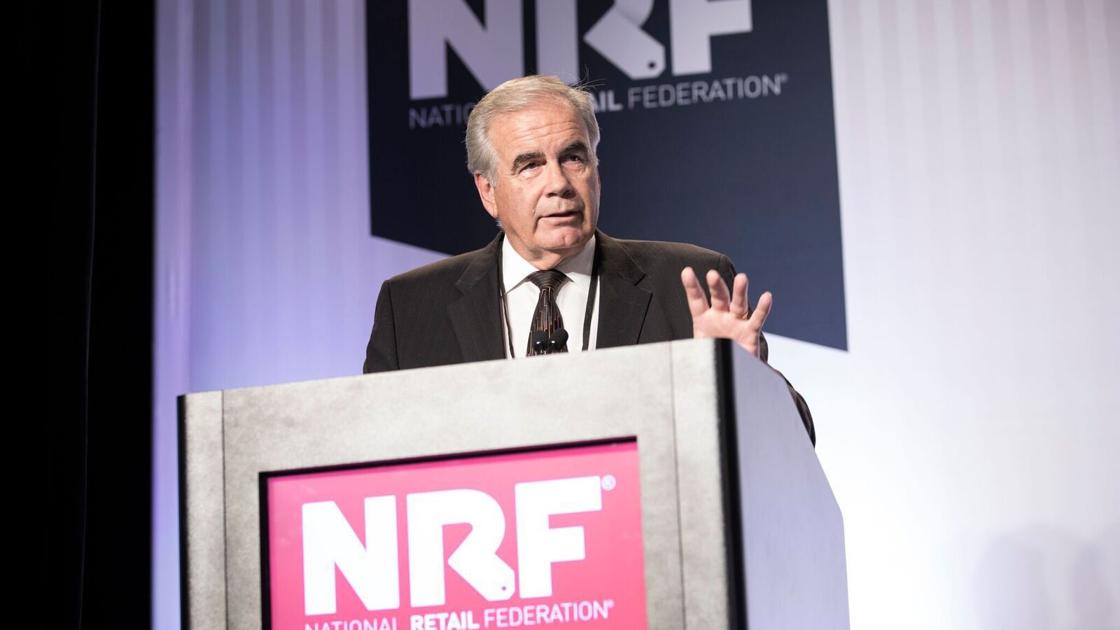

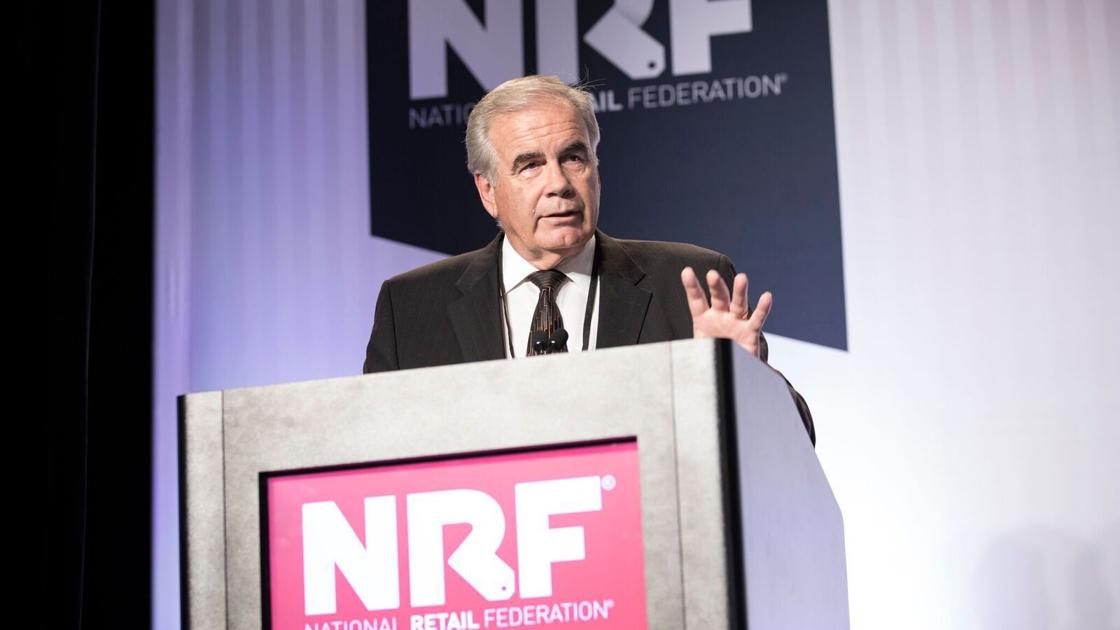

“This is great news for the retail core in every Nebraska community,” said Jim Otto, president of the Nebraska Retail Federation, whose group has been working on changing the law for more than two decades.

The Supreme Court has acted correctly in recognizing that it’s time for outdated sales tax policies to change with the times, Otto said in an email. However, he said, there is still work to be done.

He was referring to the fact that the Nebraska Legislature would still have to pass a law setting up such a system and codifying the details of how out-of-state retailers would collect and remit state sales taxes.

“We have already started the process to make sure the Nebraska Legislature addresses this in the 2019 session,” Otto said.

Paul Jarrett, CEO of Bulu, a Lincoln company that sells a subscription service offering sample boxes of nutrition products, said collecting online sales taxes has for some time been a question of when rather than if, “and I think most people are prepared for it.”

The companies likely to be most affected are those that will have to manually change custom software systems, he said.

Jarrett also said he believes making all retailers collect sales taxes for online sales is the fair thing to do and the right thing to do: “It should be the same level playing field for everyone.”

Earlier this year, legislation to begin collection of the online sales tax in Nebraska was blocked by a filibuster. With 33 votes required to invoke cloture, a motion to end debate on the bill fell two votes short on a 31-13 vote.

Sen. Dan Watermeier of Syracuse, sponsor of the proposal (LB44), argued that the state should move ahead with collection of the sales tax, contending that the state needs to level the playing field for Main Street businesses in Nebraska that automatically add the state sales tax to the price of local purchases.

Gov. Pete Ricketts contended that the state should wait for the Supreme Court decision.

Amazon, one of the giant online retailers, already voluntarily collects the tax on purchases made by Nebraskans. But most online purchases by Nebraskans go unreported with no payment of sales taxes owed.

OpenSky Policy Institute executive director Renee Fry said the court ruling “paves the way for Nebraska to modernize its tax code to better conform to our economy.”

And, she said, it will “help the state collect revenue already owed and necessary to support our schools, health programs and other services that are essential to a strong economy.”

The American Legislative Exchange Council (ALEC) said the court decision will be “detrimental to small businesses and online retailers,” stifling economic growth and discouraging entrepreneurship.