Excerpts in this article first appeared in the Forbes Real Estate Investor.

Americold (COLD) is the largest global and U.S.-based REIT focused on the ownership, operation, development and acquisition of temperature-controlled warehouses. It operates in major food-producing and retail markets, making it an important component of the food industry infrastructure.

Headquartered in Atlanta, Ga., COLD owns and operates 158 temperature-controlled warehouses, with approximately 934 million cubic feet of storage.

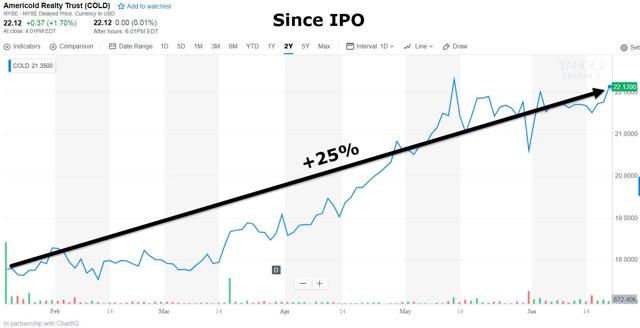

Americold announced its IPO on January 9, and it successfully offered 45.3 million common shares at a public offering price of $16 per share on January 18. As you can see BELOW, share performance has been the opposite of its ticker; its hot – up 20% since the IPO.

Recently, I caught up with Americold’s CEO, Fred Boehler. He was promoted to president and CEO in December 2015 after serving as Americold’s president and COO since March 2014. Prior to joining COLD, Boehler served as a SVP with SuperValu (NYSE:SVU), a leading grocery retailer and wholesaler.

Before that Boehler spent ten years in senior leadership roles culminating as the senior VP, logistics and purchasing at Borders Group, where he oversaw distribution operations, industrial engineering, logistics planning, and purchasing. Boehler holds a Bachelor’s Degree in Management Science and Operations from Wright State University, and a Master’s in International Business from Northern Illinois University.

Brad Thomas: Can you provide us with an overview of the company?

Fred Boehler: Americold is a 115-year-old company, based in Atlanta. We have an integrated network of 158 temperature-controlled sites in five countries: The U.S., Canada, Australia, New Zealand and Argentina. Worldwide, Americold owns just under a billion cubic feet of temperature-controlled capacity. We’re the world’s largest provider and have approximately a 4.5% global market share of the temperature-controlled food and beverage supply chain industry.

We handle almost every type of perishable food and beverage product, from ice cream that’s stored at -20 degrees Fahrenheit to frozen foods that might be at zero degrees, to fresher meats, dairy and deli that might be 28, 32 or 34 degrees.

Thomas: How would you describe the value proposition for investing in temperature-controlled warehouses?

Boehler: Our assets and network serve as the infrastructure to support the storage, preservation and movement of goods from the point of manufacturing or harvest to the point of sale, whether a grocery store or restaurant. Regardless of what is happening in the macro-economic climate, overall consumption remains relatively steady.

What we eat and where we eat may shift but the pure volume still flows through our infrastructure. Given that more than 95% of food manufacturers outsource their physical distribution, coupled with our diversified portfolio, we have a very stable platform.

In addition to that foundational stability, we are seeing a rise in retail outsourcing. This, along with basic, population-driven consumption growth, presents us with many development opportunities. Then add acquisition opportunities within a fragmented industry, and it gives us a nice growth vehicle above and beyond what we are able to harness via same-store improvements.

Thomas: COLD owns and/or operates around 934 million cubic feet of storage. How is scaling the business and what are the opportunities?

Boehler: There’s still plenty of opportunity for us in the food and beverage market. We currently benefit from about 20%-21% market share in the U.S, but only about 4.5% worldwide. So, there is plenty of opportunity to gain market share.

Consider in the U.S., where we have our largest facility portfolio, 48% of the temperature-controlled capacity is held by operators with ten or fewer sites, so there’s great potential for acquisitions of some of those smaller, top-performing organizations.

Outside of the food and beverage market, there are a significant number of industries that require temperature-controlled environments we could support, such as floral, chemicals, pharmaceuticals, materials, polymers and hi-tech. We already own the facilities, and we can be ready for all these industries, and more, very quickly.

Thomas: Can you compare pricing for these markets?

Boehler: Supply is tight, and the infrastructure needs are similar across the geographies. We deploy the same underwriting parameters and commercial business rules across our global platform. Ultimately, pricing is a function of the underlying local market dynamics combined with the needs and profile of the customers we serve.

Thomas: I used to own a few Papa John’s pizza stores, so I know the meaning of the phrase “critical mission” when it comes to freezer space. Can you provide me with your thoughts as it relates to your critical mission assets?

Boehler: Our assets represent meaningful outsourced temperature-controlled infrastructure for our customers. We have facilities in every major food production and consumption market in the U.S., Australia and New Zealand.

We have some sites dedicated for specific use, such as plant-attached sites for some of our food manufacturing customers, and dedicated distribution center-specific sites for some of our retail/grocery customers, so I would consider these sites mission-critical for those specific customers.

More often than not, we support national and international customers in a number of sites up and down the vertical distribution channel so we’re able to share resources and inventory should we need to.

So, by example, if you think about the French fries you consume at a restaurant, fast food chain, or at home, we facilitate the movement of that product through our infrastructure from the point of manufacture to the point of sale. In Idaho, we have several facilities that are attached to the food manufacturing facilities.

Once the product is created, it is moved into our facility to be brought into a frozen state. From there, our customers instruct us to move product forward to major logistics hubs such as Chicago, Atlanta, Dallas, Eastern Pennsylvania and Los Angeles. There you will find an Americold-owned and operated facility that we call a distribution center. These facilities store multiple products for multiple manufactures under the same roof.

From there, we facilitate the movement of goods to a retailer or distributor’s distribution facility. In some cases, we also own and operate that retail distribution center, which in turn selects individual cases destined for a retail store or restaurant supplier. All along this chain, we are maintaining the proper temperature and integrity of the specific product so it is preserved until the point of consumer acquisition. As such, you can see why this infrastructure is so mission-critical.

Thomas: How are the leases structured?

Boehler: Our contracts are more similar to modified gross leases with an embedded service contract, as our typical agreement covers both the infrastructure or storage/preservation of our customers’ goods and the associated value-added warehouse services. The contracts, especially with our larger customers, tend to be multi-year. In recent years and increasingly so, our customers have contracted for fixed space within our facilities. Our contracts contain profile protection language and provide for annual escalation.

Thomas: I’m curious about the credit of your company’s rent roll. Do you have any investment-grade rated tenants?

Boehler: Given our primary focus on the food, beverage and customer staple industries, the markets we serve and our business tends to be very stable. We have a diverse customer base, and our largest customers include leaders in the food manufacturing, CPG, distribution and retail industries. Many of these customers are investment grade. Our top 25 customers generate 61% of our global warehouse revenues. Over half of these customers have investment-grade ratings.

Thomas: Americold is a 115-year old company, but you’re new to the REIT sector. Can you discuss your capitalization and cost of capital? Also, what range of cap rates are you buying new properties?

Boehler: While we are new to being a publicly-traded REIT, we have been structured and operated as a REIT since 2004. Our IPO allowed us to accelerate our balance sheet transformation by reducing overall indebtedness and improving liquidity. Today our debt-to-total capital has improved to the mid-30s percentile. Over the past few years and including the IPO, we have seen our access to the broad capital markets increase and our cost of capital significantly decrease.

Cap rates vary depending on if we are looking to buy the real estate supported by a triple-net lease or if we are acquiring an industry participant who both owns their own infrastructure and provides the associated services. For quality assets in our core markets supported by strong credit worthy tenants, we have seen cap rates as tight as the mid-5% to low-6%. We see acquisitions for quality industry participants who own their assets and provide the services being 100 to 200 basis points wider than triple-net lease cap rates.

Thomas: Reviewing the first quarter results, COLD appears to be well-positioned to grow earnings. Can you discuss your deal pipeline?

Boehler: We have a development pipeline of more than $1 billion of investment in the countries in which we have operations. To support our growth opportunities, we own more than 600 acres of undeveloped land adjacent to current assets that’s ready for building expansions and new facility construction. In fact, we’ve just completed a new construction project in Clearfield, Utah, and have two more underway in Rochelle, Ill. and Middleborough, Mass. that should open later this year.

We’re in a great position to support the opportunities we have in our pipeline, future growth opportunities of our customers, and the markets we serve. In addition, we will continue to seek out the right acquisitions to add to the Americold family. That said, we are not looking to acquire just for the sake of getting bigger. We will do so in a very controlled and disciplined manner that will present us with the greatest opportunity to add shareholder value.

Thomas: What is your dividend policy and what do you think about the yield today compared with your peer group?

Boehler: We seek to find the balance between maintaining and growing our dividend while supporting the attractive growth opportunities available to us. Currently, we are targeting adjusted funds from operations payout ratios in the mid-60%.

Thomas: Finally, how does the “retail apocalypse” fit into your strategy? People have to eat, right?

Boehler: We continue to see evolution of the grocery retail channel as participants adapt their offerings to better serve their customers. The channels people use to purchase their groceries or locations where they eat their meals may change over time or in different economic cycles, but the physical need for food – the demand – will continue to increase.

Industry growth is about in line with population growth, and our facilities are already well-positioned in production and consumption markets so that we can continue to support current and new customers. Americold continues to partner with our customers within the retail channel, assisting them to benefit from these emerging growth opportunities. We believe the fundamental need for reliable, secure, temperature controlled infrastructure will continue to grow. These are exciting times for COLD.

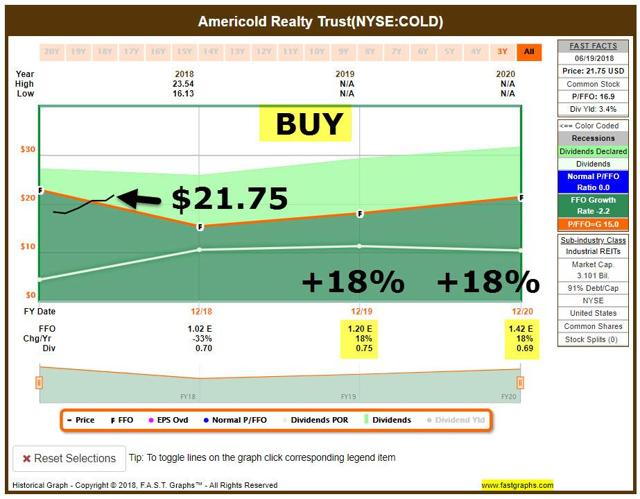

Initiating BUY: We like the necessity-based drivers for COLD and although shares are a tad “frothy,” we like the forecasted FFO/share growth of 18% in 2019 and 2020. We suspect the company will deliver steady dividend growth at the high-end of the peer group (10%+/-) and the investment spreads are attractive (100 to 200 basis points wider than triple-net lease cap rates).

COLD has a nice moat and we don’t see the Net Lease REITs competing in the specialized refrigeration marketplace. We like companies with long-term competitive advantages and we consider COLD an excellent hedge for our retail REIT holdings.

All Strong Buy picks can be viewed in my Marketplace service (The Intelligent REIT Investor). We recently announced our first subscriber-only call with Brad Thomas. Join Brad every Friday at 2:00 PM ET. Subscribe NOW.

Note: Brad Thomas is a Wall Street writer, and that means he is not always right with his predictions or recommendations. That also applies to his grammar. Please excuse any typos and be assured that he will do his best to correct any errors if they are overlooked.

Finally, this article is free, and the sole purpose for writing it is to assist with research, while also providing a forum for second-level thinking. If you have not followed him, please take five seconds and click his name above (top of the page).

Disclosure: I am/we are long ACC, AVB, BHR, BRX, BXMT, CCI, CHCT, CIO, CLDT, CONE, CORR, CTRE, CUBE, DEA, DLR, DOC, EPR, EXR, FRT, GEO, GMRE, GPT, HASI, HT, HTA, INN, IRET, IRM, JCAP, KIM, KRG, LADR, LAND, LMRK, LTC, MNR, NNN, NXRT, O, OFC, OHI, OUT, PEB, PEI, PK, PSB, PTTTS, QTS, REG, RHP, ROIC, SBRA, SKT, SPG, STAG, STOR, TCO, TRTX, UBA, UMH, UNIT, VER, VNO, VNQ, VTR, WPC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.