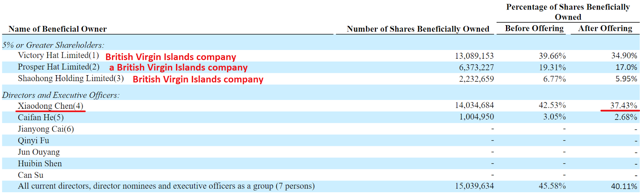

Reporting 52% revenue growth in the nine months ended September 30, 2018, Blue Hat Interactive (BHAT) should impress a lot of growth investors. In addition, value investors should also appreciate that the company is profitable and net income grew by 76% in the nine months ended September 30, 2018. Having mentioned these beneficial figures, there are very worrying features. Firstly, the company was incorporated in Cayman, where securities laws don’t protect shareholders as much as in the United States. In addition, many shareholders are located offshore, where investors have a small amount of information about them.

Source: Prospectus

Business

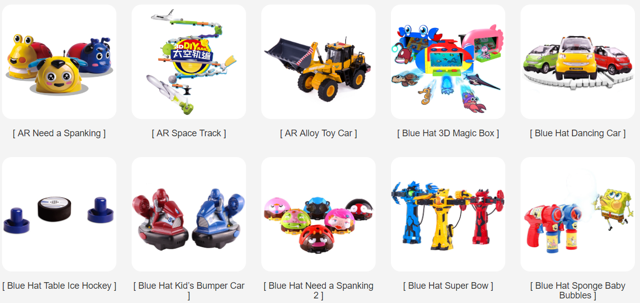

Founded in 2010, Blue Hat Interactive designs augmented reality (AR) interactive entertainment games, toys, and original intellectual property. The company targets users between the ages of 3 and 23. Some of the products offered by Blue Hat on its website are shown in the image below:

Source: Company’s Website

Source: Company’s Website

The company’s most valuable asset is its intellectual property rights. As of January 31, 2019, Blue Hat reported 161 authorized patents, 56 registered trademarks, 645 copyrights, and 25 software copyrights. With many other emerging operators in the AR industry, this know-how should be quite valuable. Please understand that creating IP assets takes time. As a result, these assets should help the company compete with younger peers.

The company has four product lines, but two of them report the largest amount of revenue. The names of the products are AR Racer, AR Need a Spanking, AR 3D Magic Box, and AR Picture Book. AR Racer reported 57% of the company’s total revenues in 2017, and AR Need was responsible for 31% of total revenues of the company in 2017.

With photosensitive recognition technology, AR Racer offers simulated racing tracks and the possibility of competing with other individuals. The company presents the game with the following words in the prospectus:

AR Racer is a car-racing mobile game with a small physical toy car that is placed onto the user’s mobile device screen. AR Racer allows users to virtually race one another via a simulated racing track and to also engage in individual races. The physical toy car uses non-adhesive materials to stick to a designated area of the mobile device. Our photosensitive recognition technology allows the toy car to be used as a controller such that when a player encounters an obstacle in the mobile game, the toy car will respond with entertaining actions, such as flashing lights and vibrations that enhance the user experience.

Source: Prospectus

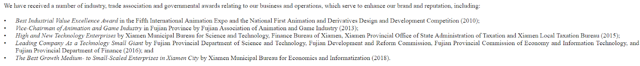

It seems also interesting that the company’s business seems to have received a large amount of recognition from governments, trade associations, and industrial organizations. Determining whether the business is promising is always very difficult. The fact that third parties believe in the reputation of Blue Hat Interactive seems very relevant. The lines below provide further details on this matter:

Source: Prospectus

Market Opportunity

The market opportunity seems significant. According to Euromonitor, retail sales of toys and games in China increased from RMB 111.8 billion in 2012 to RMB 276.5 billion in 2017, which represents average annual growth of 19.9%. The increase in the average income at a rate of 8%-11% annually in China seems to explain this market opportunity. Keep in mind that toy demands seem to change quite a bit as Chinese population earns more money.

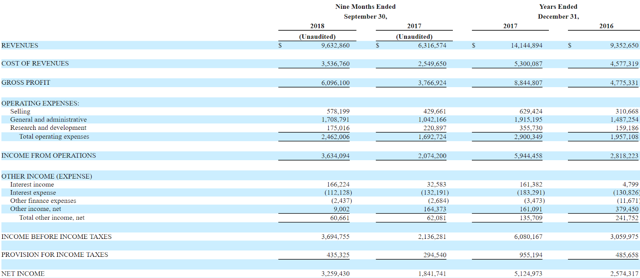

Income Statement

The revenue growth in 2018 was quite impressive. In the nine months ended September 30, 2018, Blue Hat reported $9.6 million, 52% more than that in the same period in 2017. The gross profit margin was also quite beneficial. The gross profit in the nine months ended September 30, 2018 was equal to $6.09 million, 61% more than that in the nine months ended September 30, 2017.

The bottom line is also quite beneficial, which should be appreciated by value investors. The income from operations in the same period in 2018 was equal to $3.6 million and the net income was equal to $3.2 million.

The image below provides further details on this matter:

Source: Prospectus

The increase in the amount of net income should impress value investors. The company reported net income growth of 76% in the nine months ended September 30, 2018.

Balance Sheet

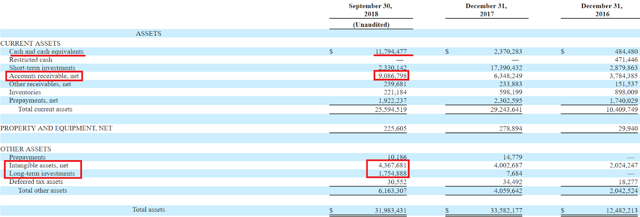

The increase in cash and short-term investments seems remarkable. In 2016, the company had cash of $0.4 million and short-term investments of $2.8 million. As of September 30, 2018, the amount of cash and short term investments was equal to $14 million.

The company is making a good amount of money from short-term investments of certificate deposits. The lines below provide further details on this matter:

Net cash provided by investing activities was $12.7 million for the nine months ended September 30, 2018 and was primarily attributable to $17.3 million in proceeds from short-term investments of certificate deposits.

Source: Prospectus

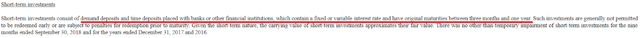

The prospectus provides further details on what are the short-term investments. They are deposits placed with banks that include variable and fixed interest rates. The lines below provide further details on this matter:

Source: Prospectus

As of September 30, 2018, the total amount of assets was equal to $31 million with $11 million in cash, accounts receivables worth $9 million, intangible assets worth $4 million, and long-term investments worth $1.7 million. Investors should appreciate the cash in hand and may appreciate the intangible assets, the accounts receivable and the investments a bit less. Keep in mind that these assets cannot be easily converted into cash. The image below provides further details on this matter:

Source: Prospectus

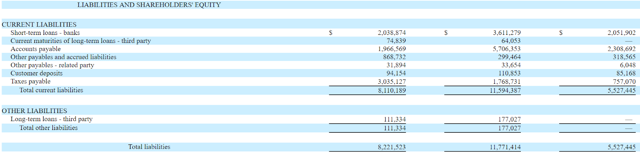

The liabilities should not worry investors. The total amount of liabilities is $8.2 million, which is below the total amount of cash. In addition, the amount of financial debt is very small. Short-term loans amount to $2.03 million, and interest rates range from 5% to 6.10%. Most investors should not be worried about the interest rates being paid by the company. The images below provide further details on this matter:

Source: Prospectus

Source: Prospectus

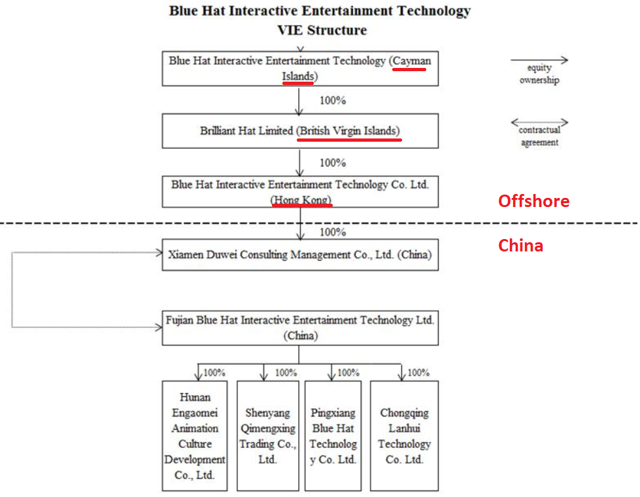

Business Structure

The business structure of Blue Hat is the most worrying feature on this name. Investors buying shares in the IPO will acquire shares of a company incorporated in Cayman. This company owns shares of a British Virgin Islands company, which has a contractual agreement with another company in Hong Kong. The subsidiary in Hong Kong owns several operating subsidiaries in China. The image below provides further details on this matter:

Source: Prospectus

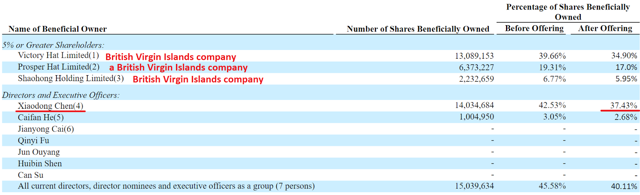

The list of shareholders also reveals that companies in British Virgin Islands own more than 57% of the total amount of shares. There are also directors with 40% of the total amount of shares outstanding. The image below provides further details on this matter:

Source: Prospectus

Having shareholders in British Virgin Islands does not look good. When shareholders are located offshore, investors cannot know who are the owners of the shares. The company could be controlled by a few shareholders and investors may not know it.

The fact that the float is extremely small on this name is worrying. It means that the share price is expected to exhibit a large amount of volatility. This is a considerable risk for investors. They could be making or losing tons of money in short period of time.

Valuation

The company mentions in the prospectus that toy and games producers like Shanghai Putao Technology Co., Ltd., Sphero, Inc. and Nintendo (OTCPK:NTDOY) are peers. Among these peers, the sole public company is Nintendo, so it should be used for assessing the valuation of Blue Hat Interactive.

Nintendo reports very small revenue growth, only 0.14%, and gross profit margin of 0.37%. In addition, the company is massive with an enterprise value of $23 billion. It seems very different as compared to Blue Hat Interactive, which is small and reports massive gross profit margin. Having mentioned this, using the numbers of Nintendo to value Blue Hat Interactive should be better than not doing any valuation at all.

Nintendo trades at 2.20x sales. In the nine months ended September 30, 2018, Blue Hat reported $9.6 million, 52% more than that in the same period in 2017. With this in mind, assuming forward revenue of $20 million seems reasonable. Using this figure and the ratio of Nintendo, Blue Hat Interactive should have an enterprise value of $44 million or more. Keep in mind that the revenue growth and gross profit margin of Blue Hat Interactive are larger than that of Nintendo. As a result, the company should trade at more than 2.20x sales. With double digit revenue growth, 5x sales may not be enough for certain investors.

Conclusion

With double digit revenue growth, massive gross profit margin and positive net income growth, Blue Hat Interactive should interest both value investors and growth investors. With that, the fact that the company was incorporated in Cayman and has its assets in China is very worrying and may make many investors pass on this one. Please understand that company law in Cayman does not protect shareholders as much as that of United States. In addition, the low float is another detrimental feature. Investors should remember that there should be a lot of volatility risk on this name.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.