REUTERS/Lucas Jackson

REUTERS/Lucas Jackson

- Grayscale Investments put out its first Digital Asset Investment report, showing record-breaking stats for its business.

- The firm raised $250 million in new assets during the first six months of the year, the strongest pace of inflows ever for such a period.

Bitcoin is trading down more than 45% since the beginning of the year, and the market for digital currencies has shed billions.

But for one crypto investor, this bearish backdrop has been coupled with a spike in investor interest.

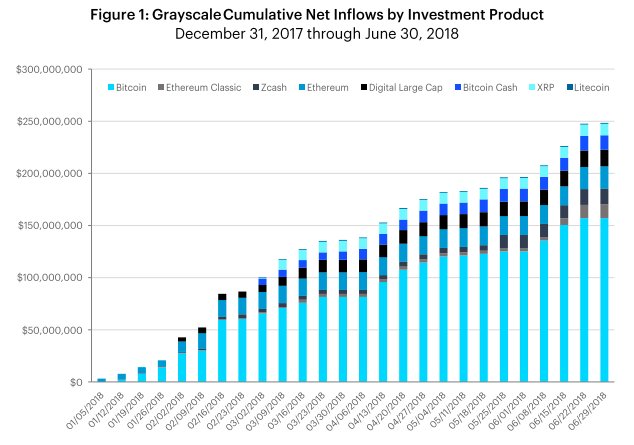

Grayscale Investments, a subsidiary of Barry Silbert’s Digital Currency Group — which launched in 2013 — put out its first Digital Asset Investment report, showing a steady growth of net inflows into its funds during the first half of 2018.

According to the report, the firm raised $250 million in new assets during the first six months of the year, the strongest pace of inflows ever for such a period.

GrayscaleGrayscale, which manages $2 billion in assets, runs a number of bitcoin funds including its Bitcoin Investment Trust as well as one for XRP, bitcoin cash, and ethereum.

GrayscaleGrayscale, which manages $2 billion in assets, runs a number of bitcoin funds including its Bitcoin Investment Trust as well as one for XRP, bitcoin cash, and ethereum.

The majority of the interest this year, 56%, came from so-called institutional investors, according to Grayscale’s report. Such a figure could indicate the space for digital currencies is shaking off its scrappy roots as a retail-majority market.

At the same time, over 300 crypto funds have launched to invest in digital assets, according to a report by Autonomous NEXT released this week.

The report found the market for initial coin offerings has continued to grow this year and Wall Street firms are moving quickly to adopt technologies related to crypto, echoing Grayscale’s findings that institutions are more interested in the market.