Photo Source: Arcimoto Website

Arcimoto (NASDAQ:FUV) announced on 12 June that they had completed production of their Signature Series vehicles and were beginning Beta series production. Since then, the stock jumped from $2.73 to as high as $4.99 on the morning of 20 June.

Business Mission

Arcimoto shares some similarities with the cult like stock Tesla (NASDAQ:TSLA). For example, both companies design, develop and manufacture fully electric vehicles. Like Tesla, Arcimoto plans to achieve its mission by replacing internal combustion engine vehicles. But, unlike Tesla’s electric vehicle solution, Arcimoto’s electric vehicle solution is a quarter the weight, a third the price and ten times as efficient as the average US passenger car.

The ”Fun Utility Vehicle”

According to Arcimoto, their vehicle delivers a thrilling ride experience, exceptional maneuverability, full comfort for two passengers with gear, optimal urban parkability, safety, and ultra-efficient operation, at an affordable target base model price of $11,900. Arcimoto says they have taken their vehicle from a napkin sketch, through eight generations of product development, to a refined design on the cusp of production. It is manufactured in the United States and is currently available for advance purchase.

Unlike Tesla, Arcimoto’s business model is focused on low-end electric vehicle market disruption. Arcimoto targets customers who cannot or will not participate in today’s market due to the lack of affordable clean daily vehicle purchase options.

Vehicle specifications:

- 2-seat tandem

- 3 wheels

- Handle-bar steering

- 100% electric

- 70 or 130 mile range, highway certified

- Top speed of 80 mph

- 0 to 60 in 7.5 secs

- Low price, starting at $11,900

- Low weight at 1,023 pounds

Stock Price History and Recent Events

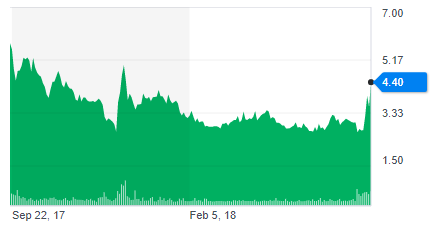

Chart Source: Yahoo Finance

Arcimoto raised $18.1 million in net proceeds through a Regulation A+ initial public offering and listed shares for trading on the Nasdaq Capital Market in September 2017. Arcimoto traded as high as $6.35 a share and then trended pretty consistently down into June 2018.

On June 12, 2018, Arcimoto announced that they had completed production of their Signature Series FUV’s and were beginning Beta Series production.

On June 14, 2018, Zacks Small Cap Research published an investment report on Arcimoto with a $5.00 valuation.

On June 12, Arcimoto’s stock closed at 2.73. By the morning of June 20, Arcimoto stock traded as high as $4.99.

Key Statistics

- Stock Price: $3.92 (18 Jun 2018)

- Stock 52 week price range: $2.26 – $6.35

- Market cap: $62 million (18 Jun 2018)

- Shares outstanding: 15.9 million (31 Dec 2017)

- Cash & Equivalents including certificates of deposit: $10.9 million (31 Mar 2018). Cash is falling as Arcimoto prepares for retail production.

- 2017 net revenue: $0.1 million. There are no significant revenues to date but these are expected to start with retail sales in the second half of 2018.

- 2017 net loss: $3.3 million

- 2018 Q1 net loss: $2.0 million. The net loss and negative cash flow is increasing as Arcimoto prepares for retail production and sales.

- Pre-ordered vehicles: 2,461 (31 Mar 2018). Up from 1281 on 31 Mar 2017.

Opportunity

Source: Arcimoto Website

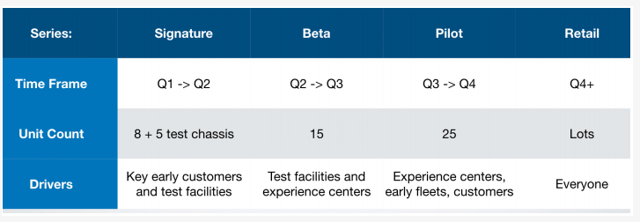

On June 12, 2018, Arcimoto announced that they had completed production of their Signature Series FUV’s and were beginning Beta Series production. Six of the eight Signature Series vehicles were pre-purchased by customers and two were retained by the company for marketing purposes. Arcimoto announced that it had begun its 15 unit Beta Series production run, earmarked for fleet and rental operations. This was an important announcement as it kept Arcimoto on track for “Beta”, “Pilot” and finally “Retail” production in 2018. Retail production is required for Arcimoto to turn cash flow positive and minimize the need to raise cash in the near future.

Arcimoto is a microcap stock that has little trading volume, so the stock did not immediately move on this news but within two days of this announcement, volume increased and the stock price jumped. If Arcimoto can stay on schedule with the “Beta”, “Pilot” and “Retail” production in 2018, Arcimoto stock price should continue to rise.

Risks/Concerns

Like Tesla, Arcimoto is not without risks and some of these are similar. Three of the more significant risks that investors may want to watch include:

- Arcimoto currently has limited production and distribution capabilities and is still in the process of setting up facilities to manufacture vehicles on a larger scale. Arcimoto also does not have a history of higher-scale production and may encounter delays, flaws, or inefficiencies in the manufacturing process, which may prevent or delay them from achieving higher-scale production within the timeline they anticipate. Arcimoto believes that small scale Retail Series production will commence in the second half of 2018; however, delays in receiving machinery, availability of inventory, and machinery customization could delay such estimates.

- Arcimoto has limited experience in developing, training and managing a sales force, and will incur substantial additional expenses marketing their current and future products and services. Developing a full marketing and sales force is time consuming and could delay launch of their future products and services. In addition, Arcimoto will compete with companies that currently have extensive and well-funded marketing and sales operations. Arcimoto marketing and sales efforts may be unable to compete successfully against those companies.

- Arcimoto raised $18.1 million in an initial public offering in September 2017. It has approximately $11 million of this remaining and burned through approximately $2.8 million in operating activities in the first quarter of 2018 as they produced the “Signature Series” vehicles and prepared for “Beta”, “Pilot” and “Retail” production. There is some question whether Arcimoto will need to raise cash again before retail sales start.

Summary

Like Tesla, Arcimoto was founded over a decade ago to catalyze the shift to a sustainable transportation system by devising new environmentally sound vehicles that are affordable, safe, and fun to drive. Tesla’s stock price was fairly flat until it started producing and delivering their Model S to the market. Arcimoto has now completed production of their eight Signature Series vehicles and started their Beta Series production with plans for their “Retail” production and deliveries in the second half of 2018. The two companies have many similarities and differences, but one similarity is that both of their stock prices are taking off. If Arcimoto can continue to execute on its plan, Arcimoto stock should have much more upside.

Disclosure: I am/we are long FUV, TSLA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.