ACI Africa’s Ali Tounsi: “African airports must turn to non-aeronautical streams because these generate a higher profit margin and thus contribute more to financial sustainability and the capacity to withstand traffic volatility.”

AFRICA. Airports Council International Africa attended the Middle East & Africa Duty Free Association conference* for the first time as it seeks to expand the commercial side of the airport business in Africa.

Speaking to a large audience of 442 delegates in Beirut, Lebanon on Monday, ACI Africa Secretary General, Ali Tounsi, said: “African airports face several challenges for growth. Commercial sales can be a stable source of revenue that can help recover operating costs and reduce the use of aviation taxes for future airport development.

“The commercial side of the airport business in Africa has plenty of opportunities to seize. We need to explore the current climate for African airports, and discuss the steps we need to take to exploit the continent’s undoubted potential for duty free and travel retail.”

The message comes as traffic growth forecasts for the continent look encouraging, despite inherent volatility. Last year traffic grew +6.3%, after a decline of -0.4% in 2016. But, according to ACI, from 2000 to 2017, Africa experienced a healthy compounded annual growth rate (CAGR) of +4.1%.

Tounsi said: “We forecast a CAGR of +3.7% from 2017 to 2040 when passenger traffic in Africa will reach 450 million. To cope with the growth, airports should generate enough revenues to finance their activities build new infrastructure and remain competitive. Non-aeronautical revenues has the potential to be the major source of funds for operators.”

Too reliant on the aeronautical side

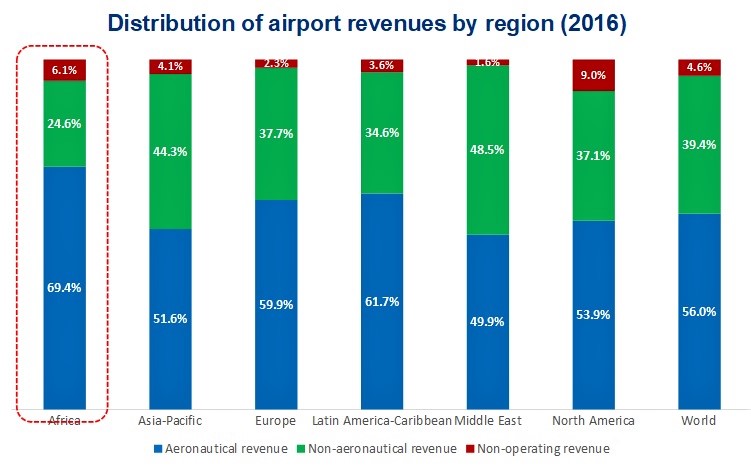

Africa has a greater reliance on aeronautical income than any other region and this has become a major issue because airport charges alone can’t cover the capital costs for infrastructure development.

Analysis by ACI suggests that the average US$10.15 cents aeronautical revenues per passenger, is insufficient to meet the cost per passenger (US$13.55) in terms of providing airport services. “Commercial or non-aeronautical sources of income such as retail concessions will significantly contribute to the diversification in an airport’s income portfolio and provide an additional cushion during adverse economic times,” said Tounsi.

There is still a lot of work to do to bring the non-aeronautical share of revenue at African airports (24.6%) up to the global average of almost 40%.

He added: “African airports must turn to non-aeronautical streams because these generate a higher profit margin and thus contribute more to financial sustainability and the capacity to withstand traffic volatility.” ACI Africa is therefore urging a change in focus so that “airports, airlines and retailers form joint partnerships and initiatives to create an integrated retail experience”.

[*For Moodie Live sound-bite coverage of the two-day MEADFA conference in Beirut, please click here and then click ‘oldest’ to go to the start of the live feed.]