From the millions of shoppers using Walmart’s grocery app to the smaller customer bases tapping into their favorite local grocer, mobile apps have become an integral part of the customer experience for grocery companies of all sizes.

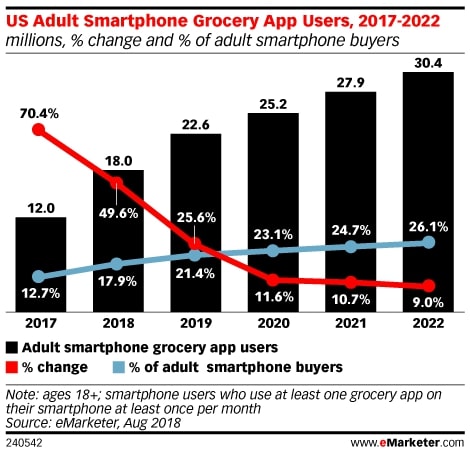

According to a report from eMarketer, about 18 million adults in the U.S. used a grocery app at least once a month in 2018, up nearly 50% from 2017. This year eMarketer projects that more than one in five adult smartphone mobile commerce buyers will use a grocery app to order food.

“Consumers, I think, are at a place where they’re much more ready to start transacting this way for some percentage of their grocery shops,” Andrew Lipsman, a principal analyst at eMarketer, told Grocery Dive.

As customer adoption picks up, the number of companies offering mobile apps is also increasing. Some large grocery retailers have been investing in their mobile capabilities for several years. Kroger, for example, launched mobile offerings back in 2010, and Albertsons unveiled its Just For U app in 2016. Other retailers have only recently gotten started.

eMarketer

Providing useful tools ‘on-site’

In Salt Lake City, Harmons is a fourth-generation family-owned regional grocery chain operating 19 stores. The grocer introduced its first mobile app about a year ago, primarily as a way to provide digital access for shoppers to its customer loyalty program, the Foodie Club.

“What we were finding is that people don’t always know what rewards they’ve earned when they’re in the store,” Lindee Nance, vice president of marketing for Harmons, told Grocery Dive. “The mobile app was a way we could provide that information on-site.”

Now, with the app, customers can manage their Foodie Club rewards in one spot. They can use the app to scan their club card at checkout and redeem points, track the freebies and fuel rewards they’ve earned, and clip coupons in the mobile app.

Since creating the app, Nance said Harmons has added additional functions, including a pharmacy feature that allows customers to renew their prescriptions and a link to eShop, Harmons e-commerce site — though it is not fully integrated into the app.

Harmons

BJ’s Wholesale Club, which operates more than 200 locations in 16 states, also launched its app a little over a year ago. In the BJ’s app, shoppers can access digital coupons, pickup in-club, same-day grocery delivery, a digital membership card, Perks Rewards status and BJ’s Gas prices.

Rafeh Masood, BJ’s senior vice president and chief digital officer, told Grocery Dive in an email that digital coupons, order pickup and same-day grocery delivery have been particularly popular app features for shoppers.

“Our members are loving the BJ’s app. We have more than 1.5 million downloads and an average rating of 4.5 stars across the Apple App and Google Play stores,” Masood said. “We’ve added several new features since we launched the app to make shopping at BJ’s more convenient.”

Last spring, SpartanNash launched mobile apps for its major retail banners, including Family Fare Supermarkets, D&W Fresh Market and Family Fresh Market. Similar to Harmons and BJ’s, mobile apps for each of these banners include digital coupons, rewards account management and pharmacy refills. The app also enables online shopping through Fast Lane, SpartanNash’s e-commerce platform.

“Our Fast Lane in-app e-commerce ordering provides a level of personalization that sets us apart from others,” said Brian Holt, vice president of marketing for SpartanNash, in an email to Grocery Dive. “Fast Lane integrates with our yes Rewards program, allowing users to clip or apply previously clipped digital coupons, select commonly purchased items or sort by department, sale items or dietary restrictions when placing an order.”

User experience and personalization drive usage

In today’s industry, grocery mobile apps run the gamut from basic functionality to sophisticated features. In most cases, experts say apps are still a work in progress.

“A lot of people, through the digital transformation, are simply applying what worked yesterday to the digital format, and it’s just not good enough anymore,” Matt Sebek, vice president of digital for World Wide Technology, a firm that works with grocers including Wegmans and Schnucks, told Grocery Dive.

Market research firm Forrester recently evaluated several retail apps and determined where they’re excelling and where they’re falling behind. According to Brendan Miller, a principal analyst with Forrester and author of the ensuing report, the findings show that many retailers are using their apps simply as an extension of their mobile websites — which is a lost opportunity, he said.

“If you’re going to build a mobile app … it’s got to be more than just traditional e-commerce. It’s got to provide something more for the consumer,” Miller told Grocery Dive in an interview.

Forrester’s report is not specific to grocery companies, but Miller said the findings can be applied. “There’s a tremendous opportunity for grocery even more than some other categories, where you can customize and cater to your customers.”

In Forrester’s evaluation, Walmart was noted as a leader in the mobile app space for features such as detailed in-store maps and complementary product bundling. When it comes to grocery, Miller said, Walmart has made great strides with its mobile app.

“There’s a tremendous opportunity for grocery even more than some other categories, where you can customize and cater to your customers.”

Brendan Miller

Principal analyst, Forrester

“Walmart has really thought through the customer journey. On their app, there’s a button to ping them to let them know you’re ready to pick up your groceries,” Miller said. “So far, they are nailing that experience and executing it well.”

Good user experience comes first, Miller said. Customers who have a bad experience with an app will delete it and never use it again.

Forrester concluded that it’s important to give customers utility and control. Features that created utility for the shopper, and ultimately a better and more convenient experience, included an “in-store” mode that helped shoppers find items as they walked the store, robust filters and relevant search results.

Given that the grocery industry operates as a more traditional space, Lipsman said he doesn’t think enough attention is given to how much user experience dictates in the digital world. “If you don’t take the opportunity now to condition users to your digital experience, you will lose them in the future.”

Lipsman said that grocers should drive customers to engage with an app at least three to five times so that they become comfortable with it and continue to use it while shopping.

Personalization is also a significant opportunity for grocery companies designing mobile apps, Sebek told Grocery Dive. “What consumers are demanding and really the expectation that they have is that this is tailored ‘totally for me.’ Grocery is one area where personalization is of the utmost importance, and there are not a lot of grocery stores that are quite there yet.”

Mobile app adoption is fairly low when there’s not a value-add, Sebek said, and there are ways to increase mobile app adoption — but there has to be an overarching strategy behind it. His firm has helped increase adoption rates for grocery clients’ mobile apps through tactics such as buy-one-get-one coupons and allowing customers to redeem points only through mobile apps.

Harmons

At Harmons, app adoption has been strong, Nance noted. The company has about 200,000 views per month on the app, which reflects regular usage among its Foodie Club customers. Membership for Foodie Club, including app users and non-users, stands at about 400,000.

“The adoption was quite rapid at first, but I think there’s always that last, final segment of the audience that’s holding out, so it’s slowed down a bit,” Nance said.

The way forward for grocery mobile apps

At SpartanNash, Holt said he anticipates mobile apps will continue to evolve, providing an all-in-one-place platform dedicated to making shopping easy, quick and personalized to what the customer wants in every shopping trip, whether online or in-store.

In some cases, grocers are testing out individual apps for separate programs or partnering with other app developers to extend their reach. Hy-Vee, for example, recently introduced an effort to fight food waste through an app with Flashfood. Kroger’s OptUp app was launched as a tool to aid customers in healthy eating. Northern California grocery chain Raley’s operates a separate app for shoppers to manage their pharmacy needs and prescriptions.

As grocers look to update their apps and develop next-generation versions, experts say simplicity and customer experience are essential.

Sebek said that in some cases, he is seeing retailers pair features down rather than adding more. He encourages grocers to focus on digital features that are helpful to the shopper, such as wayfinding or personalized coupons.

Updating apps and adding new functions is about more than just adding bells and whistles, Miller said. “It has to be rooted in customer understanding and knowing how customers want to navigate your store and brand.”

Nance has high hopes for the Harmons app in the future. For example, she would like to see push notifications that would notify shoppers of store freebies they’re close to earning when they enter the store, and reminders about fuel rewards as they leave.

She also has a long-term goal of integrating augmented reality into the app, such as a feature where customers can scan an item and then see a video play that explains more about the sourcing of that product and its ingredients.

“That’s a huge area of interest for our customer base, they’re conscious of that,” Nance said. “We want to do more without being overwhelming.”