Hello BoF Professionals, your exclusive ‘This Week in Fashion’ briefing is ready, with members-only analysis on the key topic of the week and a digest of the week’s top news.

On Tuesday, the house of Chanel announced the death of Karl Lagerfeld — the world’s most famous, most iconic and most prolific fashion designer — sending the industry in Paris and around the world into collective mourning for a man widely considered to be its king. He was 85.

Chanel named Lagerfeld’s longtime studio director, Virginie Viard — described by the late designer as “my right hand and my left hand” — to succeed him at the creative helm of the storied French luxury brand. Meanwhile, Fendi, the Roman fur and leather house where Lagerfeld oversaw women’s collections for more than 50 years, has yet to announce a succession plan. “Now is not the time to discuss his succession,” said the house in a statement. “We intend to take the time to honour his life and pay him the tribute he deserves.”

The appointment of Viard provides continuity for Chanel, which is growing briskly and highly profitable. Last June, the company disclosed its annual results for the first time in 108 years, revealing global sales of more than $9.6 billion in 2017, up 11 percent from the previous year, with operating profits of $2.69 billion, making it one of the most successful luxury businesses in the world.

To maintain this trajectory, some predicted Chanel would need to hire a star designer to succeed Lagerfeld, floating names like Hedi Slimane (now ensconced at Celine), ex-Celine designer Phoebe Philo and former Lanvin star Alber Elbaz. But such a move would have been out of character for Chanel’s owners, the discreet Wertheimer family, who waited 12 years after the death of Coco Chanel to appoint Lagerfeld and rather than disrupting the model he put in place, have decided on Viard “so that the legacy of Gabrielle Chanel and Karl Lagerfeld can live on.”

Whether or not Viard will be able to keep Chanel fresh for years to come in a luxury market craving newness at a faster and faster pace remains to be seen. But, for the time being, the decision seems sound. (Questions remain around the succession plan on the executive side of the company, where Alain Wertheimer, positioned as a temporary solution, has held the reins for over three years, following the ouster of Maureen Chiquet, Chanel’s former global chief executive.)

But Lagerfeld’s greatest legacy goes far beyond the houses of Chanel and Fendi alone. At Chanel, the master designer transformed a dusty French fashion label into a multi-billion-dollar global luxury powerhouse, writing the playbook that has since been imitated with astounding success across the wider fashion industry by giants including Louis Vuitton, Christian Dior and Gucci. All of these houses — and many more — are using the template that Lagerfeld created.

When the designer arrived at Chanel in 1983, there was no such thing as a global luxury brand as we know it today. Instead, many of fashion’s most storied houses were dormant, their cachet damaged by rampant licensing deals made in the 1960s and 1970s. But at Chanel, the designer took a set of longstanding house codes — the intertwined double Cs, the camellias, the pearls, the tweed jacket, the quilted bag, the two-tone shoe — and turned them into the iconography of a powerful global-scale fashion cult with as much power as mass consumer symbols like Nike’s swoosh.

Then, he went about devising a pyramid of products, starting with haute couture at the top, and broadening to ready-to-wear, accessories, fragrance and beauty products, all the way down to $28 nail polish. While couture and ready-to-wear garments were well beyond the reach of most consumers, selling for as much as $100,000 per dress, they created a powerful brand halo that allowed the company to charge improbably high margins on fragrance and beauty products bought by consumers around the world who wanted to buy into the Chanel lifestyle and dream. The fundamental trick was maintaining the perception of exclusivity, while shifting millions of units.

“Chanel is a master of category segregation,” explained analyst Luca Solca in 2018. “This strategy involves confining iconic, core category products to high-end price ranges, while deftly positioning other product categories (lipsticks, for example) at lower price points to address aspirational customers.”

Needless to say, it worked. But while Lagerfeld’s playbook remains hugely powerful — witness the explosion of luxury consumption amongst China’s aspirational classes as waves of new wealth creation transform the country — there are elements that clearly need an update.

For one, the concept of turning seasonal ready-to-wear and haute couture fashion shows into multi-million-dollar marketing spectacles with icebergs and space shuttles at the scale of the Grand Palais in Paris remains a powerful driver of earned media attention for Chanel. But the resulting marketing spikes are increasingly out of sync with today’s world where consumers no longer buy in seasonal batches and social media feeds require new content on a daily basis.

What’s more, a “millennial mindset” is taking hold across the luxury market. Generations Y and Z are already the main engine of luxury growth, driving 85 percent of expansion in 2017, according to Bain. And the values of this new consumer cohort are increasingly at odds with the traditional luxury business model, which some see as uncool; its high prices, glossy advertising, glitzy flagships and seasonal runway spectacles rooted in a tired and inauthentic formula, tied to old-fashioned ideas of social hierarchy and extravagance, while streetwear labels offering community are capturing the imagination of today’s consumers.

It’s interesting that James Jebbia, the stealthy founder of streetwear juggernaut Supreme — often dubbed “the Chanel of downtown New York” — looked to Lagerfeld and the storied French powerhouse for cues on how to build his brand. “I’m influenced a lot by Chanel and by what Karl Lagerfeld has done,” Jebbia told The New York Times when he opened his first Paris boutique back in 2016. Now, we’re seeing the luxury sector looking to streetwear labels like Supreme for cues on how to adapt Lagerfeld’s template to the dynamics of a new generation.

Lagerfeld himself was intimately aware of the need for change. “Somebody has to do something different,” he once said. “It’s very dangerous to think you know it all.”

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

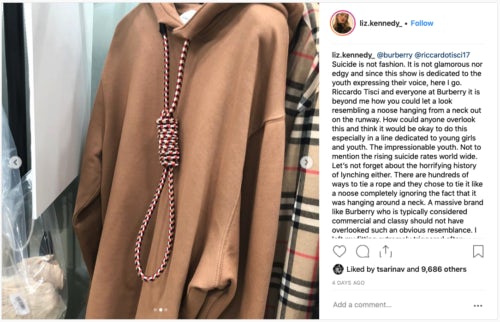

Source: @liz.kennedy_ Instagram

Burberry apologises for ‘noose’ hoodie after model complains. Chief executive Marco Gobbetti and creative director Riccardo Tisci have apologised for putting a hoodie with strings tied in the shape of a noose on Burberry’s London Fashion Week runway. The knotted strings surfaced after model Liz Kennedy complained before the show and on Instagram, saying the noose not only evoked lynchings but also suicide. Tisci apologised and said, “while the design was inspired by a nautical theme, I realise that it was insensitive.” This is the latest in a long line of recent PR miscalculations by luxury brands including Prada and Gucci — who both released products resembling blackface but have apologised and pulled them from shelves — and Dolce and Gabbana’s racially insensitive China-themed ad campaign.

China’s Fosun makes bid for German fashion chain Tom Tailor. The Chinese conglomerate announced a takeover bid for the troubled German clothing retailer on Tuesday, further expanding its reach into Europe’s fashion sector. Shares in Tom Tailor surged 14 percent to €2.46 after the company said Fosun was increasing its shareholding to 35.35 percent by buying new shares worth €2.26 each. This will lift Fosun’s stake above the 30 percent threshold that triggers a mandatory takeover offer under German law.

Nike target of twitter storm after basketball star’s shoe splits. Duke University star Zion Williamson limped off the court after the mishap during the game against his school’s arch rival University of North Carolina. Twitter lit up with jibes and jeers aimed at the sports brand, pushing the keyword Zion to the top of the worldwide trending list on Wednesday night. Former President Barack Obama, courtside at the high-profile clash, was shown on video appearing to say with an incredulous look: “His shoe broke!”

Flowerbx raises $5.5 million to launch in US. The London-based direct-to-consumer and wholesale flower delivery service — founded by the former senior vice president of communications at Tom Ford — has raised £4.2 million ($5.5 million), and will use the capital to launch in New York this May and eventually expand throughout the US. The online floral brand earned the early backing of Natalie Massenet and Carmen Busquets, and already has a presence in Belgium, Ireland, France and Germany.

Footasylum shares up 59 percent after JD Sports takes stake. Shares rose 58.6 percent after British retailer JD Sports said it had acquired an 8.3 percent stake and could buy nearly 30 percent of its smaller rival. JD, which has a network of more than 2,400 stores, said, however, that it is “not intending to make an offer for Footasylum” under merger regulations. Footasylum was forced to cut prices at its 60 stores after a disappointing run up to Christmas.

Climate change protests disrupt London Fashion Week. Environmentalist group Extinction Rebellion led protestors chanting “there’s no fashion on a dead planet,” while some of the biggest names in British fashion were showing their Autumn/Winter 2019 collections. During Victoria Beckham’s show at Tate Britain, they blocked Mercedes-Benz-sponsored cars, dressed in grass coats and carried signs that read “Ethical is always on trend,” among other pointed slogans.

UK takes aim at fashion’s sustainability problem. Taxes on clothes and tougher regulations to force the industry to act more sustainably have been proposed in a new report from a cross-party group of UK lawmakers. Amazon and Boohoo, as well as luxury labels like Versace, are in Parliament’s sights. Fashion companies should receive tax incentives to produce environmentally friendly garments — and penalties if they don’t — the report said.

Inditex launches Netflix-partnered brand Pull & Bear in US. The Spanish owner will start operating its youth-focused Pull & Bear brand in the US on Wednesday, as the retailer plows ahead with plans to sell in every country worldwide by next year. The brand will be available via web ordering in the US, its 34th global online market. Inditex already operates 94 Zara stores, three Massimo Dutti stores and one Bershka store in the US, but declined to comment on whether it plans to open physical Pull & Bear stores there.

THE BUSINESS OF BEAUTY

Henkel will relaunch shampoo brand Schauma with a “vegan” formula | Source: Schauma

Henkel goes vegan to revive beauty business. The German consumer goods company and owner of Schwarzkopf and Persil has announced new hair care formulations and brands, seeking to tap into consumer demand for more natural ingredients, as it tries to revive sluggish growth in its beauty business. Henkel will relaunch its European shampoo brand Schauma with a “vegan” formula, roll out its Nature Box line of hair and body care products made from cold-pressed oils to more markets and launch a new “free-from” hair dye line called OnlyLove.

Virtual makeovers are better than ever. Beauty companies are trying to cash in. Augmented reality (AR) — which has been available in a handful of mobile apps for years, but has largely failed to catch on with consumers — is going mainstream and selling real-world products all thanks to virtual makeup. AR has become accurate enough that major beauty companies including Ulta Beauty, Sephora and L’Oréal are using it to try to sell their latest products, and consumers are keen to try it as a way to experiment quickly, without touching messy and unhygienic tester products.

Glossier launches oil-based makeup remover. Following on from the cult success of the Milky Jelly Cleanser, the beauty brand has launched a new product that is similar in function, but dissolves makeup faster. Created with micellar water, pro-vitamin B5 and comfrey root extract, Milky Oil is a bi-phase formula designed to remove waterproof makeup. It’s also ophthalmologist-approved, vegan, cruelty-free and marketed as ideal for sensitive types.

PEOPLE

Virginie Viard and Karl Lagerfeld during the Chanel Metiers D’Art 2018/19 Show in December 2018 | Source: Getty Images

Karl Lagerfeld dies in Paris. Arguably the world’s most iconic designer and undoubtedly the most prolific, Lagerfeld passed away aged 85. In a seven-decade career, he created collections simultaneously for Chanel and Fendi, in addition to his own signature label. The designer’s passing presents Chanel, which he helped turn into a global megabrand with $9.6 billion in annual sales, with its biggest creative challenge since Gabrielle “Coco” Chanel’s death almost half a century ago. Longtime creative deputy Virginie Viard is now in charge of the collections. Meanwhile, a successor has yet to be announced at Fendi.

Salvatore Ferragamo names creative director. The Italian fashion house has appointed Paul Andrew as creative director. Andrew, who was most recently women’s creative director at the brand, initially joined the company in September 2016 as women’s footwear director. The company also announced that Guillaume Meilland, who will maintain his role as men’s ready-to-wear design director, is entrusted with the additional responsibility of studio director under Andrew’s leadership.

Bethany Williams wins royal award for ethically-focused fashion. The Duchess of Cornwall presented the British designer with the Queen Elizabeth II Award for British Design — a prestigious prize that recognises young designers making a difference to society. Since graduating from the London College of Fashion in 2016, Williams has built her business with a singular focus on social and environmental concerns. Her clothing line is manufactured using sustainable materials in partnership with charities that support social change.

MEDIA AND TECHNOLOGY

Web retailers should pay higher taxes to save UK shops. Internet giants such as Amazon, Asos and Boohoo should pay higher UK taxes such as “green taxes” on shipping and packaging to help save ailing shopping districts that are losing revenue to e-commerce, according to a government report. Some 70,000 jobs were lost in the UK retail sector in 2018 as chains like Marks & Spencer and Debenhams announced plans to close hundreds of stores. Internet sales are a major factor, with UK consumers spending more via the web than any other European country.

Tencent-backed plastic surgery app SoYoung files for US IPO. The Chinese cosmetic surgery website has filed confidentially for a US initial public offering and could raise around $300 million. SoYoung, founded in 2013, allows customers to review and book nip-and-tuck procedures through its app and websites as well as share treatment experiences via posts, pictures and videos.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.