Gruss & Co Inc decreased its stake in Microsoft Corp (MSFT) by 12.77% based on its latest 2018Q3 regulatory filing with the SEC. Gruss & Co Inc sold 9,000 shares as the company’s stock declined 1.64% with the market. The institutional investor held 61,500 shares of the prepackaged software company at the end of 2018Q3, valued at $7.03 million, down from 70,500 at the end of the previous reported quarter. Gruss & Co Inc who had been investing in Microsoft Corp for a number of months, seems to be less bullish one the $789.25 billion market cap company. The stock decreased 0.77% or $0.8 during the last trading session, reaching $102.8. About 28.31M shares traded. Microsoft Corporation (NASDAQ:MSFT) has risen 30.43% since January 13, 2018 and is uptrending. It has outperformed by 30.43% the S&P500. Some Historical MSFT News: 17/04/2018 – Gigamon Announces General Availability of GigaSECURE Cloud for Microsoft Azure; 10/04/2018 – Quantitative Brokers Appoints Deepak Begari as Chief Technology Officer; 26/04/2018 – Gamida Cell Strengthens Leadership Team with Appointments of Josh Hamermesh as Chief Business Officer and Paul Nee as Vice President of Marketing; 26/03/2018 – Tech Today: Microsoft to a Trillion, Defending Tesla, Cutting AMD — Barron’s Blog; 29/03/2018 – MICROSOFT – FORMATION OF TWO NEW ENGINEERING TEAMS; 27/03/2018 – Companies clamp down on crypto ads as regulators play catch-up; 20/05/2018 – MICROSOFT BUYS SEMANTIC MACHINES; 12/03/2018 – Microsoft women filed 238 discrimination and harassment complaints -court documents; 13/03/2018 – CafeX Extends CRMs Power with New Release of Live Assist for Microsoft Dynamics 365; 16/05/2018 – L7 Informatics Announces the Availability of Microsoft Genomics on L7 Enterprise Science Platform

Fca Corp increased its stake in Apple Inc (AAPL) by 114.44% based on its latest 2018Q3 regulatory filing with the SEC. Fca Corp bought 3,011 shares as the company’s stock declined 22.32% with the market. The institutional investor held 5,642 shares of the computer manufacturing company at the end of 2018Q3, valued at $1.27 million, up from 2,631 at the end of the previous reported quarter. Fca Corp who had been investing in Apple Inc for a number of months, seems to be bullish on the $720.30 billion market cap company. The stock decreased 0.98% or $1.51 during the last trading session, reaching $152.29. About 27.02 million shares traded. Apple Inc. (NASDAQ:AAPL) has risen 0.17% since January 13, 2018 and is uptrending. It has outperformed by 0.17% the S&P500. Some Historical AAPL News: 16/03/2018 – Apple will have a Mar. 27 event focused on education; 03/04/2018 – Bank of America says Apple could save $500 million a year making its own PC chips; 15/05/2018 – ♫ Reuters Insider – Asia Insight: Weak China data suggests long-anticipated slowdown; 09/05/2018 – Chinese consumers don’t idealize American products the way they used to – and that’s bad news for Apple and Tesla; 03/04/2018 – MacDailyNews: Apple prepping Micro-LED displays for Apple Watch and Smartglasses for 2019; 25/03/2018 – Intl. Business Times: Apple discontinuing iPhone X amid `slowing sales,’; 10/04/2018 – Brew City Royalties: Nvidia is a buy according to Bank of America, Apple reportedly dives deeper into augmented realit; 10/04/2018 – MEDIA-Apple must pay $502.6 Mln to VirnetX, federal jury rules- Bloomberg; 12/03/2018 – CRN: CRN Exclusive: Apple Hires Oracle Channel Veteran To Help Drive Enterprise Sales Growth; 17/05/2018 – CECONOMY CEO SAYS ALLIANCE WITH FNAC DARTY NOT JUST ANSWER TO AMAZON, BUT ALSO TO SIZE OF GOOGLE, APPLE

Since August 31, 2018, it had 0 buys, and 10 insider sales for $54.07 million activity. The insider Capossela Christopher C sold 59,162 shares worth $6.43M. Shares for $214,363 were sold by BROD FRANK H on Monday, November 5. $21.70M worth of stock was sold by Nadella Satya on Friday, October 26. On Friday, August 31 the insider Hood Amy sold $13.09M.

Analysts await Microsoft Corporation (NASDAQ:MSFT) to report earnings on January, 30. They expect $1.09 earnings per share, up 13.54% or $0.13 from last year’s $0.96 per share. MSFT’s profit will be $8.37B for 23.58 P/E if the $1.09 EPS becomes a reality. After $1.14 actual earnings per share reported by Microsoft Corporation for the previous quarter, Wall Street now forecasts -4.39% negative EPS growth.

Among 38 analysts covering Microsoft Corporation (NASDAQ:MSFT), 34 have Buy rating, 1 Sell and 3 Hold. Therefore 89% are positive. Microsoft Corporation had 216 analyst reports since July 22, 2015 according to SRatingsIntel. The rating was upgraded by Macquarie Research on Friday, October 12 to “Outperform”. The firm has “Buy” rating given on Thursday, August 13 by Stifel Nicolaus. Nomura maintained it with “Buy” rating and $115 target in Thursday, October 25 report. The stock of Microsoft Corporation (NASDAQ:MSFT) has “Buy” rating given on Monday, October 2 by Piper Jaffray. Credit Suisse maintained it with “Buy” rating and $8400 target in Monday, August 7 report. The stock of Microsoft Corporation (NASDAQ:MSFT) earned “Overweight” rating by Barclays Capital on Friday, April 27. The company was maintained on Monday, July 17 by Credit Suisse. The company was maintained on Friday, July 21 by Raymond James. The firm has “Buy” rating given on Thursday, January 18 by Credit Suisse. The firm earned “Outperform” rating on Wednesday, January 6 by RBC Capital Markets.

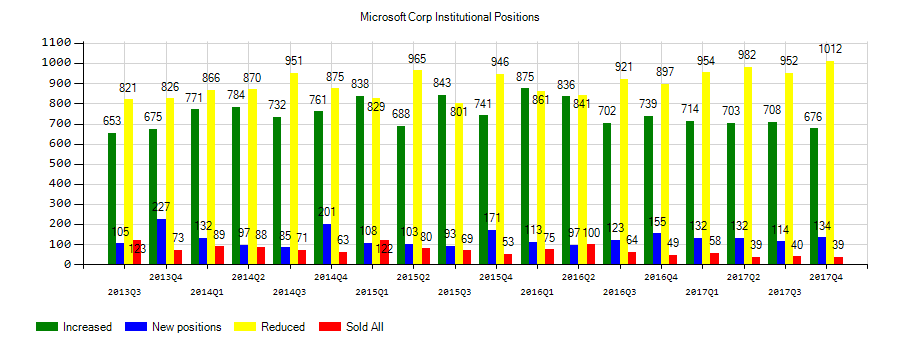

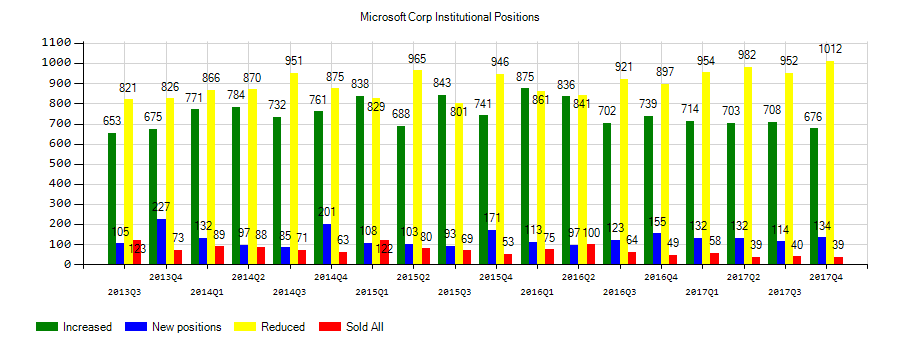

Investors sentiment decreased to 0.81 in Q3 2018. Its down 0.03, from 0.84 in 2018Q2. It dived, as 33 investors sold MSFT shares while 981 reduced holdings. 145 funds opened positions while 681 raised stakes. 5.28 billion shares or 0.60% less from 5.31 billion shares in 2018Q2 were reported. Altavista Wealth Mngmt holds 3.35% of its portfolio in Microsoft Corporation (NASDAQ:MSFT) for 78,827 shares. Rothschild Inv Corporation Il has 1.65% invested in Microsoft Corporation (NASDAQ:MSFT) for 122,258 shares. Palladium Partners Llc holds 456,660 shares. Neuberger Berman Llc reported 11.92 million shares. Meiji Yasuda Life Company invested 2.81% in Microsoft Corporation (NASDAQ:MSFT). Hartwell J M LP reported 423,689 shares. First Allied Advisory Service has 0.97% invested in Microsoft Corporation (NASDAQ:MSFT) for 122,790 shares. Jabre Cap Prtn reported 43,600 shares or 1.65% of all its holdings. 315,642 were reported by Wesbanco Bancorp. Credit Suisse Ag reported 14.65 million shares stake. First Retail Bank has 2.61% invested in Microsoft Corporation (NASDAQ:MSFT). Capital Invest Ltd Limited Liability Company holds 94,516 shares or 0.64% of its portfolio. Jacobs And Ca reported 2.78% of its portfolio in Microsoft Corporation (NASDAQ:MSFT). Wells Fargo Mn reported 57.45M shares. Campbell Newman Asset Inc owns 4.86% invested in Microsoft Corporation (NASDAQ:MSFT) for 293,888 shares.

More notable recent Microsoft Corporation (NASDAQ:MSFT) news were published by: Nasdaq.com which released: “Technology Sector Update for 12/31/2018: SFET, FB, GOOG, GOOGL, MSFT, AAPL, IBM, CSCO – Nasdaq” on December 31, 2018, also Seekingalpha.com with their article: “AT&T And Microsoft: High-Yield Alternative Strategies For A Choppy Market – Seeking Alpha” published on December 21, 2018, Nasdaq.com published: “Technology Sector Update for 12/20/2018: BILI, BABA, ERIC, QTRH, MSFT, AAPL, IBM, CSCO, GOOG – Nasdaq” on December 20, 2018. More interesting news about Microsoft Corporation (NASDAQ:MSFT) were released by: Nasdaq.com and their article: “Noteworthy Monday Option Activity: DDD, PUMP, MSFT – Nasdaq” published on December 17, 2018 as well as Nasdaq.com‘s news article titled: “After Hours Most Active for Dec 21, 2018 : CSCO, BAC, MSFT, XOM, AAPL, GE, PFE, QQQ, MBI, MU, KGC, FB – Nasdaq” with publication date: December 21, 2018.

Fca Corp, which manages about $377.83M and $261.85 million US Long portfolio, decreased its stake in Cvs Health Corp (NYSE:CVS) by 4,892 shares to 9,551 shares, valued at $752,000 in 2018Q3, according to the filing.

Among 58 analysts covering Apple Inc. (NASDAQ:AAPL), 31 have Buy rating, 1 Sell and 26 Hold. Therefore 53% are positive. Apple Inc. had 470 analyst reports since July 21, 2015 according to SRatingsIntel. The rating was downgraded by Stifel Nicolaus on Wednesday, March 7 to “Hold”. Credit Suisse maintained the shares of AAPL in report on Monday, August 21 with “Hold” rating. Morgan Stanley maintained Apple Inc. (NASDAQ:AAPL) rating on Monday, July 17. Morgan Stanley has “Overweight” rating and $182 target. The stock has “Buy” rating by Credit Suisse on Tuesday, July 25. The rating was maintained by Cowen & Co with “Outperform” on Wednesday, April 27. The stock has “Buy” rating by UBS on Tuesday, September 20. The stock of Apple Inc. (NASDAQ:AAPL) earned “Outperform” rating by FBR Capital on Wednesday, January 27. Barclays Capital maintained the shares of AAPL in report on Thursday, September 29 with “Overweight” rating. On Friday, November 3 the stock rating was maintained by Robert W. Baird with “Outperform”. Pacific Crest maintained the stock with “Overweight” rating in Monday, March 7 report.

More notable recent Apple Inc. (NASDAQ:AAPL) news were published by: Nasdaq.com which released: “IWV, AAPL, JPM, XOM: Large Inflows Detected at ETF – Nasdaq” on January 10, 2019, also Nasdaq.com with their article: “After Hours Most Active for Dec 21, 2018 : CSCO, BAC, MSFT, XOM, AAPL, GE, PFE, QQQ, MBI, MU, KGC, FB – Nasdaq” published on December 21, 2018, Seekingalpha.com published: “CIRP: iPhone XR took 32% share in November – Seeking Alpha” on December 26, 2018. More interesting news about Apple Inc. (NASDAQ:AAPL) were released by: Nasdaq.com and their article: “Better Buy: Apple vs. IBM – Nasdaq” published on December 22, 2018 as well as Nasdaq.com‘s news article titled: “Apple tries to shake off China warning – Nasdaq” with publication date: January 05, 2019.

Since November 19, 2018, it had 0 insider purchases, and 1 insider sale for $647,520 activity.