B8ta delivers tech-centric retail outlets, as well as online shopping for startup products such as the Boosted board

Venture capitalist Fifth Wall has outlined how e-commerce innovators are set to continue revolutionising the retail sector this year.

According to Fifth Wall’s 2019 retail predictions, “the popularity of digitally native vertical brands across multiple categories, combined with the ubiquity of Amazon, is altering the traditional retail landscape dramatically and permanently.”

DNVBs, also known as v-commerce, are a growing force in retail, and have several defining attributes. They are digitally-based companies which innovate rapidly, are obsessed with quality consumer experience, have very visually alluring, well-designed products, directly source materials, and deliver to consumers living locally.

In 2019, Fifth Wall predicts that the United States’ 200 largest v-commerce brands combined will grow faster than Amazon. Expansion will not only be seen in their online footprint, but these companies are also set to outgrow their digital roots in order to open physical stores.

While already impacting sectors such as healthcare, food and drink, beauty, and clothing, Fifth Wall says that v-commerce could soon branch out into more niche products, such as for the elderly, LGBTQ brands, multicultural products, and digital-first products for common ailments.

AskTia provides healthcare advice to women via an app, and is opening its first clinic in New York this year

Sectors to watch

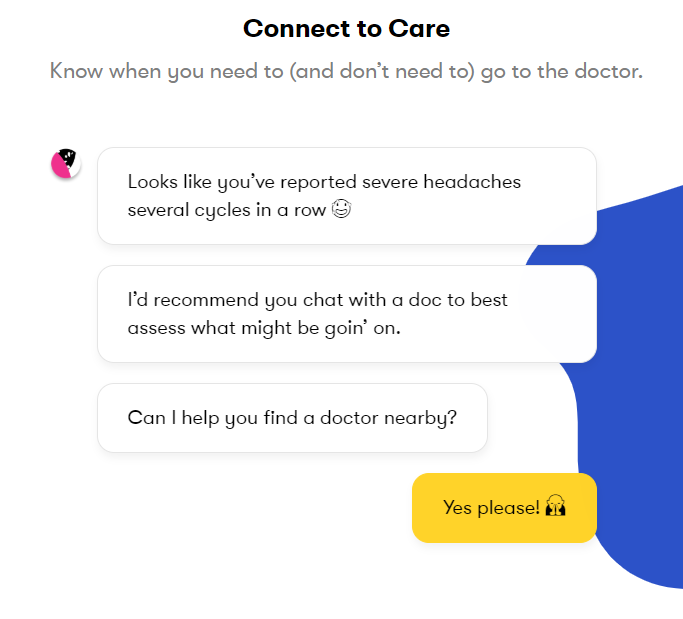

- Healthcare tech: 89% of healthcare leaders expect telehealth to transform US health, and Fifth Wall spotlights innovators such as Candid, AskTia, Hims, and Everlywell

- Ghost kitchens: predicted to occupy 20 million sq ft in US by 2022, led by companies such as Cloud Kitchens and Kitopi

- Boutique wellness: 98% of Heyday customers book online, and blow dry salon DryBar also bases its business model on an easy online booking experience

- Retail as a service: brands have to spend 10x more when opening a store on their own compared to using space providers such as Fourpost or B8ta

- Digitally-enabled business: Sweetgreen’s online food ordering revenue is increasing 80% year-on-year, alongside fitness company Soulcycle

- Immersive entertainment: consumer expenditure on experiences grew nearly 4x faster than expenditure on goods between 2014 and 2016, according to Fifth Wall, with operators such as Two-Bit Circus and The Void leading the way

Fifth Wall’s retail trends

- Holistic health concepts: locations offering both physical activity and diet solutions

- Credit for non-essential goods: payment plans offered at point of sale to make big luxury items more affordable

- Retail as a service: companies focused on helping young brands open next-gen physical locations

- Cashier-less check outs: seamless shopping with tech that allows for the elimination of the cash register

- Same day delivery: last mile fulfilment centres and innovative delivery methods

- Sustainability/traceability: tech used to create more sustainable supply chains and give customers transparency, such as AI, blockchain

- Waste not, want not: landlords finding uses for all parts of retail real estate i.e. using back of house for ghost kitchens

- Near-shoring: close geographical supply chain to cut shipping costs and lead times

- Retail inside schools: branding of in-school cafes, clothing stores, and convenience stores

Spotlight on v-commerce brands

B8ta – retail-as-a-service provider, builds tech-integrated shops for brands, including software platforms for easy purchases and an online store featuring client products

Fourpost – Operates stores which offer space to multiple start-up retailers, who occupy on a subscription basis rather than through long term leases. A focus on tech-enabled experiences, Fourpost aims to “democratise the traditional department store for local, native brands”

AskTia – an online women’s health clinic and app, with its first physical clinic set to open in New York’s Flatiron this year. Bookings will be connected to member’s apps for booking “as easy as booking a yoga class”

Kitopi – operate takeaway-only kitchens and digital booking/tracking services on behalf of established restaurant brands, to stop restaurants losing efficiency meeting takeaway orders alongside their usual business

Sweetgreen – Casual dining restaurant with a focus on healthy eating. Meals can be ordered in store, online or via an app