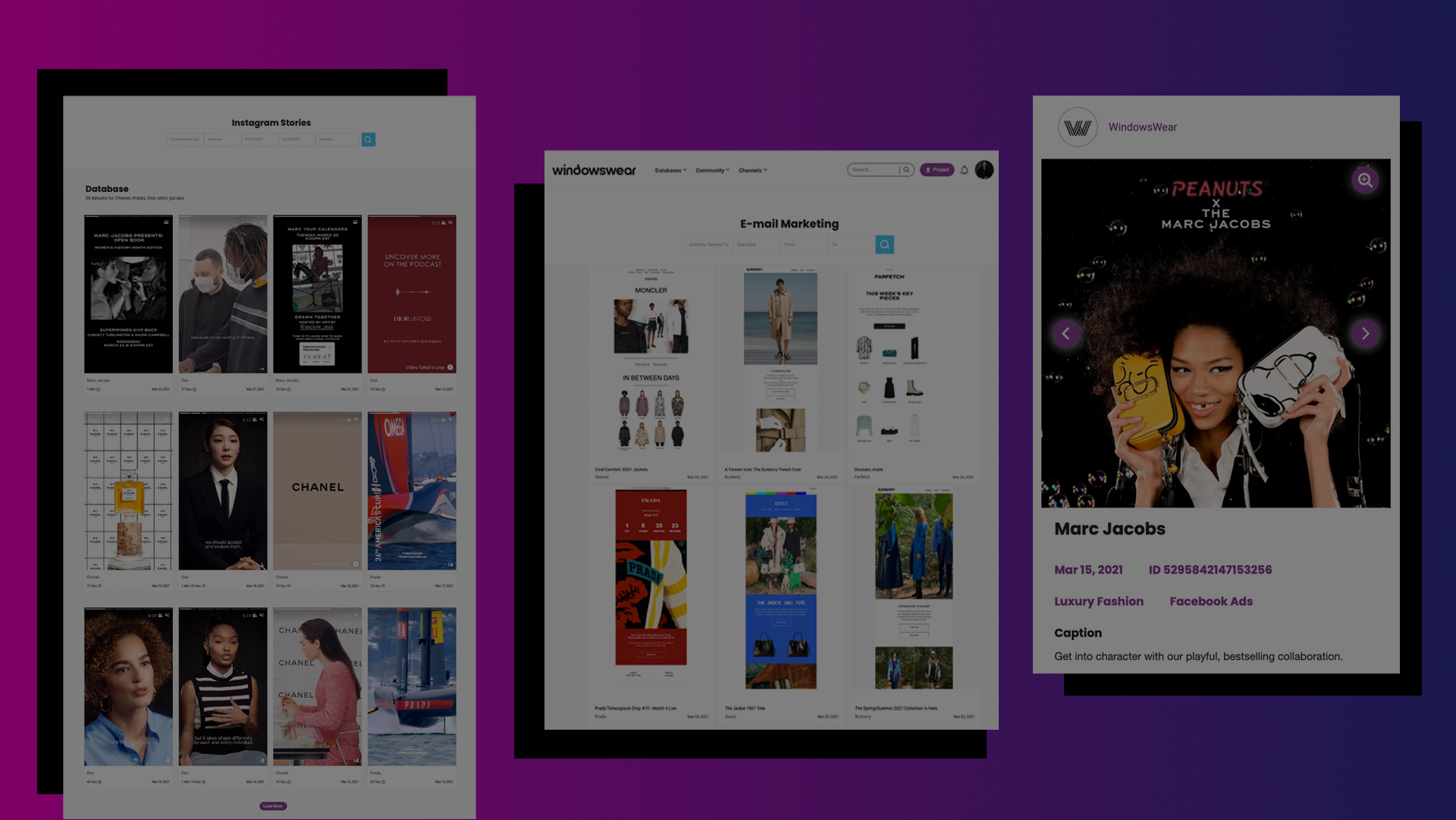

Take your digital marketing and social media campaigns to the next level! Stay on top of your competitor’s social media, marketing campaigns, and advertisements! Whether you’re looking to inspire your next campaign, or analyze what makes their content go viral; we have everything that you need to know in one place.

Leading brands, visual creatives, designers, visual merchandisers, architects, vendors and academic institutions worldwide use WindowsWear; one-of-a-kind database. This unique online resource provides competitive research, information, insights, and trends for visual creatives to enhance and coordinate their brand’s physical and e-commerce environments. Content includes visual merchandising, window displays, retail & interior design, product packaging, e-commerce, technology and more from the hottest global brands.

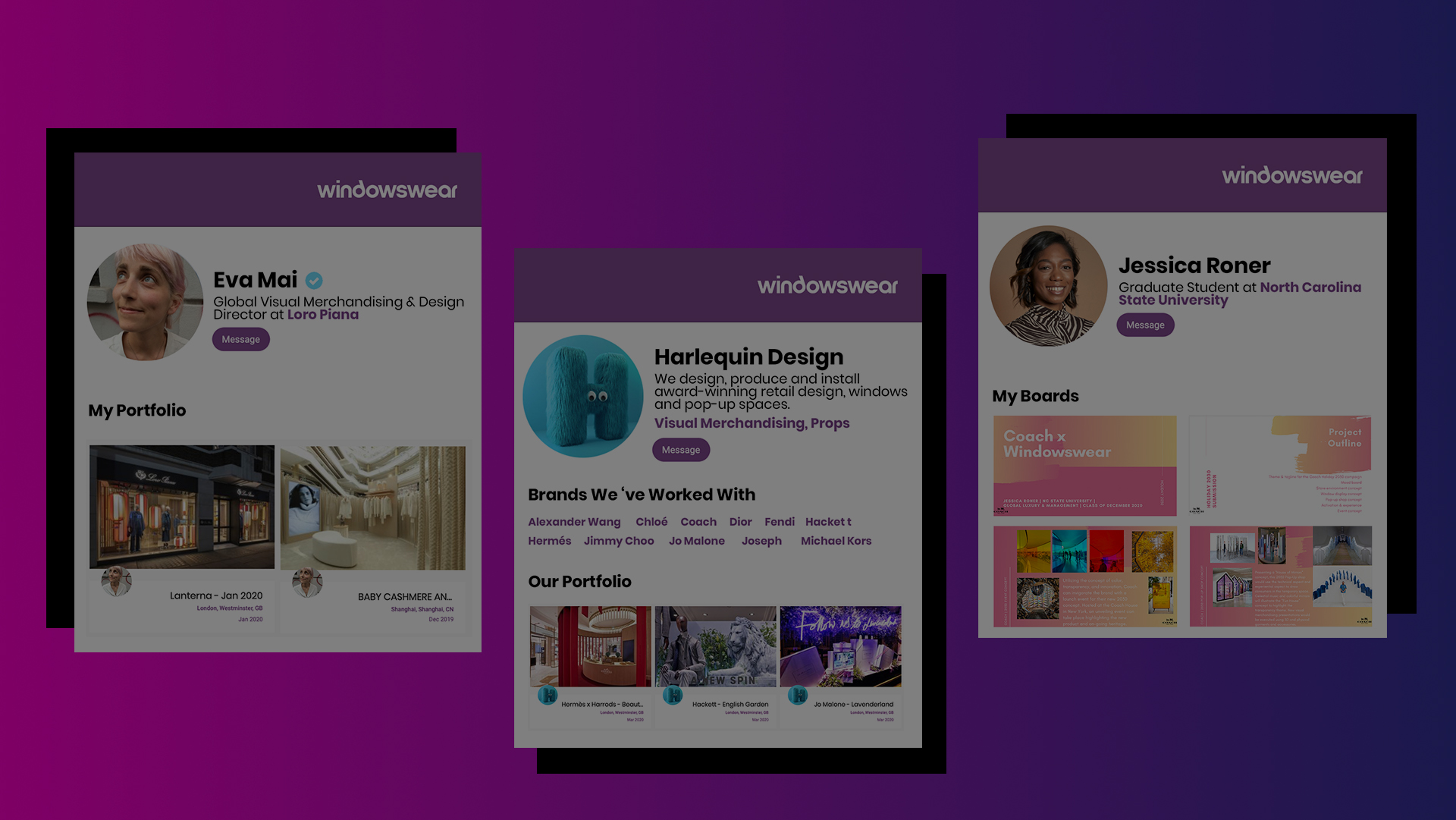

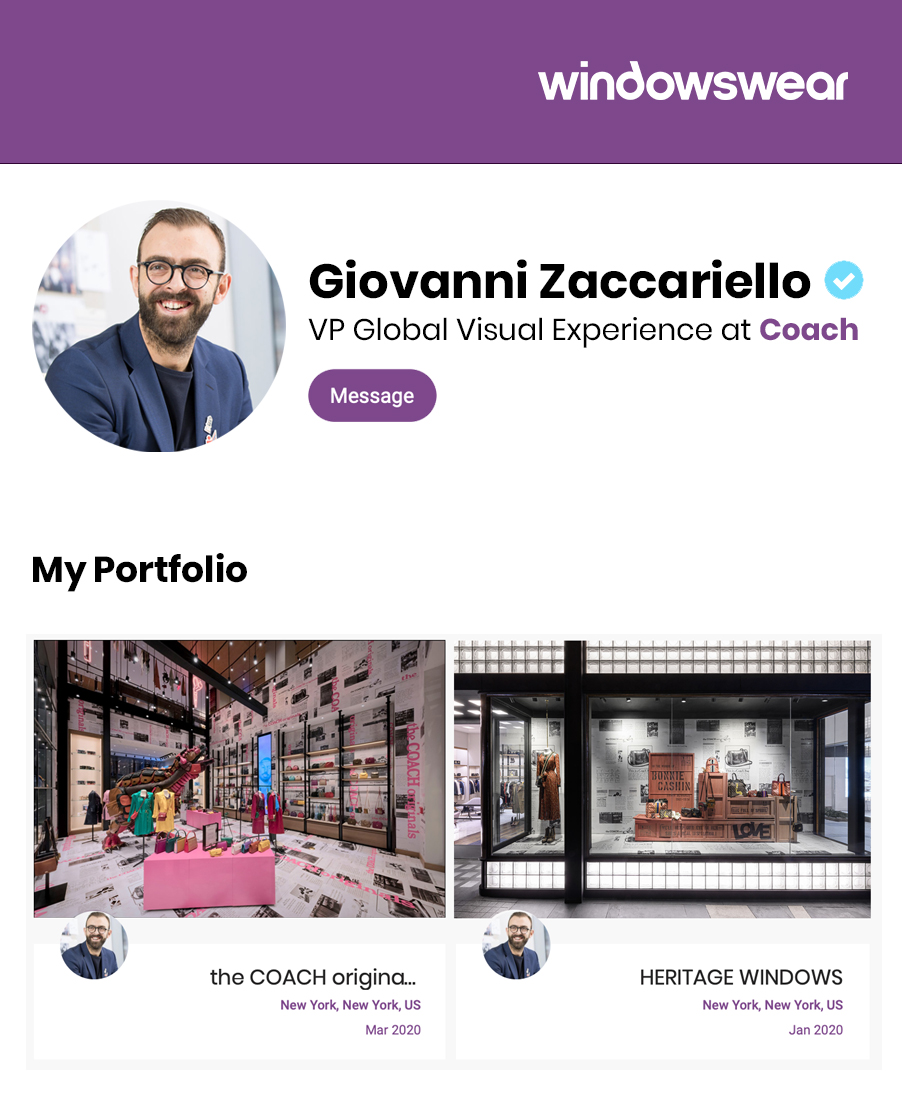

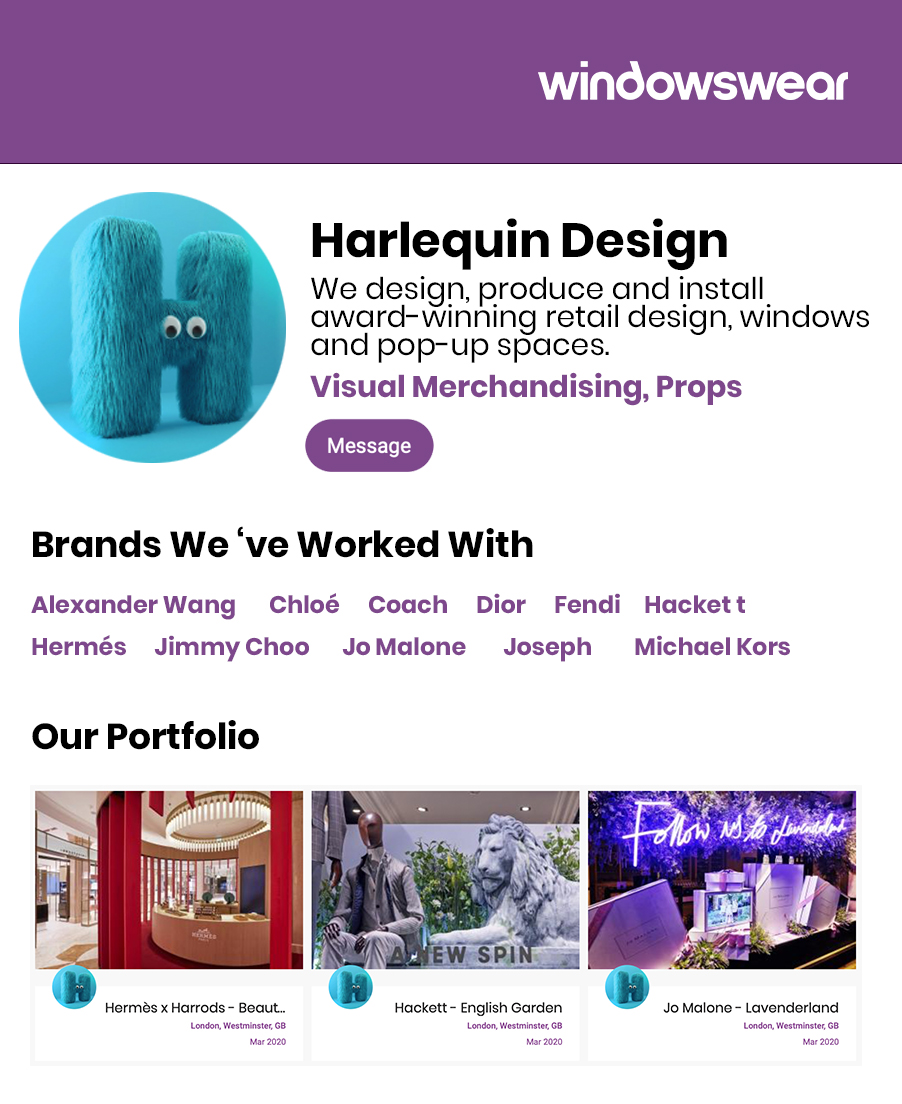

An exciting online hub for visual creatives in this physical and digital era. Create your WindowsWear profile now to showcase your creative projects and your life’s work. Tag your colleagues and the vendors that helped to bring your project to life. Discover what brands, visual creatives and leading specialists are doing around the world.

Meet other members through our community and member-only events. Post job opportunities and find new talent.

Stay in the know with the latest trends across all the verticals of visual merchandising and retail. From the most exciting pop-ups, super photogenic packaging from the brands engaging with younger generations, the most innovative spaces around the world and the latest technology such as AR/VR used to engage with the consumer. Analyze and enhance your creative and competitive research and get a glimpse of who is doing what in the industry.

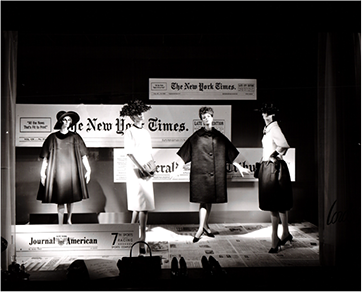

WindowsWear archives date back to 1931. As WindowsWear captures and memorializes the world’s

latest physical and e-commerce environments, this historical content is searchable as part of WindowsWear’s

proprietary archival collection. In addition, individuals and organizations may contribute their archives to WindowsWear.

The collections provide historical information covering nearly 90 years!

For brands, the information provides unparalleled competitor intelligence and trend data.

For educators, the archives provide a rich resource to take your students back in time to study visual creative and fashion trends.