The young woman walked into the Kohl’s store in Grafton, Wis., dressed to run errands, in Ugg boots, yoga pants, and a hoodie. She was pushing a stroller and looked to be in her twenties—barely half the age of the chain’s average customer. Kohl’s CEO, Michelle Gass, who was showing a reporter around the store, interrupted the tour to watch the younger woman intently. “This is the quintessential Kohl’s shopper we want to see in the future,” she said.

The top compartment of the woman’s stroller held a cute baby, who was duly cooed over by store workers. The lower compartment, on the other hand, was overflowing with Amazon boxes—brick-and-mortar retail kryptonite.

But while an Amazon super-shopper might seem to be the last person a department store CEO would want to see, the young mom’s presence was a small victory for Gass. As part of a daring experiment begun a year ago, Kohl’s handles returns of Amazon online orders at 100 of its 1,158 stores. (It also sells Amazon’s smart-home products at branded kiosks in about 30 stores.) Kohl’s has made it a mission-critical priority to get more shoppers to its stores, particularly the younger, more affluent customers Amazon tends to draw. The idea is that, when an Amazon shopper comes into a Kohl’s to return, say, an ill-advised adult onesie, she’ll see items she needs, like Nike running shorts or a waffle iron, and make a purchase at Kohl’s.

Gass has heard a million times that bringing apex predator Amazon into her stores is akin to bringing a fox into the henhouse. But that, she says, is the kind of antiquated thinking that got many retailers into trouble, and she’s betting Kohl’s will prove to be crazy like a fox. The Amazon gambit is meant to be a shock to the system, she says: “The big idea is that this is teaching us to think differently.”

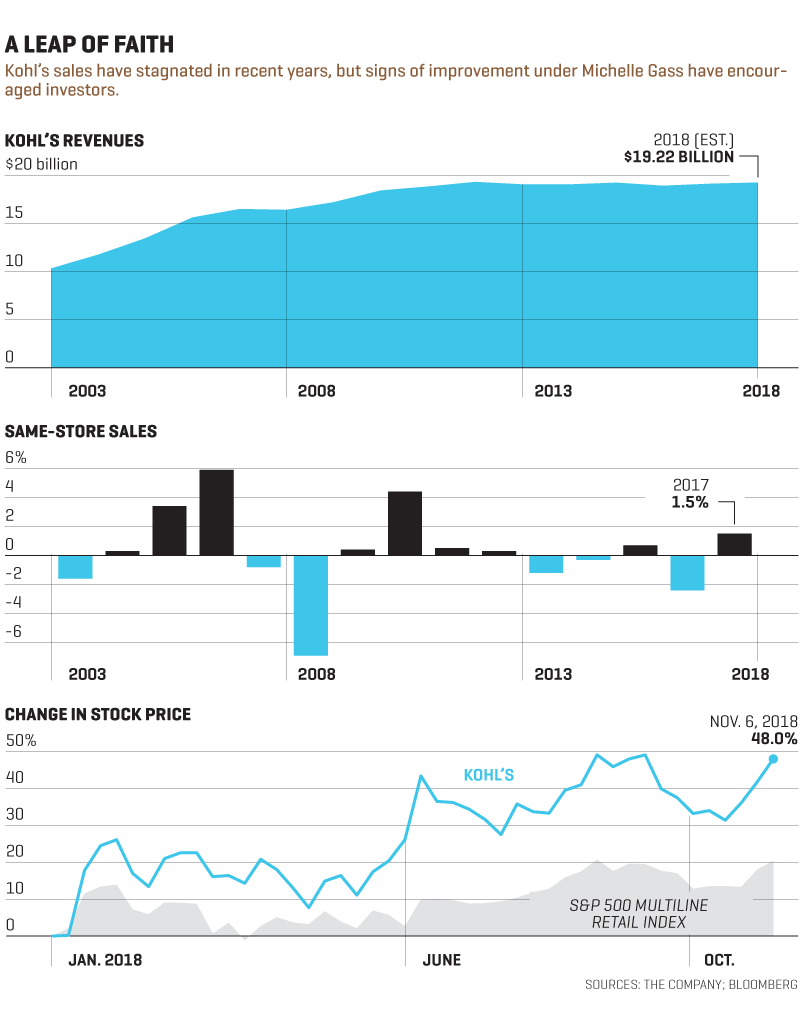

Thinking differently has only recently become a priority at Kohl’s. Over the past five years, the venerable retailer has steered clear of the retail carnage that accompanied the rise of e-commerce, helped by customer loyalty and its low exposure to malls’ problems, and developed a best-in-class reputation for its tech and inventory management. But it also failed to win over many new shoppers, and its revenue has essentially flatlined since 2012.

Over the past 18 months, though, the slumber-inducing giant has started to stir, and Gass, a Starbucks alum who became CEO in May after almost five years in different roles at Kohl’s, is a big reason why. In 2017, Kohl’s enjoyed one of its most successful holiday seasons in years, with comparable sales up 7%; it has now clocked five straight quarters of “comp” growth. The growth has been driven by factors ranging from bread-and-butter moves, like overhauling its e-commerce and bringing in coveted brands such as Under Armour, to counterintuitive ones, like inviting Amazon in—or deciding to shrink nearly half its stores while closing none. The upshot: Kohl’s stock trades near all-time highs on the assumption that its recent momentum is no fluke.

Digital price tag screens, like these at a store in Wisconsin, let Kohl’s managers instantly change prices, without the hassle and clutter of paper price labels.

Chuck Burton—AP/Shutterstock

Sustaining that momentum, of course, is up to Gass. She was recruited from Starbucks by her predecessor, Kevin Mansell, who hoped she would infuse Kohl’s with radical ideas from outside traditional retail. (The radical idea she’s best known for: the frappuccino.) Now she’s betting that Kohl’s is perfectly positioned to steal market share from weakened rivals, like J.C. Penney, Macy’s, and Sears—not to mention recently shuttered ones, like Bon-Ton Stores and Toys “R” Us. She’s driving Kohl’s to continue catching up with rivals online. And her retail holy grail is winning over young adults who’ve long seen Kohl’s as the Place Where Your Mom Shops.

“We are the middle,” Gass says of Kohl’s, which is headquartered in Menomonee Falls, outside Milwaukee. “We’re Middle America. We want to own the middle.”

American mass retail never had a more prolific year than 1962. That year marked the opening of the first Target, Walmart, and Kmart stores. It was also the year that Kohl’s, a grocery chain founded in the 1920s by Polish immigrant Max Kohl, opened its first general merchandise department store in Brookfield, Wis.

Kohl’s quickly found a winning formula: selling the national brands found at department stores, along with lower-price house brands, without forcing shoppers to go to the mall. (It got out of the food business in 1983.) Its stores tend to be smaller than those of its rivals: The typical Kohl’s occupies 90,000 square feet, compared with 130,000 for the average Macy’s. They’re usually found in “strip” centers, closer to where customers live, with easier parking. Today only 7% of Kohl’s stores are in malls. The chain’s no-frills “racetrack” store layout also proved to be genius. The typical store has one defined main aisle that loops around the store to whisk shoppers in a circle that ends at cash registers at the front. That maximizes the visibility of the merchandise and adds to speed and convenience, exactly what legions of suburban moms wanted.

In 1992, when Kohl’s went public, it had 76 stores, mostly in Wisconsin and Illinois, and sales of $1 billion. Over the next two decades, it grew in a steady march to 1,150 locations in 49 states, and in 2012, its sales peaked at $19.3 billion. But then growth leveled off, stalled by consumers’ changing tastes and the rise of new rivals.

Kohl’s sales never plummeted like those at rivals J.C. Penney or Macy’s. It helped that the chain had cultivated a hyper-loyal clientele with its Kohl’s Cash store-credit rewards program. Thanks in large part to that program, about 60% of its sales go through its store-branded charge cards—far more than at its peers. Still, Kohl’s was well behind not only Amazon but also rivals like Macy’s in the e-commerce wars. It was also deriving about half its sales from house brands in apparel, like Sonoma—few of which had much cachet compared with national brands like Levi’s.

It was amid this meh climate that Mansell, who had been CEO since 2008, was sketching both new strategies and plans for his own succession. What Kohl’s needed, he and the board agreed, was someone who could sustain Kohl’s left-brain discipline on pricing and inventory management—but who could also tap into his or her right-brain, creative-daring side. Gass, a 17-year veteran of Starbucks who was also serving as a director of fashion company Ann Taylor (which has since been acquired by Ascena Retail), seemed to have all the right gray matter.

She lacked department store experience, but she knew plenty about getting new products to market. A native of Lewiston, Maine, Gass earned a chemical engineering degree at Worcester Polytechnic Institute in Massachusetts and an MBA at the University of Washington. But the 50-year-old exec spent her formative professional years at Procter & Gamble, where she helped develop its wildly popular Crest for Kids toothpaste brand.

She raised her game higher at Starbucks, which she joined in 1996, helping to build the frappuccino into a billion-dollar business and elevating the coffee chain’s loyalty program into an industry leader. And when a broader sales slump led founder Howard Schultz to return as CEO in 2008, Gass became a top lieutenant. Her mandates included helping Starbucks improve its food business—now a staple at most cafés—and turning around its European division. She approached every new task as a challenge to make sure new initiatives built on older traditions. As she puts it, “How do you evolve? How do you keep your core—your coffee credentials—but then innovate?”

By the time Kohl’s came calling, Gass was ready for a new challenge. She waves away the idea that she saw a quicker path to the CEO role than she’d have at Starbucks. But in Mansell, who had served at Kohl’s for 30 years by then, she saw a retail veteran who could mentor her much as Schultz had. “I love fashion,” Gass adds. “It’s fun.” Last but not least: She was drawn to the idea of being part of another transformation story.

Gass’s first role at Kohl’s, in fact, was to write that story. Right after hiring Gass—with a title, chief customer officer, created just for her—Mansell tasked her with designing the retailer’s transformation plan. She spent months developing what was known in house as the Greatness Agenda, presenting it to the board in late 2013 and to the national-brand vendors who sold through Kohl’s in early 2014. All around were impressed: “She had dug into consumer data insights and really tried to understand what Levi’s needed from Kohl’s,” recalls Levi Strauss & Co. CEO Chip Bergh. “She was a really quick study.”

She then took on the job of updating Kohl’s loyalty program, with its 30 million members. Gass tweaked it so customers could earn rewards even if they didn’t shop with a Kohl’s credit card—a move that opened up a mother lode of new data to help stores make decisions about what to stock and sell. (A more recent innovation: Customers who hit certain spending thresholds get new incentives and perks.)

Mansell also tasked Gass with shifting Kohl’s portfolio back toward national brands, with much less focus on its house brands. On that front, she made a big and profitable leap into the booming activewear market. Kohl’s had always had a good selection of Nike (it sells $800 million a year of Nike products, by some estimates). But Gass believed the chain could expand the business enormously if it gave activewear brands a better showcase than the basic shelf space in Kohl’s low-frills emporia.

She wooed top brands by promising them dedicated spaces with prominent placement at the front of Kohl’s stores, along with fancier fixtures and lighting and more eye-catching mannequins. She used Nike, Kohl’s biggest brand partner, to showcase the approach. The campaign lured Fitbit and (briefly) the Apple Watch. And in 2017, it helped Gass land Under Armour, then riding a wave of enormous growth. Some 18 months later, Under Armour is the second-bestselling national brand at Kohl’s, after Nike. And overall sales in activewear are growing by at least 10% each quarter.

Kohl’s took a calculated risk with a deal to let shoppers return Amazon purchases at 100 Kohl’s stores.

Courtesy of Kohls

Kohl’s Greatness Agenda was generating interest, but the overall top line wasn’t moving: The company, which aimed to bring in $21 billion in revenue in 2017, instead fell below $19 billion that year. The sting of falling short of that goal despite a big effort motivated Gass and her team to try something that seemed far crazier on the surface: the Amazon partnership.

Under the plan, which the two companies announced in September 2017, Kohl’s would process Amazon’s returns, sending them back to its rival’s warehouses with its own shipping infrastructure. And Amazon would operate its own stores-within-stores at Kohl’s, but only to sell smart-home tech like the voice-activated Amazon Echo—arenas in which Kohl’s doesn’t sell a competing product.

The news inspired skepticism from retail analysts, many of whom fretted that Amazon would steal Kohl’s own e-commerce customers and stunt its online sales growth. But others saw things Gass’s way. “Amazon is going to be a competitor come what may,” says Neil Saunders of GlobalData Retail, who gives Kohl’s kudos for its pragmatism; why not leverage its popularity to get a few more people in the door? Perhaps most tellingly, Wall Street rewarded Kohl’s for shaking things up. Shares rose on the announcement, and they have nearly doubled in the ensuing 12 months.

Kohl’s and Amazon decline to offer data on how the partnership has fared. (The stroller mom Gass observed scooted out of sight before it could be determined whether she browsed the aisles.) But a similar service, where shoppers can go in-store to pick up an order from Kohls.com, typically adds 25% to any given online transaction, as pickup customers buy things on the fly. On the morning Fortune visited the Kohl’s in Grafton, the first customer through the door was a harried woman returning 20 or so Halloween costumes to Amazon. And what retailer wouldn’t want to woo a shopper who buys in bulk?

If Gass isn’t afraid of Amazon, it may be because Kohl’s has been handling its own tech evolution with surprising aplomb. One of the great paradoxes of retail this year has been that the best performing brick-and-mortar chains online have also been the ones not closing stores wholesale. Think Best Buy, Ulta Beauty, Home Depot, Nordstrom, and, of course, Kohl’s. And that is why Gass and her team are so adamant about getting people into stores: E-commerce and physical retail feed each other in this day and age. Since 2013, e-commerce has gone from generating 9.1% of Kohl’s revenue to 18.7%, making it a $3.6-billion-a-year business, according to eMarketer. There are four times as many items available on the website as there are in Kohl’s stores—and this holiday season, nearly 50% of online orders will be filled by Kohl’s stores.

Figuring out where to focus took some trial and error. During Gass’s early years, Kohl’s experimented with sci-fi touches, including holograms for product displays and augmented-reality mirrors at beauty counters. But ultimately, Kohl’s found that the unsexy stuff offers the biggest payoff and helps Kohl’s “contemporize” itself, to use a favorite verb of Gass’s. “You have to know who you are and then innovate to your core,” says Kohl’s president Sona Chawla. Chawla was the head of digital at Walgreens before joining Kohl’s in 2015 to overhaul its tech and e-commerce. She was also a candidate to succeed Mansell; now she’s the architect of the chain’s tech strategy, on which it has spent $1 billion in the past three years.

How Kohl’s is Turning Tech to its Advantage

Kohl’s was a latecomer to the e-commerce race. But it has made up for lost ground with innovations that keep the organization more nimble and convert more shoppers into buyers.

PRICE CHECK

Like most retailers, Kohl’s offers a potentially confusing swarm of discounts, coupons, and loyalty rewards. The Your Price feature on the Kohl’s app helps consumers process those options instantly on any given item to get a bottom-line price.

SMART CART

E-commerce accounts for about 19% of Kohl’s overall revenue. Borrowing an idea popularized by Walmart, Kohl’s Smart Cart program offers either discounts or rewards points to web shoppers who opt to pick up online orders in-store. The company saves on shipping costs, and shoppers doing in-store pickups often buy something else on the fly—a double win.

COUNTDOWN

Kohl’s has one of the more sophisticated inventory-tech infrastructures in retail. It uses identification tags, called RFIDs, to track goods in real time, enabling store managers to avoid advertising understocked popular goods, or having to mark down overstocked ones. And machine learning software analyzes the data to help store managers figure out the right assortment to eke the most sales out of local customers. Leaner inventories will help Kohl’s create less cluttered, more welcoming stores.

WAIT-LESS

Kohl’s store designs create potential bottlenecks at the cash registers. This holiday season, the retailer will deploy staff with handheld checkout devices for the first time to break up any traffic jams.

Chawla says she favors a “surgical approach” in deciding where to innovate. That means no holograms (yet) but more testing of things like line-busting handheld check-out devices, which Kohl’s will trot out during the holiday season. Also making an impact: RFID (radio-frequency identification) tags that let Kohl’s know where virtually any piece of inventory is in real time, making it easier to assure customers that the products they want are in stock. “That’s solving a real problem for the core Kohl’s shopper, much more so than magic mirrors or virtual reality,” says Jason Goldberg, a senior vice president of commerce at digital consultancy Publicis.Sapient.

Indeed, inventory tech may be Kohl’s secret weapon. Even as sales tick up, store inventory these days is down about 8% year over year. That has meant fewer profit-devouring markdowns, less need for store workers to devote time to stock management, and the ability to more quickly change up the products it sells. Leveraging that same data, Kohl’s is using machine learning to help managers at the store level see what is selling the best, meaning that no two Kohl’s locations sell the same product assortment. This is a key tool in Gass’s effort to decentralize how the chain is run:“The store manager is CEO,” she says.

Having less stuff in its stores, in turn, will enable Kohl’s to downsize in inventive ways. Kohl’s is the only major retailer working on shrinking selling space at stores en masse rather than close them: Some 500 stores, nearly half its fleet, already are stocked as if they were a third smaller, with more space between aisles. In many cases, Kohl’s plans to sublet the extra space to other businesses that generate frequent visits, like gyms or grocery stores—a double win that could generate both rental income and foot traffic. Next year, Kohl’s will test the idea with a few Aldi grocery stores that will move into next-door-neighbor spaces freed up by Kohl’s shrinkages.

“Lower inventory clears up floor space for special projects,” notes Wharton School professor Barbara Khan. Extra space could also be used for events, temporary exhibits, cafés, or just anything more interesting than yet another shelf full of clothes. And that makes the stores more inviting destinations. It’s a big departure from retail’s old “stack ’em high, watch ’em fly” model. For Kohl’s, “that’s over,” says Gass.

Gass likes to take advantage of the quiet in her house in suburban Milwaukee while her family sleeps. She typically rises at 4:30 a.m. to map out strategy, look at the previous day’s sales, meditate, or work out. “That’s my thinking time,” she says.

Lately, she’s been thinking about a generation gap. The average Kohl’s shopper is 50.3 years old, according to Kantar Retail data. That’s almost exactly Gass’s age, but it skews older than the average at Target (and certainly at Amazon). Much of Kohl’s heavy lifting is aimed at luring younger customers, particularly as they start to build families. When it comes to wooing millennials, Gass said at the recent WWD retail CEO conference, “we have not done our job. And I’m making it a personal priority to make sure that once and for all, we crack the code.”

Click here to see who else made Fortune’s Businessperson of the Year list.

One big plank in her strategy: making Kohl’s a credible destination for beauty products—a major driver of shopper visits for all kinds of retailers. Presently, beauty is stuck at 2% of sales, well short of Kohl’s 5% goal. But the chain is making progress, recently adding higher-end products like Ralph Lauren’s Polo fragrances and Gucci’s Bamboo perfume. And it is experimenting with much larger beauty areas with fancier fixtures in some stores.

Elsewhere, Gass is doubling down on what already works: At four stores in Ohio, Kohl’s is testing activewear areas that are 40% larger in size. “How far can we push this with it still being Kohl’s?” she muses. The initiative involves pushing things along the price spectrum: Kohl’s is testing to see whether customers will pay $120 for upscale shoe brands like Adidas Boost, up from the more typical $80.

A big front in Kohl’s battle for younger shoppers is its house brands, which include billion-dollar businesses like its Sonoma brand, as well as lines with Vera Wang and Jennifer Lopez. At 42% of sales, they remain a big part of the business; they’re more profitable than national brands and give Kohl’s something exclusive that sets it apart. Here, too, some rivals have a head start: Target and Walmart have each upgraded their clothing lines, with some notable successes.

After some brand refreshes, Kohl’s own labels are finally on the upswing again. Gass wants her team to be nimbler and faster in creating brands, to satisfy the urge for novelty that online shopping and fast-fashion retailers like H&M can slake. Already, Kohl’s has cut the time from design to delivery of some clothing by 40%, making it easier to jump on trends or drop flops. And Kohl’s will finally launch a brand for plus-size millennial women, called EVRI, in the spring, hoping to catch up with J.C. Penney and Target.

The focus on young families is also shaping Kohl’s holiday strategy. This Christmas season all stores will have a Santa Claus with whom families can pose—a big break from Kohl’s get-in-and-out-fast heritage. To take advantage of the demise of Toys “R” Us, Kohl’s has ramped up its toy sections with brands like Lego and FAO Schwarz.

Sona Chawla, Kohl’s president, joined the company from Walgreens in 2015. She has upgraded the company’s tech and e-commerce, with a focus on unsexy but essential infrastructure.

Photograph by Rebecca Greenfield

Even the holiday-season ads show the new, hipper brand that Kohl’s aspires to be. Kohl’s centerpiece TV commercial features a Western-style adventure in which the hero is a mom on horseback riding through a frontier-style town and tossing trendy gifts—an Instant Pot! Nike sneakers! An Xbox!—to grateful family members. Only after she leaps from her horse onto a boxcar full of Kohl’s Cash do you get a close look at her face and see how young she is.

Back at the Grafton store, one of 58 around the country that Kohl’s uses as a laboratory for new ideas, Gass is pointing out another experiment. One of the first things shoppers see near the entrance is a display of Kohl’s LC Lauren Conrad fashion brand. It’s staged in a prominent area that Kohl’s plans to change every few weeks to showcase a different brand. This is standard operating procedure at Nordstrom, Macy’s, and Target, but it’s new at Kohl’s.

The goal is to show shoppers something new on each visit—and make sure they don’t stop visiting. But it’s also symbolic of Gass’s belief that Kohl’s will only escape the middle of the pack by continually trying new tricks. In retail, “nine out of 10 experiments aren’t going to work, so [retailers] need to have a pipeline of 30 experiments,” says Forrester analyst Sucharita Kodali. “Amazon lives and dies by this.” Gass wants to make sure Kohl’s lives.

In 2017, Kohl’s launched a fashion-forward clothing line called K Lab. It bombed badly. But during the development process, the Kohl’s team was introduced to PopSugar, a social media company popular with millennial women. The two companies collaborated on a clothing line that needed only a few months to get products on shelves—light speed, compared with Kohl’s past practices. “Our metabolic rate is increasing, and that feeds on itself,” says Gass. In other words,

the flops are coming faster—but so are the successes.

A version of this article appears in the December 1, 2018 issue of Fortune with the headline “Michelle Gass Is Cracking The Kohl’s Code.”