This article is intended for those of you who are at the beginning of your investing journey and want a simplistic look at the return on CapitaLand Retail China Trust (SGX:AU8U) stock.

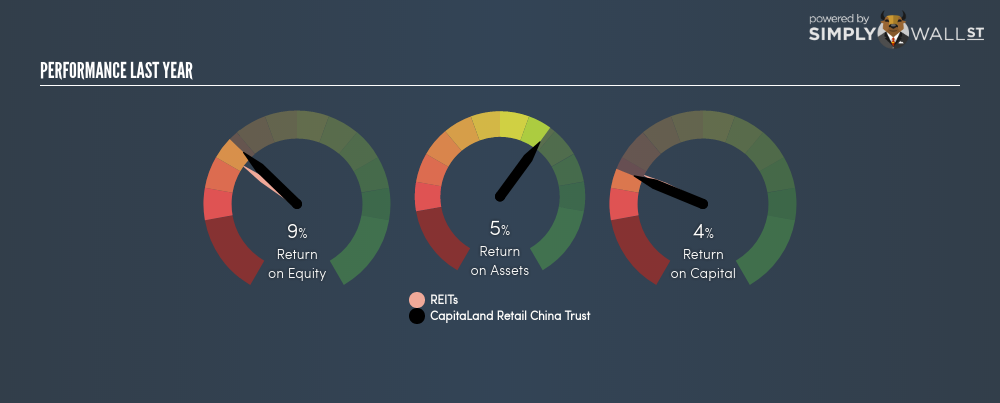

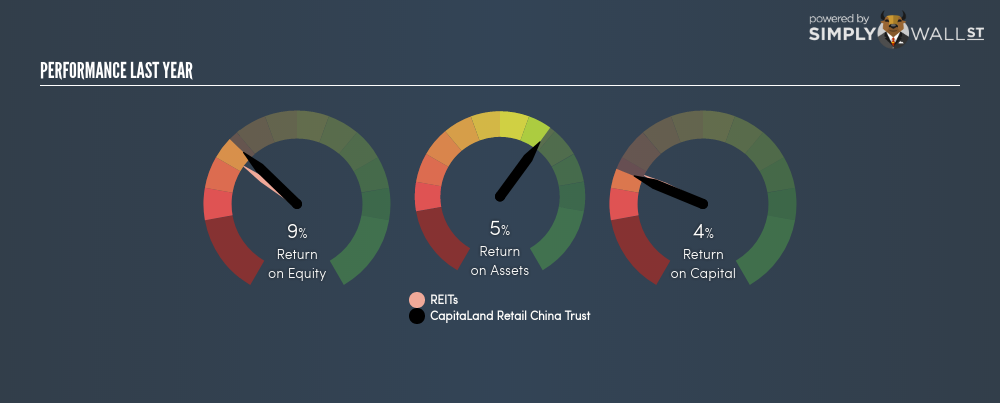

CapitaLand Retail China Trust (SGX:AU8U) delivered an ROE of 8.64% over the past 12 months, which is relatively in-line with its industry average of 7.25% during the same period. But what is more interesting is whether AU8U can sustain this level of return. This can be measured by looking at the company’s financial leverage. With more debt, AU8U can invest even more and earn more money, thus pushing up its returns. However, ROE only measures returns against equity, not debt. This can be distorted, so let’s take a look at it further. See our latest analysis for CapitaLand Retail China Trust

What you must know about ROE

Return on Equity (ROE) is a measure of CapitaLand Retail China Trust’s profit relative to its shareholders’ equity. For example, if the company invests SGD1 in the form of equity, it will generate SGD0.086 in earnings from this. Investors that are diversifying their portfolio based on industry may want to maximise their return in the Retail REITs sector by choosing the highest returning stock. But this can be misleading as each company has different costs of equity and also varying debt levels, which could artificially push up ROE whilst accumulating high interest expense.

Return on Equity = Net Profit ÷ Shareholders Equity

ROE is assessed against cost of equity, which is measured using the Capital Asset Pricing Model (CAPM) – but let’s not dive into the details of that today. For now, let’s just look at the cost of equity number for CapitaLand Retail China Trust, which is 8.51%. Since CapitaLand Retail China Trust’s return covers its cost in excess of 0.13%, its use of equity capital is efficient and likely to be sustainable. Simply put, CapitaLand Retail China Trust pays less for its capital than what it generates in return. ROE can be broken down into three different ratios: net profit margin, asset turnover, and financial leverage. This is called the Dupont Formula:

Dupont Formula

ROE = profit margin × asset turnover × financial leverage

ROE = (annual net profit ÷ sales) × (sales ÷ assets) × (assets ÷ shareholders’ equity)

ROE = annual net profit ÷ shareholders’ equity

SGX:AU8U Last Perf June 21st 18

SGX:AU8U Last Perf June 21st 18

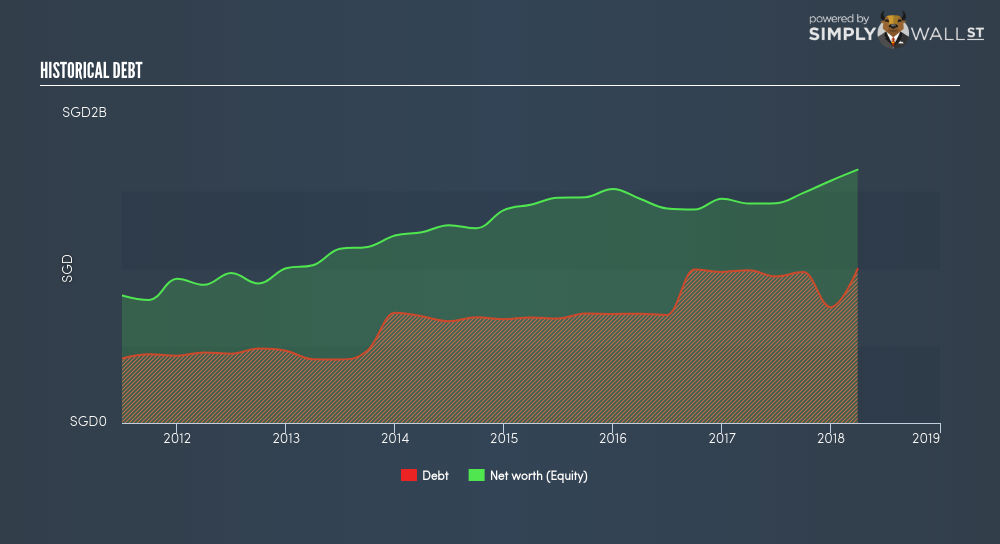

The first component is profit margin, which measures how much of sales is retained after the company pays for all its expenses. The other component, asset turnover, illustrates how much revenue CapitaLand Retail China Trust can make from its asset base. Finally, financial leverage will be our main focus today. It shows how much of assets are funded by equity and can show how sustainable the company’s capital structure is. ROE can be inflated by disproportionately high levels of debt. This is also unsustainable due to the high interest cost that the company will also incur. Thus, we should look at CapitaLand Retail China Trust’s debt-to-equity ratio to examine sustainability of its returns. Currently the ratio stands at 60.84%, which is reasonable. This means CapitaLand Retail China Trust has not taken on too much leverage, and its above-average ROE is driven by its ability to grow its profit without a huge debt burden.

SGX:AU8U Historical Debt June 21st 18

SGX:AU8U Historical Debt June 21st 18

Next Steps:

ROE is a simple yet informative ratio, illustrating the various components that each measure the quality of the overall stock. CapitaLand Retail China Trust’s above-industry ROE is encouraging, and is also in excess of its cost of equity. Its high ROE is not likely to be driven by high debt. Therefore, investors may have more confidence in the sustainability of this level of returns going forward. ROE is a helpful signal, but it is definitely not sufficient on its own to make an investment decision.

For CapitaLand Retail China Trust, I’ve compiled three important aspects you should look at:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Valuation: What is CapitaLand Retail China Trust worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether CapitaLand Retail China Trust is currently mispriced by the market.

- Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of CapitaLand Retail China Trust? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

The easiest way to discover new investment ideas

Save hours of research when discovering your next investment with Simply Wall St. Looking for companies potentially undervalued based on their future cash flows? Or maybe you’re looking for sustainable dividend payers or high growth potential stocks. Customise your search to easily find new investment opportunities that match your investment goals. And the best thing about it? It’s FREE. Click here to learn more.