How do you add the equivalent of more leasing space to a portfolio without buying another building? According to Scott Armstrong, property portfolio manager for Local Government Super, adding solar PV is part of the answer.

Adding solar to a building is “akin to building more [net lettable area]” in terms of return on investment, Armstrong told The Fifth Estate.

The fund has a portfolio of eight assets comprising commercial office buildings, retail centres and one industrial asset, with a

Scott Armstrong

total of around 95,000 square metresof NLA.

The majority of the assets are B Grade, and Armstrong says that’s where the property sector needs to be focusing sustainability efforts.

“The majority of the market is mid-tier, and that is the dial we need to shift,” he says.

“It makes good business sense. You save power and take pressure off the grid. It is about education and leadership.”

The fund’s portfolio has already set a high bar for the mid-tier, with a portfolio-wide Green Star Performance rating of 5 Star Green Star.

The fact the buildings in the portfolio have an average age of 28 years is proof that age is “no barrier” when it comes to green credentials, he says.

The fund is in the process of installing a solar car park at its Leichhardt Shopping Centre asset, and has already installed 200 kilowatts of solar on the roof of its Batemans Bay retail centre asset and 100kW on its Lyon Park Road Macquarie Park commercial office asset.

It is also in the due diligence phase of investigating an embedded network for the Batemans Bay Centre. Armstrong says there will be a genuine rental rate of return if it can sell power from solar to tenants.

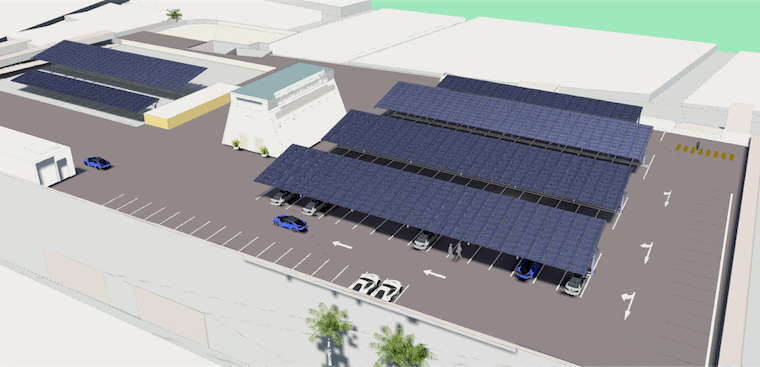

The Leichhardt installation will replace shade sails over a carpark with around 350 spaces. Armstrong says the shade sails had a “tendency to blow away” and required ongoing maintenance. Replacing them with solar PV panels will see about 40 per cent of the centre’s base building energy load met by the solar.

As it is an enclosed centre, the HVAC operates constantly, and it also has escalators, lifts and lighting on the base building load.

Armstrong says the fund expects to save around $200,000 on energy bills for the centre, giving a payback for the PV install of around seven years.

“There is also an immediate valuation uplift.”

As the tenancy leases in the centre are gross leases, the fund will also start recovering capital costs almost from day one of the system being switched on, Armstrong says.

Leichhardt Shopping Centre solar car park

Tenant retention

At its industrial property at Allambie Grove, as there is no significant base building load – all the power use is with the tenants – the fund is not looking to install solar itself.

It is, however, working with the tenants to support them in installing their own 10kW or 20kW systems on the building rooftop for their business’ use.

“We see that as a tenant retention strategy,” Armstrong says.

It’s all about taking the longer term view.

“Our objective is to enhance retirement for our members – our members can’t eat Green Stars, but they can eat if we generate good returns.

It’s about economic sense

“We buy in [to sustainability] because the economics need to make sense.”

Having a portfolio with low outgoings, low power bills, and happy tenants means long-term returns. The fund is more likely to hold onto those tenants rents and have low vacancies and turnover if it has a good product, Armstrong says.

He says the fund’s long-term management view “sits well with property”, and that he doesn’t believe buildings should be managed for just the short-term 6-12 month outlook.

With undertaking the Green Star rating, he says it wasn’t about the number of stars that could be gained. Instead it was a case of, “let’s buy into the tools and let’s believe it and drill down into how it works – the number of stars is incidental.”

The Performance approach is also a really good way to manage property and manage service providers, he says.

He says the fund’s members appreciate the green approach to the property portfolio.

The whole sustainability motivation comes from the fund’s headstock, he says.

Local Government Super currently has $11 billion in funds under management, and it applies a sustainability investment focus. This includes screening and analysing investments for their sustainability, a lens which carriers through into its property investments.

In addition to its owned portfolio, the fund also has invested in Investa Office and GPT Retail centres on the strength of the sustainability polices those funds have in place, Armstrong says.

Overall, property is a “great way for marketing” the sustainability imperative to investors.

“Buildings are something tangible you can touch and feel.”

He says that to really make it work, “everyone has to believe”, including the building managers.

“There are a huge number of people involved.”

And while there might be an initial expense, the returns and rewards are gained “further down the track.”

The fund was an early adopter, kicking off its sustainability path with NABERS ratings and the purchase of GreenPower back in 2008.

Government grants in 2009 enabled some equipment upgrades, including a $1 million chiller upgrade at the Leichhardtasset.

Currently, about 87 per cent of tenants across the portfolio are signed up to GreenPower, Armstrong says.

The majority of tenancies are between 500 sq m and 1200 sq m. Armstrong says the fund’s sustainability strategies “make sense” to those smaller tenants.

The vacancy rate is currently running at around five per cent, something he attributes partly to the quality of the buildings.

The fund is “running a good shop” with low outgoings, good foyers and end-of-trip facilities, LED lighting throughout and buildings that present well overall.

“We exceed the valuation benchmarks for tenant retention. Tenants don’t really want to move around. If they are happy they will stay.”

Every year the tenants of the commercial properties and the service providers are surveyed to assess how the properties are tracking in terms of performance and satisfaction. The results show the building service providers are performing in the middle range.

EOT?s at Lyon Park Rd, Macquarie Park

Speculative fitouts

Another initiative that has been implemented to improve sustainability and tenant satisfaction is funding speculative fitouts upfront for new tenants.

Armstrong says it is do-able because the tenancies are small.

The well-designed, functional and modern fitouts funded at the owner’s cost have proven a winner.

It is easier for tenants to shift it, and often they keep the fitout when lease renewal rolls around, Armstrong says.

It has also meant decreased vacancy through increased tenant retention, which means more rental income.

Plus it reduces the amount of fitout churn and associated waste, and the cost to the fund is amortised over two or three lease periods.

Where a building is being refurbished, as recently happened with its Batemans Bay commercial asset, and fitout needs to be stripped, a contract obligation is imposed on the building contractors to achieve a minimum of 80 per cent recycling for fitout.

“You need to set those requirements upfront and as part of the key requirements in the tender process,” Armstrong says.

“It is no different to getting a lift installed or a slab installed. It just needs to be dealt with and project managed.”

Building analytics

Building analytics and data is another arrow in the fund’s green quiver.

The building analytics platform Bueno was initially rolled out across the commercial portfolio and has now been applied across the retail assets also.

The fine grain level of monitoring and reporting it supplies gives the building managers insight into building system performance, how well it is being optimised and how it is tracking against the NABERS rating.

The platform also helps with fault detection and maintenance.

Armstrong says the old way of building monitoring might tell a technician where the haystack or problem is, and then the technician has to go and find the needle.

“Bueno tells you where the needle is.”

The platform also helps instil a common purpose between the building managers and the technical personnel, and is also helpful with contractor management.

The bottom-line benefits in terms of reduced energy use and reduced maintenance costs mean the platform is “more or less covering the contract costs”.

“There are the initial upfront costs, and then you identify what needs resolving, and then you are in efficiency land and the graph goes positive.”

Government support for the mid tier

Armstrong says there is one key thing the federal government could do to help more of the mid-tier shift building performance.

“Four years ago we had an energy audit done on each property that showed the opportunities, the payback, the return and capital costs. That is something I think if government could step in and do – fund free energy audits [for owners and managers] – then private owners and people that are not interested in sustainability can see something tangible to work with.”

Armstrong says it would be a way to convince the sceptics, by showing the real returns on sustainability.

SaveSave