Examining V-Mart Retail Limited’s (NSE:VMART) past track record of performance is a valuable exercise for investors. It enables us to understand whether the company has met or exceed expectations, which is a powerful signal for future performance. Below, I will assess VMART’s latest performance announced on 31 March 2018 and weigh these figures against its longer term trend and industry movements. Check out our latest analysis for V-Mart Retail

How Did VMART’s Recent Performance Stack Up Against Its Past?

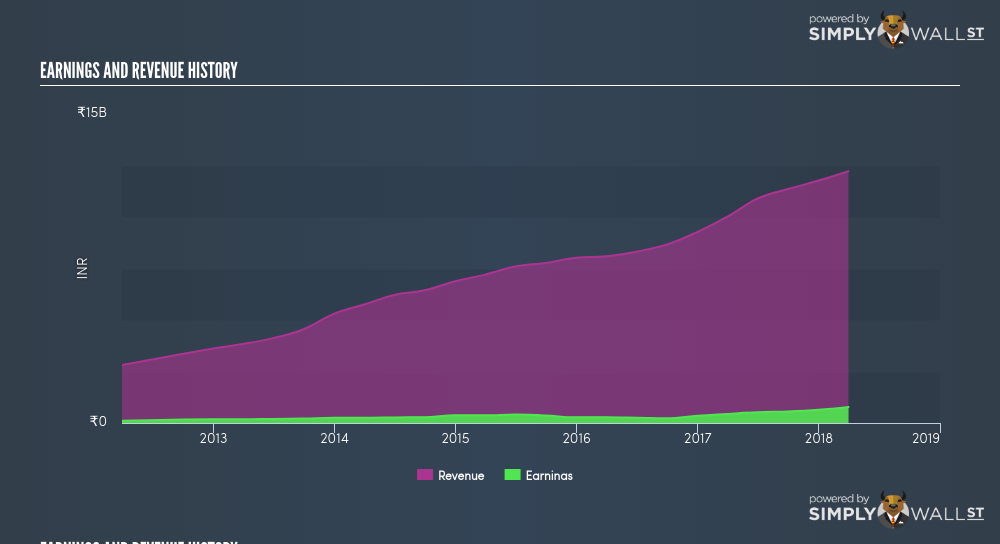

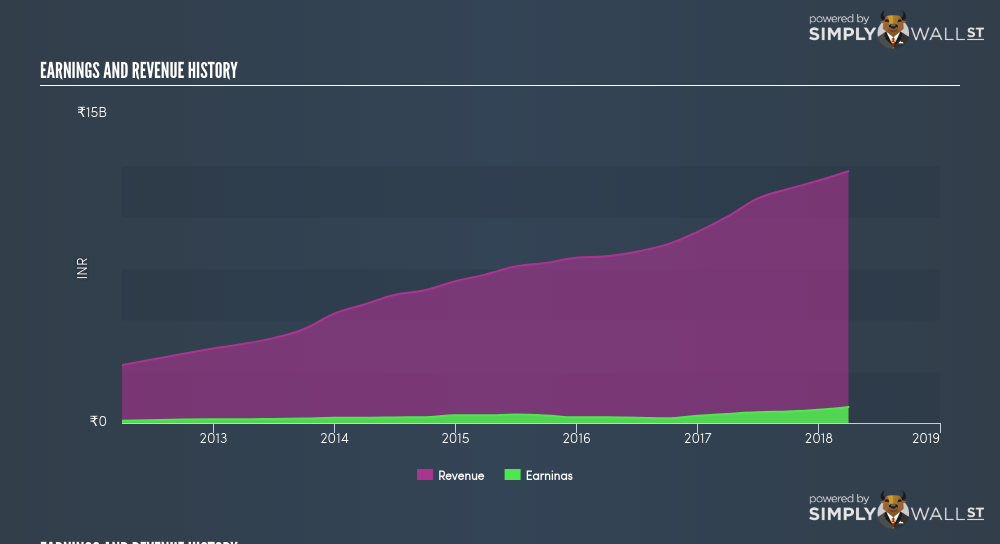

VMART’s trailing twelve-month earnings (from 31 March 2018) of ₹777.04m has jumped 76.99% compared to the previous year. Furthermore, this one-year growth rate has exceeded its 5-year annual growth average of 22.47%, indicating the rate at which VMART is growing has accelerated. What’s enabled this growth? Well, let’s take a look at whether it is only attributable to industry tailwinds, or if V-Mart Retail has experienced some company-specific growth.

In the past couple of years, V-Mart Retail expanded its bottom line faster than revenue by effectively controlling its costs. This resulted in a margin expansion and profitability over time. Inspecting growth from a sector-level, the IN multiline retail industry has been growing its average earnings by double-digit 48.49% over the past year, and 37.34% over the past five. This growth is a median of profitable companies of 10 Multiline Retail companies in IN including Future Retail, Future Retail and V2 Retail. This means that any uplift the industry is profiting from, V-Mart Retail is able to leverage this to its advantage.

NSEI:VMART Income Statement July 10th 18 In terms of returns from investment, V-Mart Retail has invested its equity funds well leading to a 22.37% return on equity (ROE), above the sensible minimum of 20%. Furthermore, its return on assets (ROA) of 14.02% exceeds the IN Multiline Retail industry of 8.13%, indicating V-Mart Retail has used its assets more efficiently. And finally, its return on capital (ROC), which also accounts for V-Mart Retail’s debt level, has increased over the past 3 years from 25.90% to 31.21%. This correlates with a decrease in debt holding, with debt-to-equity ratio declining from 23.98% to 1.60% over the past 5 years.

NSEI:VMART Income Statement July 10th 18 In terms of returns from investment, V-Mart Retail has invested its equity funds well leading to a 22.37% return on equity (ROE), above the sensible minimum of 20%. Furthermore, its return on assets (ROA) of 14.02% exceeds the IN Multiline Retail industry of 8.13%, indicating V-Mart Retail has used its assets more efficiently. And finally, its return on capital (ROC), which also accounts for V-Mart Retail’s debt level, has increased over the past 3 years from 25.90% to 31.21%. This correlates with a decrease in debt holding, with debt-to-equity ratio declining from 23.98% to 1.60% over the past 5 years.

What does this mean?

V-Mart Retail’s track record can be a valuable insight into its earnings performance, but it certainly doesn’t tell the whole story. Positive growth and profitability are what investors like to see in a company’s track record, but how do we properly assess sustainability? I suggest you continue to research V-Mart Retail to get a better picture of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for VMART’s future growth? Take a look at our free research report of analyst consensus for VMART’s outlook.

- Financial Health: Is VMART’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 31 March 2018. This may not be consistent with full year annual report figures.

These great dividend stocks are beating your savings account

Not only have these stocks been reliable dividend payers for the last 10 years but with the yield over 3% they are also easily beating your savings account (let alone the possible capital gains). Click here to see them for FREE on Simply Wall St.