Saks Fifth Avenue — reengineered with a new business model, equity partner and stronger balance sheet — intends to grab market share in luxury e-commerce.

It’s a vibrant, resilient sector with an escalating battle to win over customers, between Mytheresa, Neiman Marcus.com, Moda Operandi, Net-a-porter, Farfetch and Matchesfashion.

But on Friday, the Hudson’s Bay Co., which is the parent of Saks Fifth Avenue, disclosed that it split the Saks Fifth Avenue store fleet and saksfifthavenue.com into separate companies, and that Insight Partners, a venture capital and private equity firm, made a $500 million minority equity investment in the Saks e-commerce business, valuing it at $2 billion.

As stand-alone companies, Saks Fifth Avenue’s e-commerce business is now known as simply Saks. The 40-store Saks Fifth Avenue fleet is known as SFA, which remains wholly owned by HBC.

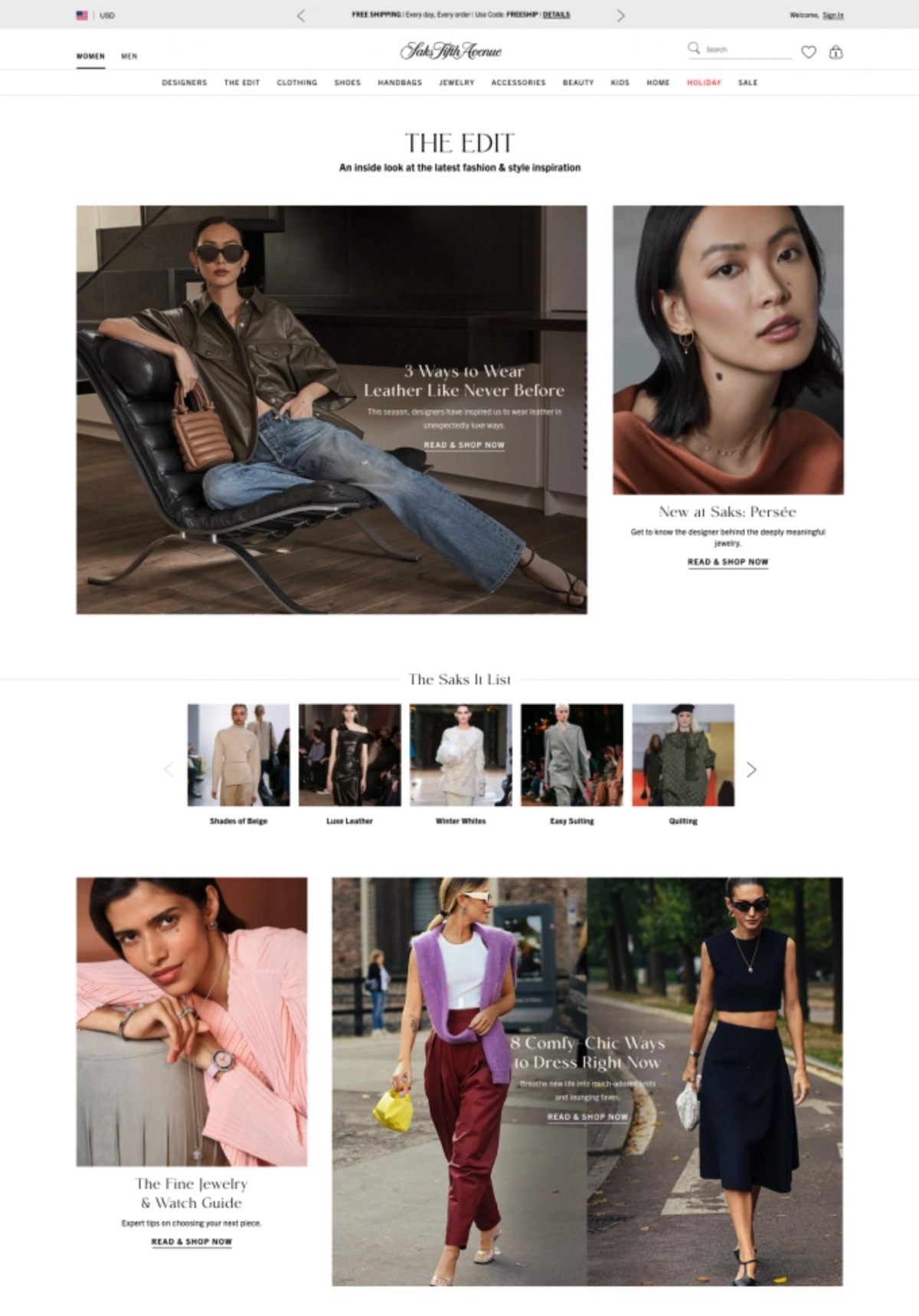

Executives at Saks and Insight Partners told WWD that the restructuring of Saks Fifth Avenue means investing in its e-commerce like HBC could never do before, to spur the business. Increased spending on technology, contact centers, marketing, and to enhance styling, personalization, shipping and return capabilities are seen. Last year, saksfifthavenue.com was re-platformed with Salesforce Commerce Cloud to capture more data on users, leading to messaging that furthers personalization. Men’s wear got its own homepage, which leads to a designated men’s section, and the overall look and feel of the website was upgraded.

Transforming the Saks Fifth Avenue stores and e-commerce businesses into separate companies is a prelude to potentially spinning off the e-commerce operation into a public company. WWD exclusively reported in January that HBC was meeting with investors to pursue such a maneuver. An IPO for Saks e-commerce is appealing given the current high valuations on e-comm pure plays like Mytheresa and Farfetch. It provide a clearer view of the value of Saks Fifth Avenue assets — stores and website — and present opportunities to continue to raise money.

Saksfifthavenue.com generates about $1 billion in annual sales. That’s roughly twice the volume of Mytheresa, which went public in January and saw its stock price quickly soar.

“This is just early days for online shopping, especially in luxury,” Richard Baker, governor, executive chairman and chief executive officer of Hudson’s Bay Co., said in an interview Friday. “There is an opportunity for luxury to triple its size online. No one really knows how retailing is going to play out. With this move, we are redefining the luxury shopping ecosystem.”

The transaction with Insight Partners “reinforces HBC’s ability to unlock significant value within our company’s assets,” Baker said. “We are delighted to partner with Insight Partners, a firm globally recognized for its ability to scale internet, software and e-commerce leaders, to unleash Saks’ full potential.” He believes Saks is “primed to win significant market share.” Baker said that Insight “took the whole offering” on saksfifthavenue.com. He declined to address the possibility of a public offering for Saks IPO.

“E-commerce at all of our banners have been very, very strong,” Baker said. HBC operates Hudson’s Bay in Canada, Saks Off 5th, as well as Saks Fifth Avenue. It also has extensive real estate holdings, including real estate joint ventures.

With the split-up, Marc Metrick, who has been president and CEO of Saks Fifth Avenue, becomes CEO of the Saks e-commerce business, and a member of the new company’s board of directors.

Larry Bruce has become president of the SFA stores. Bruce has been with Saks Fifth Avenue for nearly 20 years, including the past eight as director of stores.

Sebastian Gunningham will join the Saks board of directors and serve as an adviser. Gunningham was previously an executive at Amazon, leading its marketplace expansion among other large technology and operational divisions at the company. Earlier, he held executive roles at Apple and Oracle.

While the split presents new possibilities for Saks e-commerce, it also presents executional challenges and a lot of things to work out. But in its Friday morning statement, HBC said SFA and Saks will work in conjunction to continue delivering “a seamless customer experience” and spelled out some of the division of functions. The Saks e-commerce company will lead marketing and merchandising across both Saks and SFA. Saks will retain ownership and control of the Saks Fifth Avenue intellectual property, including the brand and visual identity.

The SFA stores company will fulfill the physical functions of Saks, such as buy online, pick up in-store; exchanges; returns, and alterations.

“This is disruptive from a business model and a partnership standpoint. We are breaking the mold,” Metrick told WWD. “This will allow both channels to be independent from an investment standpoint, to grow, and to continue to provide amazing customer experiences. The consumer experience is going to improve and consumers won’t realize there are two separate entities delivering that experience. They will view it as the Saks Fifth Avenue ecosystem, just as they do today.”

Asked if as separate companies, it becomes more challenging to provide consistencies from channel to channel, Metrick said, “I don’t think it’s going to be any more challenging than it is today. We are going to be consumer first — not stores first, not digital first.”

He said HBC has been working on getting this separation and all of its operational elements in place for awhile. “It’s going to be interactive, fluid, flexible.” The separation went into effect Friday, and the transaction with Insight Partners is a done deal.

Metrick also said that in his new role, he won’t be removed from the stores and that along with Tracy Margolies, chief merchant, they will be responsible for the assortments in both channels and “the look and feel” of the brand presentations.

At HBC’s headquarters in Brookfield Place in lower Manhattan, “Larry’s office is 40 feet away from mine,” said Metrick said, implying an coordination of efforts going forward. “The Saks brand is the center of gravity. I am someone who considers the Saks Fifth Avenue brand a part of me, online and with stores, but I am focused on accelerating growth of the saks.com business.”

Integrating a marketplace format into Saks’ e-commerce site, Metrick said, enables saksfifthavenue.com “to go wider in our offer with our existing brands, and go deeper. We can certainly also stretch into categories we don’t sell and bring far more brands on the website. But it’s all going to be luxury. That’s very important. And we will remain in fashion. We do not intend to be a marketplace for spearfishing. It’s always going to be Saks, with a point of view. It will know you as a consumer, giving a personalized experience.”

Metrick said the marketplace and other changes to saksfifthavenue.com will happen relatively fast. “We don’t have five-year plans anymore. We have one-year plans.

“Luxury online is on fire,” Metrick said. “We know we can explode growth and really start to move the top-line at a much more rapid pace — starting today. The Saks dot-com business is profitable. Right now, we can invest for growth. Twenty years ago, when luxury on the internet started to get grounded, stores like us and some of our competitors couldn’t get into the game with the right level of investment. You had to make choices. To that end it opened up space for others to get into the market. As luxury e-commerce is about to triple in the next few years, we are not going to miss out on the opportunity.”

“Saks Fifth Avenue is an unbelievable brand with a great customer base. If you ask anyone on the street, 90 percent know the brand, but the site experience is not where it needs to be,” said Deven Parekh, managing director of Insight Partners. Historically, he said Hudson Bay Co. had to run the Saks dot-com business on a constrained budget. “They’ve had other financial obligations and debt. Now Saks will have a well-capitalized balance sheet. The only debt is revolving credit for inventory.”

Insight Partners has invested in more than 400 companies worldwide and has raised through a series of funds more than $30 billion in capital commitments. “We have over 25 investments in e-commerce and marketplace companies. So who better to advise Saks?” Parekh said. “We are already starting to work together. I will be on the board, and we have an in-house consulting group” that applies best practices of companies within the Insights portfolio to other companies in the portfolio.

The deal with HBC, said Parekh, “is beyond a straight investment. We are a value-added partner. It’s not just money.”

Regarding a Saks dot-com IPO in the future, “It absolutely has the potential to be a public company,” Parekh said. “But first you build a great company with a great business model with a great team. Then the rest takes care of itself.”

Rhône Capital, a significant shareholder of HBC, was actively involved in the transaction. Franz-Ferdinand Buerstedde, managing director of Rhône Capital, said, “There is great potential in businesses that operate at the intersection of retail, technology and real estate. We are pleased to see this transaction come to fruition and are confident it will lead to significant value creation.”