I am writing today to help inform people who are new to the stock market and want a simplistic look at the return on Cantabil Retail India Limited (NSE:CANTABIL) stock.

With an ROE of 18.73%, Cantabil Retail India Limited (NSE:CANTABIL) outpaced its own industry which delivered a less exciting 7.44% over the past year. Though, the impressiveness of CANTABIL’s ROE is contingent on whether this industry-beating level can be sustained. A measure of sustainable returns is CANTABIL’s financial leverage. If CANTABIL borrows debt to invest in its business, its profits will be higher. But ROE does not capture any debt, so we only see high profits and low equity, which is great on the surface. But today let’s take a deeper dive below this surface. Check out our latest analysis for Cantabil Retail India

Breaking down Return on Equity

Return on Equity (ROE) weighs Cantabil Retail India’s profit against the level of its shareholders’ equity. It essentially shows how much the company can generate in earnings given the amount of equity it has raised. Investors that are diversifying their portfolio based on industry may want to maximise their return in the Apparel, Accessories and Luxury Goods sector by choosing the highest returning stock. However, this can be misleading as each firm has different costs of equity and debt levels i.e. the more debt Cantabil Retail India has, the higher ROE is pumped up in the short term, at the expense of long term interest payment burden.

Return on Equity = Net Profit ÷ Shareholders Equity

ROE is assessed against cost of equity, which is measured using the Capital Asset Pricing Model (CAPM) – but let’s not dive into the details of that today. For now, let’s just look at the cost of equity number for Cantabil Retail India, which is 13.55%. Given a positive discrepancy of 5.18% between return and cost, this indicates that Cantabil Retail India pays less for its capital than what it generates in return, which is a sign of capital efficiency. ROE can be dissected into three distinct ratios: net profit margin, asset turnover, and financial leverage. This is called the Dupont Formula:

Dupont Formula

ROE = profit margin × asset turnover × financial leverage

ROE = (annual net profit ÷ sales) × (sales ÷ assets) × (assets ÷ shareholders’ equity)

ROE = annual net profit ÷ shareholders’ equity

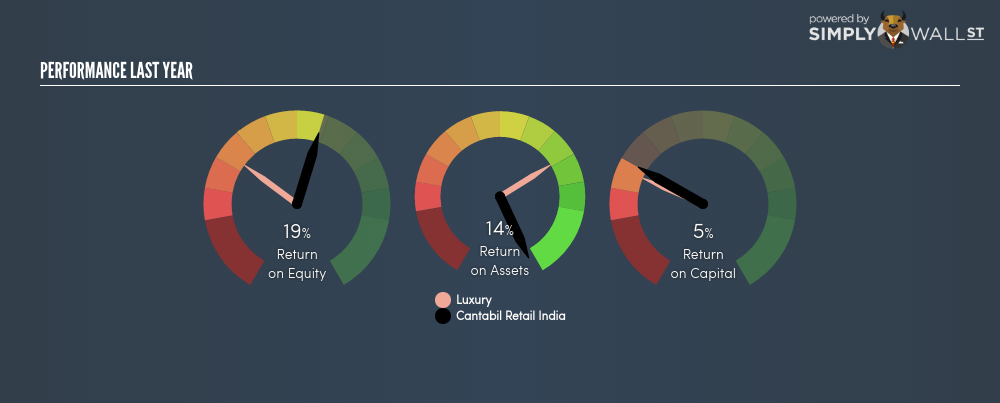

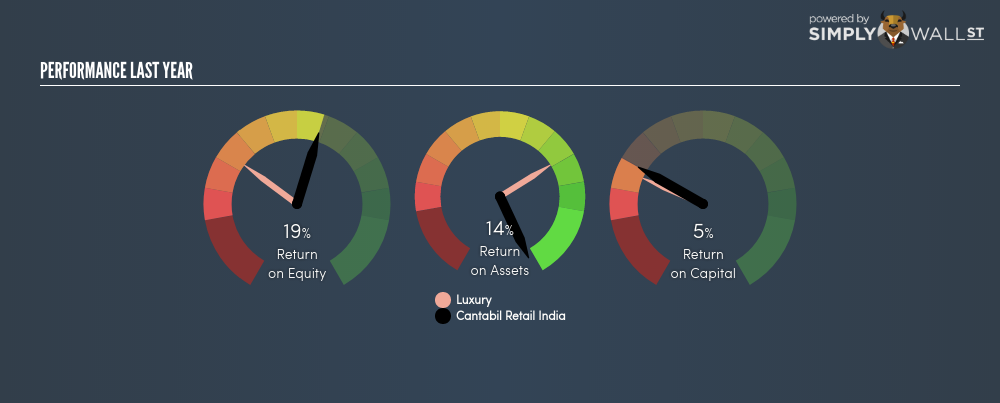

NSEI:CANTABIL Last Perf June 29th 18

NSEI:CANTABIL Last Perf June 29th 18

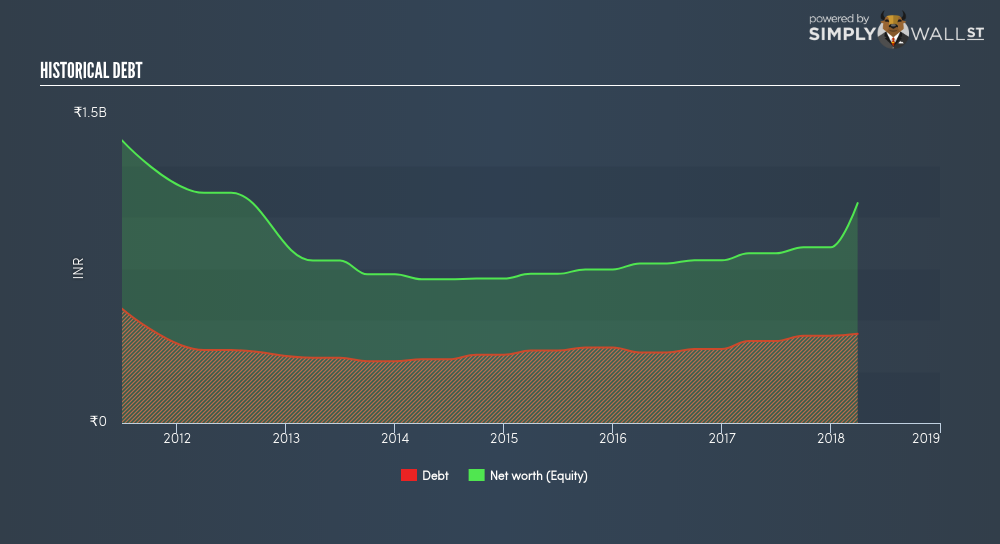

Basically, profit margin measures how much of revenue trickles down into earnings which illustrates how efficient the business is with its cost management. Asset turnover reveals how much revenue can be generated from Cantabil Retail India’s asset base. Finally, financial leverage will be our main focus today. It shows how much of assets are funded by equity and can show how sustainable the company’s capital structure is. ROE can be inflated by disproportionately high levels of debt. This is also unsustainable due to the high interest cost that the company will also incur. Thus, we should look at Cantabil Retail India’s debt-to-equity ratio to examine sustainability of its returns. The most recent ratio is 40.57%, which is sensible and indicates Cantabil Retail India has not taken on too much leverage. Thus, we can conclude its above-average ROE is generated from its capacity to increase profit without a large debt burden.

NSEI:CANTABIL Historical Debt June 29th 18

NSEI:CANTABIL Historical Debt June 29th 18

Next Steps:

ROE is one of many ratios which meaningfully dissects financial statements, which illustrates the quality of a company. Cantabil Retail India exhibits a strong ROE against its peers, as well as sufficient returns to cover its cost of equity. ROE is not likely to be inflated by excessive debt funding, giving shareholders more conviction in the sustainability of high returns. Although ROE can be a useful metric, it is only a small part of diligent research.

For Cantabil Retail India, there are three important aspects you should look at:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Management:Have insiders been ramping up their shares to take advantage of the market’s sentiment for Cantabil Retail India’s future outlook? Check out our management and board analysis with insights on CEO compensation and governance factors.

- Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Cantabil Retail India? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

Investors! Do you know the famous “Icahn’s lift”?

Noted activist shareholder, Carl Ichan has become famous (and rich) by taking positions in badly run public corporations and forcing them to make radical changes to uncover shareholders value. “Icahn lift” is a bump in a company’s stock price that often occurs after he has taken a position in it. What were his last buys? Click here to view a FREE detailed infographic analysis of Carl Icahn’s investment portfolio.